keepitreal

Platinum Member

Thank goodness for liberal policies, affirmative action, diversity programs, labor laws, unions that blacks made the gains until Reagan and the bush’s caused a Great Recession.Any person in America has access to opportunities. They may not have the skills or balls go go get them.

Things are definitely harder for people in ghettos than they are for whites in Mayberry. What do you want us to do about it? There are rich whites who do the hiring that don’t like blacks. These are mostly small and medium size corporations. What do you want us to force them to hire blacks? Big corporations have diversity programs. They are trying.

And not every small and medium size company is racist. It is what it is.

So besides that. Are blacks starting their own businesses and supporting other black businesses?

It seems to me like the first thing a black does when they get successful is leave the black community behind.

Leslee jones on snl sang, “people say I forgot where I came from. I tell them I liv3 here because I remember where I came from”

Again your opinion is not supported by fact. We put our tax dollars in the same pot as whites but do not get the same return on our tax dollars. If we did much of the blight affecting black communities would not exist.

For the past 30-40 years citizens in the black community in Chicago have asked for the same thing. In Baltimore they found it more important to improve downtown and the harbor but not the black communities next to them. In Portland Oregon white developers are getting city help to build in black communities using money blacks put in the pot relative to taxes. You consistently think you have something to say that I need to hear because you are white and we all must pay homage to the great white delusion of how they made it in America. You try pawning of that I was oppressed and the truth you weren't. Greeks are white.

This is 2019 and white racism is still strong. That means non whites DO NOT have the same access to opportunity no matter what you believe. You can do something but whites like you don't have the balls. You know other white people are out there practicing racism in employment but are too cowardly to use the legal means available to stop them. Then you want to sit on your white ass calling yourself instructing us then asking what are we going to do about the white racists you know in business who are breaking the law.223,553 million white Americans, (includes white hispanics)Again your opinion is not supported by fact. We put our tax dollars in the same pot as whites but do not get the same return on our tax dollars. If we did much of the blight affecting black communities would not exist.

72% of the total U.S. population (2010)

197,285 million white Americans (non Hispanic)

60.7% of the total U.S. population (2017)

37,144 million black Americans (non Hispanic)

42 million black Americans (multi racial

45,789 million black Americans (multi racial)

WTF...I’M CANT EVEN FINISH, I’M SO FUCKING PISSED....

AND BLACKS SHOULD BE TOO...For the past 30-40 years citizens in the black community in Chicago have asked for the same thing.

WHY THEY ARE NOT, IS BEYOND ME!

Long story short

Looking for data to use in my reply

Came across....

Although the American Community Survey (ACS) produces population, demographic and housing unit estimates, it is the Census Bureau's Population Estimates Program that produces and disseminates the official estimates of the population for the nation, states, counties, cities, and towns and estimates of housing units for states and counties.

100,000 million Hispanic, Latino, Mexican population, ALONE

(58,846 million Hispanic or Latino)

(36,668 million Mexican)

Add in Puerto Rican, Cuba, other Hispanic or Latinos

Another 23 million

THAT IS 123 MILLION, AT THE VERY LEAST

OF HISPANIC/LATINOS IN AMERICA

Fact Finder: U.S. Census Bureau

Now, THIS DOES NOT ACCOUNT FOR

THE 26.7 MILLION WHITE HISPANICS,

WHO IDENTIFIED AS HISPANIC OR LATINO

BUT, ALSO SELF IDENTIFIED AS WHITE

NOR DOES IT ACCOUNT FOR

THE HISPANIC/LATINO INDIVIDUALS

SELF IDENTIFING AS WHITE...PERIOD

In the 2010 United States Census, 50.5 million Americans (16.3% of the total population) listed themselves as ethnically Hispanic or Latino. Of those, 53.0% (26.7 million) self-identified as racially white. The remaining respondents listed their races as: some other race 36.7%, two or more races (multiracial) 6.0%, Black or African American 2.5%, American Indian and Alaska Native 1.4%, Asian 0.4%, and Native Hawaiian or other Pacific Islander 0.1%.

