AntonToo

Diamond Member

- Jun 13, 2016

- 30,828

- 8,945

- 1,340

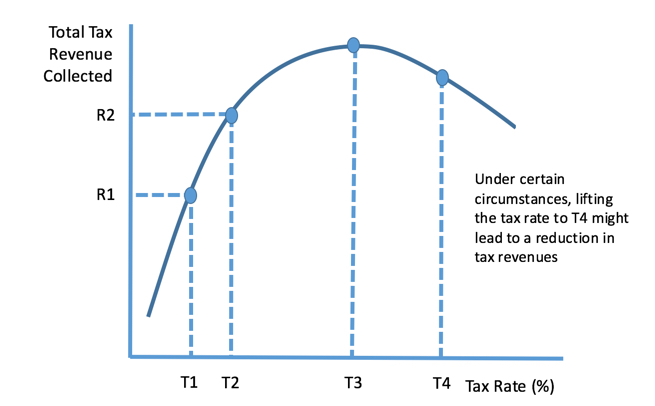

LOL. Yeah, ok. Here is JFK on record talking about how tax cuts improve a stagnant economy. A concept that would get him labeled as a “racist” and a “fascist” by you nut jobs today:LOL yea ok. JFK idea of proper marginal tax rate was 60%

Ignoramus, the marginal tax rate is currently 30% bellow JFK's rate.

Tax cut from 90 to 60% is NOT like a tax cut from 30 to 20%...though of course that needs to be explained ot the tax-cut-good! sophsticates on the right.