MaggieMae

Reality bits

- Apr 3, 2009

- 24,043

- 1,635

- 48

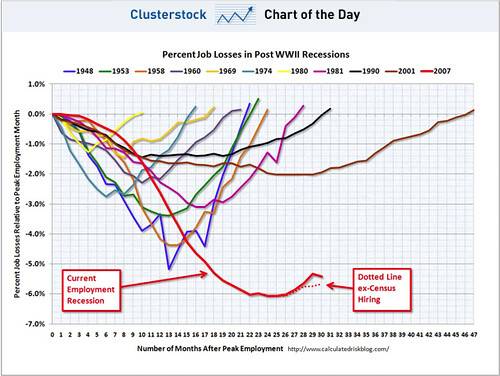

Well I see the Fed is now saying the the high unemployment numbers are here to stay for quite awhile.

Gloomy Fed employment forecast overshadows upbeat GDP data

Gloomy Fed jobs forecast overshadows upward revision on U.S. economic growth - latimes.com

The artice states that the American worker is facing competition from robots, computers and foreign workers.

And as this goes on, the US trade deficit grows.

So instead of putting 100% of the blame on Obama, Free Trade is certainly to blame and of course the outsourcing of American jobs overseas.

All of the experts agree that the manufacturing jobs lost during this recession will not be coming back. That means retraining of much of the workforce that has been in limbo these past two years in areas of production that will keep jobs HERE, not THERE. So what industry(ies) will that be? Since the U.S. dragged its feet in pursuing green energy, China now far surpasses us in those endeavors, so what else are we prepared to do that other countries can't do just as well but cheaper? Any answers?

How about a quick question. The USA just spent about a trillion dollars to "Stimulate" the economy and yet none of this re-trainig and no Green industry sprang up.

The economy sucks. The retraining did not happen and the Green industry is based in China.

Care to explain exactly what the Failed Stimulus did do?

Can't you people ever do your own research? Lazy asses--this took 5 seconds to find, since I presume if I had just given a litany from recollection, you would have demanded a link anyway.

Green Recovery Bill Will Deliver Less Pollution, More Jobs through Clean Energy - Environment America

This link details the Department of Energy's issuance of stimulus funding for the projects specified, by state. Details even include which contractors are involved.

Golden Field Office | ProPublica Recovery Tracker

I can't recall the number of times I posted the link to ProPublica.com which closely followed every aspect of the stimulus funding, BY STATE/BY PROJECT, but none of you would ever look at it. Seems it was much more politically advantageous to just continue to yammer away that the stimulus FAILED, period. How stupid. But then stupid people are only capable of absorbing a few snippets that they then believe tells the whole story as gospel.