The respondents in the "some other race" category are reclassified as white by the Census Bureau in its official estimates of race. This means that more than 90% of all Hispanic or Latino Americans are counted as "white" in some statistics of the US government.

Hispanics and Latinos who are native-born and those who are immigrant identify as White in nearly identical percentages:

53.9 and 53.7, respectively, per figures from 2007.

The overall Hispanic or Latino ratio was 53.8%.

Based on the definitions created by

The Office of Management and Budget

and the U.S. Census Bureau,

the concepts of ethnicity and race

are mutually independent, thus,

Hispanicity is not the same as race,

and constitutes an ethnicity category

as opposed to, a racial category....

the only one of which that is officially collated by the U.S

White Americans are therefore referenced as

white Hispanics and non-Hispanic whites,

the former consisting of white Americans

who report Hispanophone (Spanish Hispanic Latin America),

and the latter consisting of white Americans

who do not report Hispanophone ancestry.

WTF

White Hispanics and Latino Americans

WELL OF COURSE THE DEFINITIONS

THAT DEFINE WHAT CONSTITUTES

THE AVAILABLE CHOICES

AND DECIDED WHAT CHOICES YOU WOULD HAVE

WERE SET BY THE BUDGET OFFICE

AND PRESENTED IN SUCH A WAY

BY THE U.S. CENSUS BUREAU

SO YOU ONLY SEE THE PAINT,

NOT THE ACTUAL PAINTING!!!

Furthermore, this is what actually set me off...

The employment–population ratio

(that is, the proportion of the population that is employed)

The employment–population ratio was 57.6 percent for Blacks,

60.4 percent for Whites and 62.7 percent for Hispanics.

62.4% for individuals of 2 or more races....

MORE HISPANICS, NO DOUBT

THERE ARE MORE HISPANICS WORKING

THEN BLACKS OR WHITES

BLS reports

Tell me IM2, how is this not a problem for you?

Since you are so in tune with your people,

enlighten me as to why, other then,

blacks we see/hear from, in the media

that condemn a wall or trying to keep immigrants out

the black community has remained silent

and don’t have an issue with taking a backseat to Mexicans now

WTF...UNBELIEVABLE

HONESTLY IM2, how can you think Pelosi, Waters and Dems

are better for blacks and the black communities?

FOR 28 YEARS, SF AND THE BAY AREA

HAS BEEN REPRESENTED BY NANCY PELOSI

AND A STRONGHOLD BLUE CITY

In 1970, there were more than 96,000 black residents.

By 2016, the population had shrunk to 43,000

with most living in public housing.

Blacks are 6% of the population,

According to figures from the 2010 census,

121,744 Hispanics and Latinos were 15% of the population

That was 2010

Whites account for 44% of the population

300,000, give or take

And, it’s give or take because

THERE ARE CONFLICTING NUMBERS

BECAUSE THEY ARE COUNTING MEXICANS AS WHITE

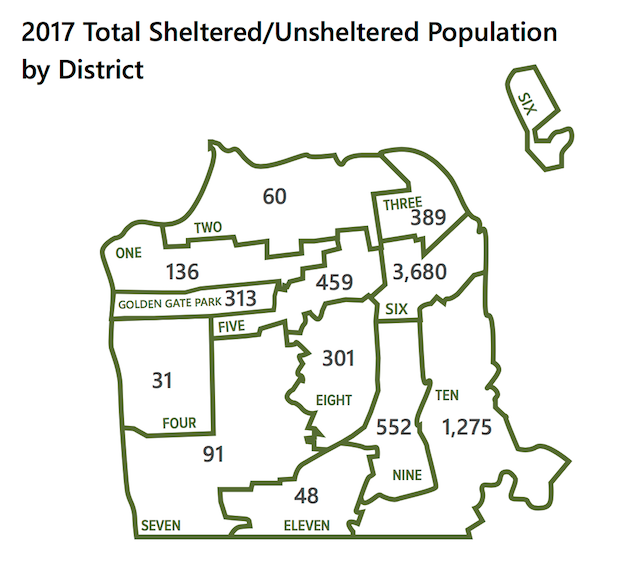

Districts 6, 9 and 10 are the Mission district

and the heaviest concentration of the Hispanic population

Yet, from the same report...

