- Feb 12, 2007

- 59,384

- 24,018

- 2,290

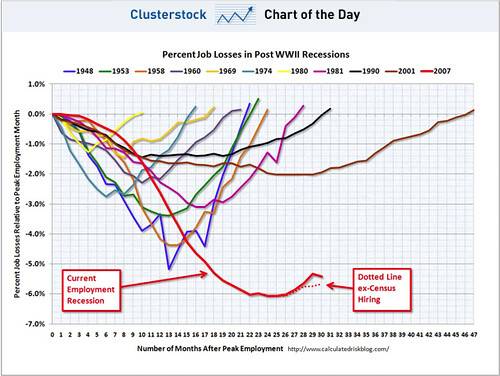

This is a good time to remind everyone of the historical comparisons:

Obamanomics made things worse. Much much worse than if he had done nothing at all.

Neither you nor anyone else can actually prove that.

Actually, economics proves it.

The economy goes through cycles of expansion and contraction. Historically, the worse the downturn, the stronger the cycle of growth during recovery. Instead of letting the private sector work by encouraging a climate favorable to growth (low taxes, less regulation, sensible monetary policy), Obama heightened uncertainty and fear by increasing the size of government by over 25% as a share of GDP in less than two years.

Money spent by the government is at the expense of the private sector. This is why growth is less than half of what it should be, and why jobs creation is on hold.