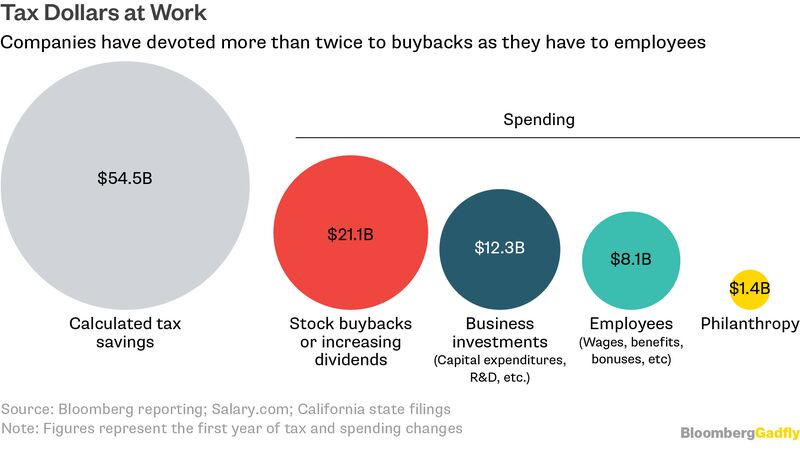

Only 13% of business' tax cuts are going to workers, survey says

Tax cut scoreboard: Workers $6 billion; Shareholders $171 billion

Wow, this is one of the most expensive tax cuts in history. And at a time when corporations are doing really, really well. Why not share with the workers?

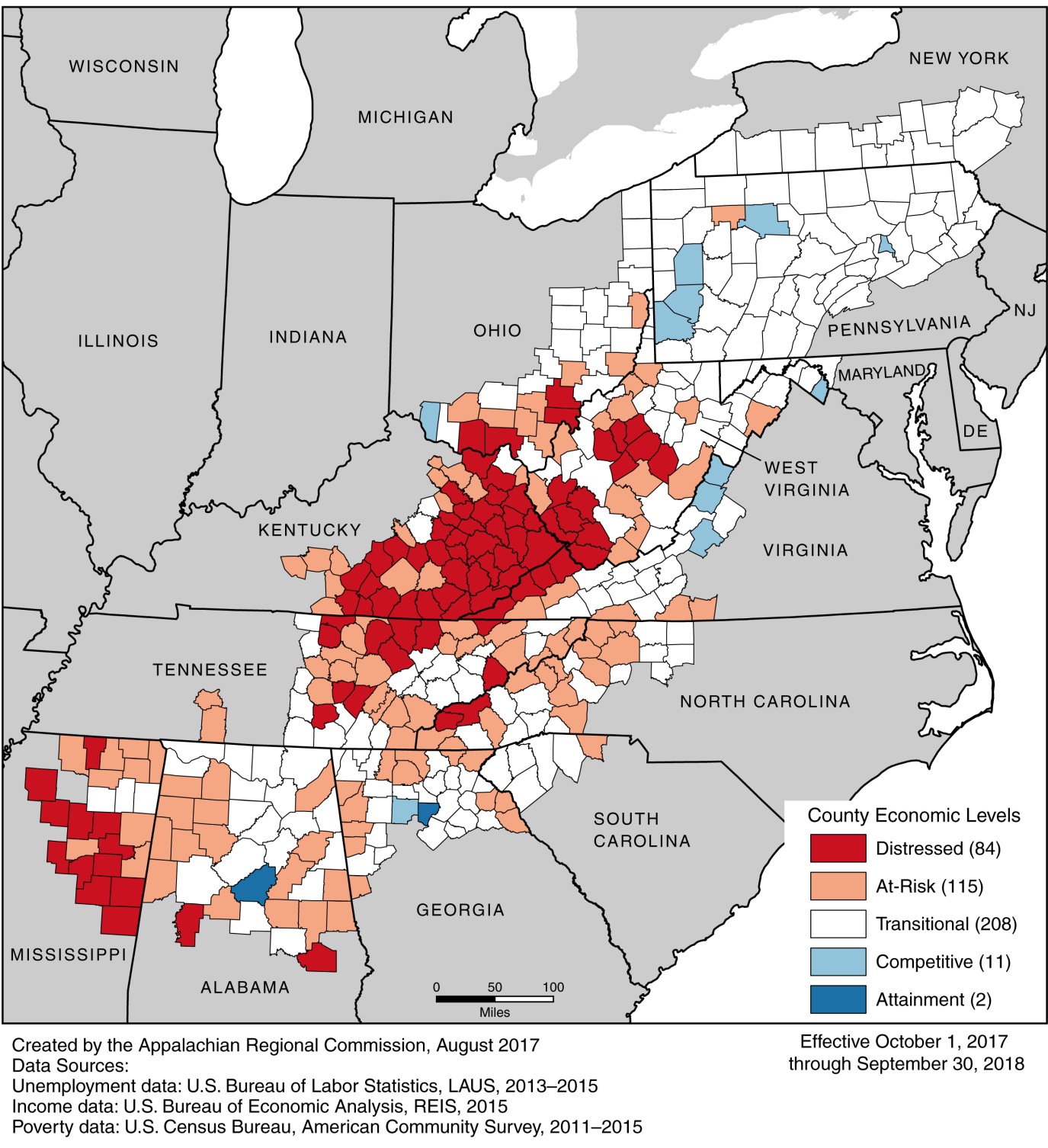

ARC: Athens County back to 'distressed' status

This is Appalachia, the center of the Republican Party. The area that has the 10 poorest counties in the United States. Those counties being more than 98% white.

Why not pass some of those tax cuts along as wage increases for whites living in the Appalachia area?

Trump's last year in office. Not so good for middle class people. Even 2019 sucked. Only 2.3% growth in 2019. And meanwhile, as Republican blame illegals and liberals for why they don't have any money....

As many Americans struggled during the COVID-19 pandemic, median pay for CEOs at more than 300 of the nation’s largest public companies

zoomed to $13.7 million, up from $12.8 million a year earlier, according to a Wall Street Journal analysis.

CEO compensation kept climbing, even in industries laid low by the pandemic and at companies where chief executives voluntarily gave up some of their salaries, according to the Journal, which analyzed data for S&P 500 companies via research firm MyLogIQ.

The median CEO pay increase was nearly 15%, the analysis found, using figures reported by companies in their regulatory filings. Pay dropped last year for some CEOs in the Journal’s analysis. But it rose for 206 of the 322 CEOs. Company performance wasn’t necessarily connected to pay hikes.

Even though Norwegian Cruise Line Holdings lost $4 billion last year, CEO Frank Del Rio’s pay doubled to $36.4 million, the Journal reported. And the CEO of institutional caterer Aramark, who gave up part of his salary during the pandemic, reaped $27.1 million in 2020 because the board bumped his bonus targets.

CEOs of 350 large publicly traded companies in 2019 earned an average

320 times more than the typical worker in the same company, according to the Economic Policy Institute. In 1989, the average ratio was 61-to-1.

It’s not just pay that’s out of whack. A worker at Missouri’s for-profit Research Medical Center in Kansas City was named employee of the month and given a

$6 cafeteria coupon as a “bonus” last year after surviving COVID-19. The CEO of the hospital’s parent company was earning $30 million a year.

Compensation jumped, even for the chief executive of a pandemic-battered cruise line, according to a Wall Street Journal analysis.

www.huffpost.com

, asshole) non-management employees actually own any sort of significant company stock where a buy back would help.

, asshole) non-management employees actually own any sort of significant company stock where a buy back would help.