Only 13% of business' tax cuts are going to workers, survey says

Tax cut scoreboard: Workers $6 billion; Shareholders $171 billion

Wow, this is one of the most expensive tax cuts in history. And at a time when corporations are doing really, really well. Why not share with the workers?

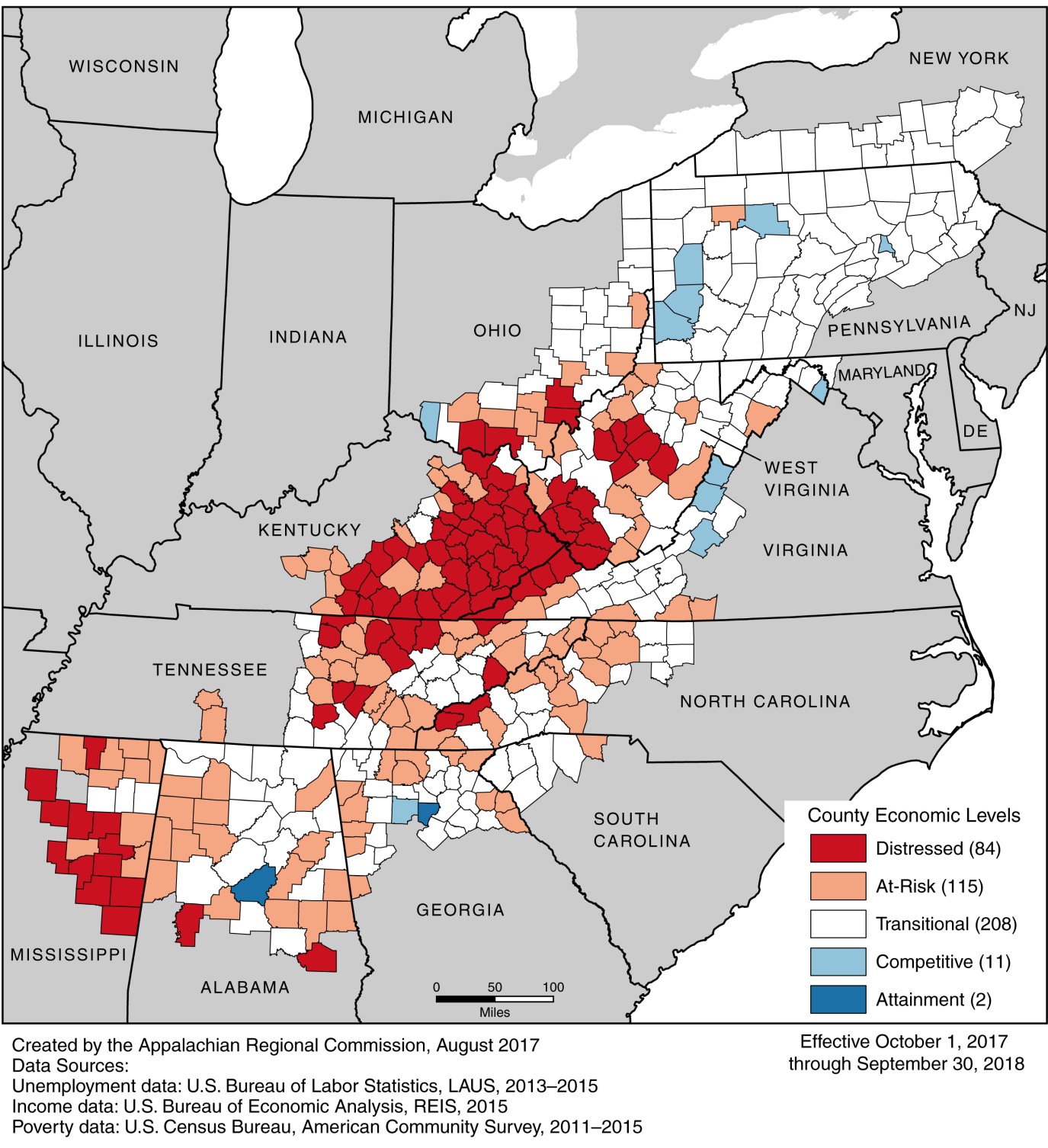

ARC: Athens County back to 'distressed' status

This is Appalachia, the center of the Republican Party. The area that has the 10 poorest counties in the United States. Those counties being more than 98% white.

Why not pass some of those tax cuts along as wage increases for whites living in the Appalachia area?

So what do you think happened the shareholders did with their $171 billion... bury it in the backyard, or better yet hide it under their mattresses... or what?

Hmmm... Let's say half goes back as dividends to those evil shareholders..(who by the way maybe workers with 401Ks but let's not quibble ok?).

$85 billion will be taxed. Also known as a double taxation by the way.

Under current law, qualified

dividends are

taxed at a 20%, 15%, or 0% rate, depending on your

tax bracket.

So let's say 15% of the $85 billion will go BACK to the Federal Government as taxes or over $12.5 billion... again BACK as taxes.

Tax cut scoreboard: Workers $6 billion; Shareholders: $171 billion

So what will those EVIL shareholders (again remember some might be your evil co-workers with 401Ks or teachers pension plans... who knows but they are evil for sure!)...

A) Well those extremely wealthy evil shareholders could buy another $60 million yacht! Now I use to get paid by a yacht manufacturer and frankly I know the workers there

would be MOST happy if that were to happen! Plus I am sure that there are some yacht captains that would LOVE to become the captain and make over $150,000 a year

just running that dirty evil shareholders $60 million yacht!

B) Or say those wealthy evil shareholders decided..."hey I need to foster that image of an evil capitalist shareholder... I know I'll donate a million dollars!"

The number of donations of $100-million or more last year was also impressive.

“Ten people committed that much, an increase from 2010, when only six philanthropists gave $100-million or more, and from 2009 when seven donors announced gifts of that size,” reports

Philanthropy.“What’s more, gifts of $1-million or more totaled $5.4-billion in 2011, compared with $3.6-billion a year ago.”

Donations From the Rich to Charities Rose in 2011

America’s biggest donors gave $14.7 billion to nonprofits in 2017, a high mark for the past decade that falls just shy of the $15.5 billion they donated in 2008.

The entire Philanthropy 50 report features our analysis of the list and giving trends among megadonors in an age of growing income inequality. It also explores the increasing popularity of

unrestricted big gifts;

how cities and other locales benefit when an area nonprofit receives a big donation; and a

2018 gift from Amazon founder Jeff Bezos that philanthropy observers believe signals his entry to big philanthropy. See the

full analysis.

Yea just what we needed more donations from those evil wealthy people !