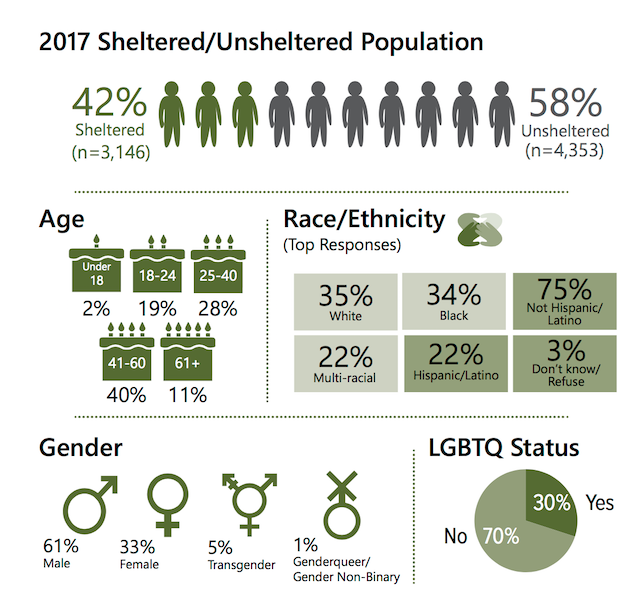

I found it pretty interesting,

when I read this in the same report...

Dispelling the notion that the majority of those on our streets have drifted here from elsewhere to receive free services and food,

69% of the homeless population claim they lived in

San Francisco housing prior to becoming homeless,

Just the fact, this was included in the report

tells me they are addressing what others in SF

are contributing the problems to

Dispelling...the notion

People in the community know what they see

and what they are seeing, leads them to believe

and what the city of San Francisco wants to dispel,

by the report

Believe me when I say....

NO ONE IN THE COMMUNITY THIS PROBLEM EFFECTS

IS REFERRING TO BLACKS AND WHITES

FLOODING INTO THE CITY FROM ELSEWHERE

FOR FREE SERVICES AND FOOD

IF BLACKS ARE ONLY 6% OF TOTAL POPULATION

AND REPRESENT 34% OF THE HOMELESS POPULATION

YOU EXPECT ME TO BELIEVE, OVER 121,000 MEXICANS

AND THEY ONLY REPRESENT 22% OF THE HOMELESS

FUCK OFF

In order for SF to get federal money to

‘fight the homeless problem’

these Homeless Census Reports

have to be filed every 2 years

The city of San Francisco has been dramatically increasing expenditure directed towards alleviating the homelessness crisis: spending jumped by $241 million in 2016-17 to total $275 million, compared to a budget of just $34 million the previous year. In 2017-18 the budget for combatting homelessness, much of which is directed towards the building of new shelters and expanding capacity, stood at $305 million.

In January 2018 a United Nations special rapporteur on homelessness, Leilani Farha, stated that she was "completely shocked" by San Francisco's homelessness crisis during a visit to the city. She compared the "deplorable conditions" of the homeless camps she witnessed on San Francisco's streets to those she had seen in Mumbai.

San Francisco

Back to spending...

On October 24, 2013, the Kellogg Foundation sent out a press release about a report they had done entitled, “The Business Case for Racial Equity”. This was a study done by the Kellogg Foundation, using information it had studied and assessed from the Center for American Progress, National Urban League Policy Institute, Joint Center for Political and Economic Studies and the U.S. Department of Justice.

“Striving for racial equity – a world where race is no longer a factor in the distribution of opportunity – is a matter of social justice. But moving toward racial equity can generate significant economic returns as well. When people face barriers to achieving their full potential, the loss of talent, creativity, energy, and productivity is a burden not only for those disadvantaged, but for communities, businesses, governments, and the economy as a whole. Initial research on the magnitude of this burden in the United States (U.S.), as highlighted in this brief, reveals impacts in the trillions of dollars in lost earnings, avoidable public expenditures, and lost economic output.”

