Weatherman2020

Diamond Member

Build back better!

Ex-Federal Reserve chair says US economy is heading toward period of stagflation for first time since 1970s: CEO of Goldman Sachs says risk of America falling into a recession 'is very, very high'

Ben Bernake warns that high unemployment and high prices could stay for years

Stagflation last happened in the US in the 70s, when OPEC pushed oil prices up

It led to years of high inflation and low economic growth that may happen again

Average prices are up by 8.3% from last year; Gas is averaging $4.48 a gallon

The CEO of Goldman Sachs and other banks warn that a recession is looming as the Federal Reserve struggles to rein in inflation without triggering a slowdown

By ADAM MANNO FOR DAILYMAIL.COM

PUBLISHED: 12:26 EDT, 16 May 2022

The former head of the Federal Reserve says the US is heading toward a period of high inflation and low economic growth as the head of Goldman Sachs and other global banks warn that a recession is coming.

Ben Bernake, who led the Fed through the 2008 financial crisis, says 'stagflation' may be on the horizon.

The term, coined in the 1960s, refers to low economic growth combined with high unemployment and high prices.

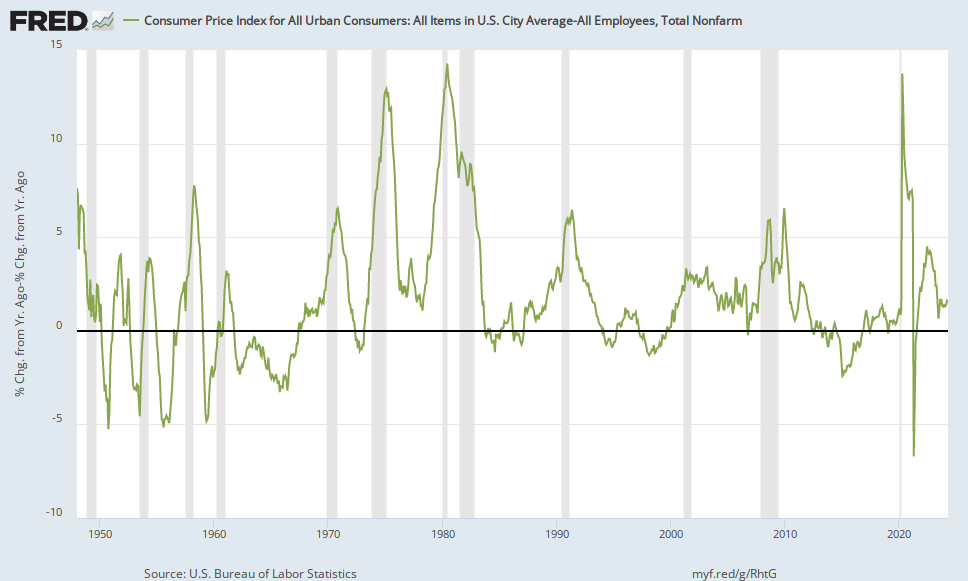

The phenomenon was a notable feature of Jimmy Carter's presidency in the 1970s, when the US experienced a 'supply shock' after oil-producing nations raised their prices.

Economists use three variables to measure it: gross domestic product (the market value of all goods and services made in a country) unemployment and inflation (a decrease in the buying power of money.)

Stagflation happens when the first is down and the last two are up.

Meanwhile, the chairman of Goldman Sachs says the risk of the US falling into a recession is 'very, very high.'

...

The economy was officially in recession from 1969 to 1970 and 1973 to 1975, according to Investopedia.

Before that, it was believed that high inflation and high unemployment were not possible at the same time.

But economists now believe that a 'negative supply shock' can cause that. Such a shock happens when a crucial good, such as energy or labor, is suddenly in short supply.

The US underwent a similar shock during the pandemic. Over the last two years, people lost their jobs, goods and services stopped being produced at the same rate and people collected massive unemployment benefits.

www.dailymail.co.uk

www.dailymail.co.uk

Ex-Federal Reserve chair says US economy is heading toward period of stagflation for first time since 1970s: CEO of Goldman Sachs says risk of America falling into a recession 'is very, very high'

Ben Bernake warns that high unemployment and high prices could stay for years

Stagflation last happened in the US in the 70s, when OPEC pushed oil prices up

It led to years of high inflation and low economic growth that may happen again

Average prices are up by 8.3% from last year; Gas is averaging $4.48 a gallon

The CEO of Goldman Sachs and other banks warn that a recession is looming as the Federal Reserve struggles to rein in inflation without triggering a slowdown

By ADAM MANNO FOR DAILYMAIL.COM

PUBLISHED: 12:26 EDT, 16 May 2022

The former head of the Federal Reserve says the US is heading toward a period of high inflation and low economic growth as the head of Goldman Sachs and other global banks warn that a recession is coming.

Ben Bernake, who led the Fed through the 2008 financial crisis, says 'stagflation' may be on the horizon.

The term, coined in the 1960s, refers to low economic growth combined with high unemployment and high prices.

The phenomenon was a notable feature of Jimmy Carter's presidency in the 1970s, when the US experienced a 'supply shock' after oil-producing nations raised their prices.

Economists use three variables to measure it: gross domestic product (the market value of all goods and services made in a country) unemployment and inflation (a decrease in the buying power of money.)

Stagflation happens when the first is down and the last two are up.

Meanwhile, the chairman of Goldman Sachs says the risk of the US falling into a recession is 'very, very high.'

...

The economy was officially in recession from 1969 to 1970 and 1973 to 1975, according to Investopedia.

Before that, it was believed that high inflation and high unemployment were not possible at the same time.

But economists now believe that a 'negative supply shock' can cause that. Such a shock happens when a crucial good, such as energy or labor, is suddenly in short supply.

The US underwent a similar shock during the pandemic. Over the last two years, people lost their jobs, goods and services stopped being produced at the same rate and people collected massive unemployment benefits.

Ex-Fed chair says US economy is heading toward 'stagflation'

Ben Bernake was appointed by former Presidnet George W. Bush led the Fed through the 2008 financial crisis. 'Even under the benign scenario, we should have a slowing economy,' he said.