Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Forbes Magazine: How Trump’s Deregulation Sowed The Seeds For Silicon Valley Bank’s Demise

- Thread starter pyetro

- Start date

If a Republican had reduced regulation decades ago and democrats controlled Washington ever since, they'd still try to, you guessed it, blame the Republican.

pyetro

Diamond Member

- Jul 21, 2019

- 5,538

- 5,751

- 1,940

- Thread starter

- #63

The article tells you it was **Economic Growth, Regulatory Relief, and Consumer Protection Act** of 2018, which raised the threshold for banks to be considered systemically important from $50 billion to $250 billion. This meant that SVB and other banks below that threshold faced less oversight and stress testing from federal regulatorsExactly what deregulation contributed to this SVB failure?

Do you believe this bank was not being regulated by the Fed?

Read.

Clipper

Platinum Member

- Dec 22, 2018

- 15,200

- 9,958

- 1,140

Nothing sane to add, Jethro?

So, IOW, recognizing economic reality.The article tells you it was **Economic Growth, Regulatory Relief, and Consumer Protection Act** of 2018, which raised the threshold for banks to be considered systemically important from $50 billion to $250 billion. This meant that SVB and other banks below that threshold faced less oversight and stress testing from federal regulators

Read.

I want to share with you an article that explains how Trump's deregulation led to the collapse of Silicon Valley Bank, one of the largest banks in the country. The article is here: How Trump’s Deregulation Sowed The Seeds For Silicon Valley Bank’s Demise

The article says that Trump signed a law in 2018 that weakened the rules for banks that were put in place after the 2008 financial crisis. The law was called the Economic Growth, Regulatory Relief and Consumer Protection Act (S.2155), but it did not protect consumers at all. It allowed banks like Silicon Valley Bank to take more risks with their money and hide their problems from regulators.

The law was supported by most Republicans and a minority of Democrats who were fooled by the bank lobbyists. Most Democrats voted against it The Senate passed it by a vote of 67-31, with 16 Democrats voting for it. The House passed it by a vote of 258-159, with 225 Republicans and 33 Democrats voting for it. Trump signed it into law on May 24, 2018.

Now we are paying the price for this Trump law. Silicon Valley Bank failed because it gambled on risky loans and investments that went bad. It also lied about its financial health and hid its losses from regulators and investors. The bank's failure caused a lot of damage to the economy and hurt millions of customers, employees and shareholders. This is why we need to hold Trump and his allies accountable for their actions.

They sold us out to the big banks and put our economy at risk. We need to repeal this law and restore strong regulations for banks that protect consumers and prevent another crisis.

Ya gotta love how the expertise just magically appears. They love them some headlines.

OhPleaseJustQuit

Diamond Member

- Jul 27, 2021

- 50,817

- 60,358

- 3,488

.

As it was in the beginning, is now and ever shall be.

Amen.

.

'The CEO of SVB didn’t like the regulations imposed after the 2008 financial meltdown by Congress’ Dodd-Frank legislation, and spent over a half-million dollars bribing…er, influencing…legislators (legalized by 5 Republicans on the Supreme Court) to change the law and exempt his and other smaller, regional banks from what he argued was the heavy hand of government.The same goes for a D in the WH. We’re witnessing this right now. Of course, you’re blind to it.

As Senator Bernie Sanders noted this weekend: “Let's be clear. The failure of Silicon Valley Bank is a direct result of an absurd 2018 bank deregulation bill signed by Donald Trump that I strongly opposed. Five years ago, the Republican Director of the Congressional Budget Office released a report finding that this legislation would increase the likelihood that a large financial firm with assets of between $100 billion and $250 billion would fail.”'

Can We Stop the Greed-Heads From Their Destruction of Banking & More?

As we learned from the Iroquois, working on behalf of and protecting society from greedy predators should be the first job of every government…

ColonelAngus

Diamond Member

- Feb 25, 2015

- 52,528

- 52,664

- 3,615

Trump bombed Pearl Harbor

'The CEO of SVB didn’t like the regulations imposed after the 2008 financial meltdown by Congress’ Dodd-Frank legislation, and spent over a half-million dollars bribing…er, influencing…legislators (legalized by 5 Republicans on the Supreme Court) to change the law and exempt his and other smaller, regional banks from what he argued was the heavy hand of government.

As Senator Bernie Sanders noted this weekend: “Let's be clear. The failure of Silicon Valley Bank is a direct result of an absurd 2018 bank deregulation bill signed by Donald Trump that I strongly opposed. Five years ago, the Republican Director of the Congressional Budget Office released a report finding that this legislation would increase the likelihood that a large financial firm with assets of between $100 billion and $250 billion would fail.”'

Can We Stop the Greed-Heads From Their Destruction of Banking & More?

As we learned from the Iroquois, working on behalf of and protecting society from greedy predators should be the first job of every government…hartmannreport.com

Less stress testing, does not mean they were not being regulated.The article tells you it was **Economic Growth, Regulatory Relief, and Consumer Protection Act** of 2018, which raised the threshold for banks to be considered systemically important from $50 billion to $250 billion. This meant that SVB and other banks below that threshold faced less oversight and stress testing from federal regulators

Read.