The Kellogg Foundation and Altarum Institute

In 2011, DEMOS did a study named “The Racial Wealth Gap, Why Policy Matters”, which discussed the racial wealth gap, the problems associated with it and solutions and outcomes if the gap did not exist. In this study DEMOS determined that the racial wealth gap was primarily driven by policy decisions.

“The U.S. racial wealth gap is substantial and is driven by public policy decisions. According to our analysis of the SIPP data, in 2011 the median white household had $111,146 in wealth holdings, compared to just $7,113 for the median Black household and $8,348 for the median Latino household. From the continuing impact of redlining on American homeownership to the retreat from desegregation in public education, public policy has shaped these disparities, leaving them impossible to overcome without racially-aware policy change.”

“Eliminating disparities in homeownership rates and returns would substantially reduce the racial wealth gap. While 73 percent of white households owned their own homes in 2011, only 47 percent of Latinos and 45 percent of Blacks were homeowners. In addition, Black and Latino homeowners saw less return in wealth on their investment in homeownership: for every $1 in wealth that accrues to median Black households as a result of homeownership, median white households accrue $1.34; meanwhile for every $1 in wealth that accrues to median Latino households as a result of homeownership, median white households accrue $1.54.”

“If public policy successfully eliminated racial disparities in homeownership rates, so that Blacks and Latinos were as likely as white households to own their homes, median Black wealth would grow $32,113 and the wealth gap between Black and white households would shrink 31 percent. Median Latino wealth would grow $29,213 and the wealth gap with white households would shrink 28 percent.”

“If public policy successfully equalized the return on homeownership, so that Blacks and Latinos saw the same financial gains as whites as a result of being homeowners, median Black wealth would grow $17,113 and the wealth gap between Black and white households would shrink 16 percent. Median Latino wealth would grow $41,652 and the wealth gap with white households would shrink 41 percent.”

“Eliminating disparities in college graduation and the return on a college degree would have a modest direct impact on the racial wealth gap. In 2011, 34 percent of whites had completed four-year college degrees compared to just 20 percent of Blacks and 13 percent of Latinos. In addition, Black and Latino college graduates saw a lower return on their degrees than white graduates: for every $1 in wealth that accrues to median Black households associated with a college degree, median white households accrue $11.49. Meanwhile for every $1 in wealth that accrues to median Latino households associated with a college degree, median white households accrue $13.33.”

“If public policy successfully eliminated racial disparities in college graduation rates, median Black wealth would grow $1,313 and the wealth gap between Black and white households would shrink 1 percent. Median Latino wealth would grow $3,528 and the wealth gap with white households would shrink 3 percent. “

“If public policy successfully equalized the return to college graduation, median Black wealth would grow $10,786 and the wealth gap between Black and white households would shrink 10 percent. Median Latino wealth would grow $5,878 and the wealth gap with white households would shrink 6 percent.”

“Eliminating disparities in income—and even more so, the wealth return on income—would substantially reduce the racial wealth gap. Yet in 2011, the median white household had an income of $50,400 a year compared to just $32,028 for Blacks and $36,840 for Latinos. Black and Latino households also see less of a return than white households on the income they earn: for every $1 in wealth that accrues to median Black households associated with a higher income, median white households accrue $4.06. Meanwhile, for every $1 in wealth that accrues to median Latino households associated with higher income, median white households accrue $5.37.”

“If public policy successfully eliminated racial disparities in income, median Black wealth would grow $11,488 and the wealth gap between Black and white households would shrink 11 percent. Median Latino wealth would grow $8,765 and the wealth gap with white households would shrink 9 percent.”

“If public policy successfully equalized the return to income, so that each additional dollar of income going to Black and Latino households was converted to wealth at the same rate as white households, median Black wealth would grow $44,963 and median Latino wealth would grow $51,552. This would shrink the wealth gap with white households by 43 and 50 percent respectively.”

