- Apr 12, 2011

- 3,815

- 761

- 130

By William Watts

Published by MARKET WATCH [ Trump is building a wall of worry, and that might be good news for stocks Jan 24, 2017 ] 4:23 a.m. ET

* * * * * * * *

MY TAKE:

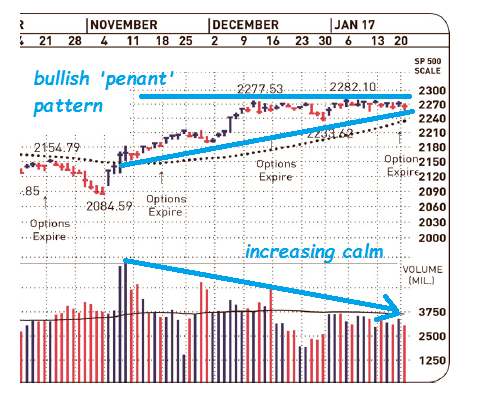

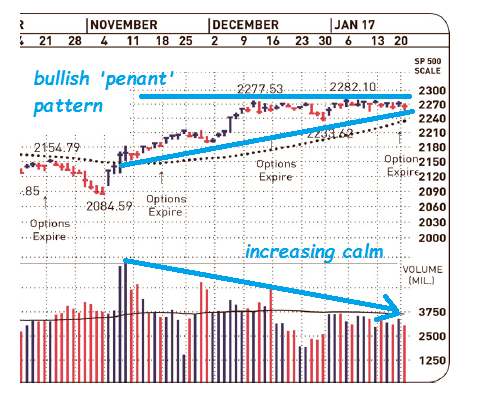

Lots of pundits say we got increasing volatility. They're crazy:

Back in late '08 IBD reported that most investors voted for O; that w/ the fact that "Wall St." is physically located in downtown Manhattan we know that there's a heavy bias w/ financial reporting toward the left.

Translation: this repeat of the blind disconnect we had back in '02 is telling us we got a HUGE buying opportunity...

Published by MARKET WATCH [ Trump is building a wall of worry, and that might be good news for stocks Jan 24, 2017 ] 4:23 a.m. ET

Should investors stop worrying and learn to love the uncertainty that surrounds the dawning of the Trump administration?

It’s a conundrum. After all, markets supposedly hate uncertainty, according to one oft-repeated market maxim. On the other hand, bull markets often see stocks “climb a wall of worry,” according to another axiom.

Donald Trump’s Nov. 8 presidential election victory sparked a stock-market rally as investors focused on pledges to cut taxes and reduce regulations and paid little heed to tough talk on trade and immigration that many had feared would be a negative...

...Trump and the accompanying partisan rancor surrounding his agenda is seen as almost certain to remain a source of market volatility.

“At this point, I think it’s clear we’re not going back to whatever normal was,” said Brad Tank, portfolio manager at Neuberger Berman, in a note.

* * * * * * * *

MY TAKE:

Lots of pundits say we got increasing volatility. They're crazy:

Back in late '08 IBD reported that most investors voted for O; that w/ the fact that "Wall St." is physically located in downtown Manhattan we know that there's a heavy bias w/ financial reporting toward the left.

Translation: this repeat of the blind disconnect we had back in '02 is telling us we got a HUGE buying opportunity...