So be specific in what type of “stress testing” would had prevented this? And why Biden didn’t put it back on.

Forbes Magazine: How Trump’s Deregulation Sowed The Seeds For Silicon Valley Bank’s Demise

This is further proof that Republicans are incapable of sound, responsible governance.

Not a republican, drive-by peckerhead.Forbes Magazine: How Trump’s Deregulation Sowed The Seeds For Silicon Valley Bank’s Demise

This is further proof that Republicans are incapable of sound, responsible governance.

easyt65

Diamond Member

- Aug 4, 2015

- 90,307

- 61,095

- 2,645

More stupid parrots ignoring facts and spreadibg failed Biden / Democrat mis-information / propaganda, proving you can provide snowflakes with all the facts available but can't make them educate themselves.Forbes Magazine: How Trump’s Deregulation Sowed The Seeds For Silicon Valley Bank’s Demise

This is further proof that Republicans are incapable of sound, responsible governance.

SVB had no CEO for something like 9 months, then when they hired one they chose a 'woke activist' who focused on LGBTQ, Gay rights activism instead of financial management, risk analysis, and sound banking practices....

....and after it collapsed Biden, Democrats, and the 'pixies' want to blame Republicans / Trump...

Last edited:

pyetro

Diamond Member

- Jul 21, 2019

- 5,538

- 5,751

- 1,940

- Thread starter

- #76

Biden isn't Congress. Biden can sign a law only if Congress passes it.Less stress testing, does not mean they were not being regulated.

So be specific in what type of “stress testing” would had prevented this? And why Biden didn’t put it back.

Duh

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

the 2008 meltdown wouldn't have happened without Clinton's deregulation of the baking, insurance and investment industries. the repeal of Glass Steagall erased the once very clear lines between banks insurance companies and investment firms which is what made too big to fail possible.Deregulation (and, actually, aggressive refusal to regulate) played a huge role in the Meltdown of 2008/2009, opening the floodgates for the shit securities like CMOs, CDOs and CDSs that brought us down.

And, as usual, we learned nothing.

Not a fucking thing.

easyt65

Diamond Member

- Aug 4, 2015

- 90,307

- 61,095

- 2,645

Biden has done so much UnConstitutional / illegal shit on his own, just like Barry did...Biden isn't Congress. Biden can sign a law only if Congress passes it.

Duh

Dems had Congress his first two years, nitwit.Biden isn't Congress. Biden can sign a law only if Congress passes it.

Duh

Yes, and I've listed that as a primary cause many times. That laid the foundation for what was to come, and we're still paying for it.the 2008 meltdown wouldn't have happened without Clinton's deregulation of the baking, insurance and investment industries. the repeal of Glass Steagall erased the once very clear lines between banks insurance companies and investment firms which is what made too big to fail possible.

I don't give a shit about partisan politics.

Similar threads

- Replies

- 147

- Views

- 2K

- Replies

- 23

- Views

- 257

- Replies

- 19

- Views

- 167

- Replies

- 11

- Views

- 166

Latest Discussions

- Replies

- 2

- Views

- 3

- Replies

- 306

- Views

- 3K

- Replies

- 30

- Views

- 396

Forum List

-

-

-

-

-

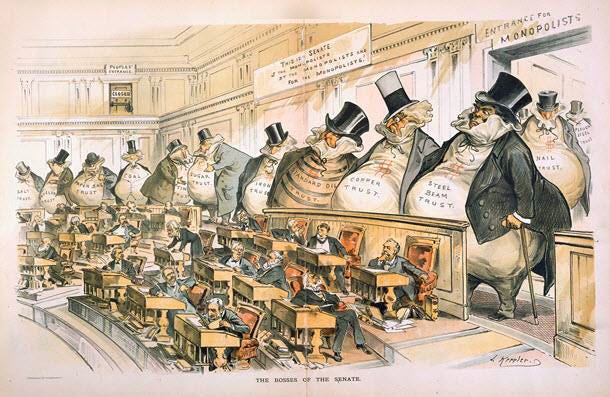

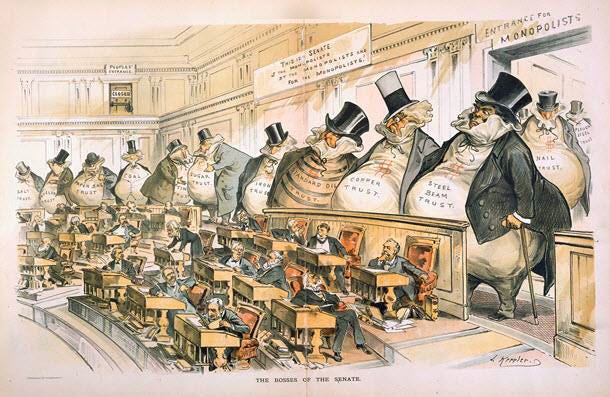

Political Satire 8125

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 472

-

-

-

-

-

-

-

-

-

-