Now STFU.No African...YOU shut the fuck up!Now STFU

Bitch...been there done thatIf public policy successfully eliminated racial disparities in homeownership rates, so that Blacks and Latinos were as likely as white households to own their homes,

Under Obama, all gains in African wealth, were lost

This wealth was gained, under Clinton

Granting loans based on income, job history

debt ratio and credit score(worthiness)

is not redlining, it’s practical

No one is entitled to own a home

unless they can afford it

What, create policies forcing buyers to pay top dollar on a homeIf public policy successfully equalized the return on homeownership, so that Blacks and Latinos saw the same financial gains as whites as a result of being homeowners,

that wasn’t taken care of, in a shithole neighborhood

What, create policies to give Africans degreesIf public policy successfully eliminated racial disparities in college graduation rates, median Black wealth would grow $1,313

So, current public policy is to blame

for the rate of Africans graduating from college?

So, current public policy is to blameIf public policy successfully equalized the return to college graduation, median Black wealth would grow $10,786

for African choices and responsibilities?

So, if an African graduates college

but, has outstanding debt, expensive taste,

maybe they already have a couple kids,

maybe they chose a field that wasn’t practical...

That’s whose fault?

White people and public policy

So, people who work at McDonalds or WalmartIf public policy successfully eliminated racial disparities in income, median Black wealth would grow $11,488

should make the same as a nurse

So, Africans being limited to low paying jobs

is the result of public policy

Again, if Africans obligations or spending habitsIf public policy successfully equalized the return to income, so that each additional dollar of income going to Black and Latino households was converted to wealth at the same rate as white households

prevent them from accumulating wealth

because they spend their money foolishly

or are taking care of their responsibilities

how is anyone or anything else to blame?

You want policies to give Africans loans, again,

so they can buy homes they can’t afford and won’t take care of

and force potential buyers to pay more then the house is worth

You want policies to give Africans college degrees

so there are as many Africans with a college degree as whites

You want policies that require paying Africans,

working low paying jobs, top dollar

You want policies that create wealth

because their obligations and poor choices

prevent them from accumulating wealth otherwise

Go fuck yourself African

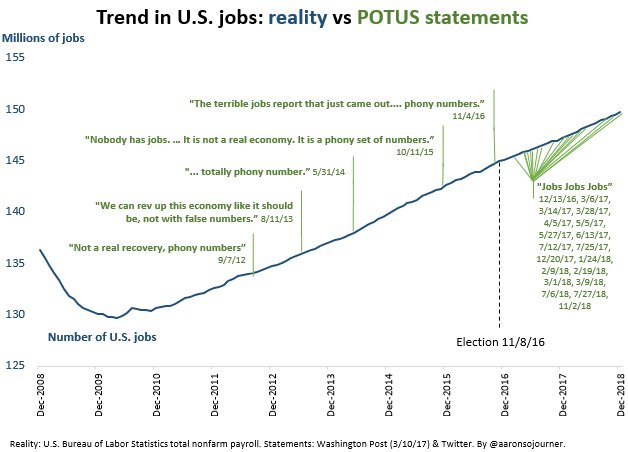

Turned Clinton’s surplus into a Great Recession. Then obama had to clean up the mess.

Thank goodness for liberal policies, affirmative action, diversity programs, labor laws, unions that blacks made the gains until Reagan and the bush’s caused a Great Recession.

Clinton’s lending policies, which enabledTurned Clinton’s surplus into a Great Recession. Then obama had to clean up the mess.

low income Africans, with unstable work history,

low credit scores and were risky, to secure loans

caused the housing crisis...African foreclosures

were already on the rise in 2007

What mess did Obama clean up?

Out of over 23 TRILLION DOLLARS

handed over to Wall Street,

less than 4 BILLION DOLLARS was spent,

to help low income, minority homeowners

at the greatest risk of foreclosure

when he earmarked 50 BILLION DOLLARS,

specifically for these homeowners with HAMP

By the end of Obama’s presidency

all gains Africans had accumulated under Clinton

vanished and have yet to be recovered