loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Who gets to define "extremist"?

oddball = extremist. duh!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Who gets to define "extremist"?

Not only that, the GOP are STILL taking credit for the Clinton surplus.BUDGET SURPLUS!

there was indeed a budget surplus and that is undeniable.

Bush in 2001 used the budget surplus as a rationale for his tax cuts.

Face The Nation - CBS News

SENATOR AMY KLOBUCHAR: Democrats have made a lot of tough decisions, if you

look at the last two years. When President came in he inherited this debt that had grown and

grown and grown over the Bush years. When Bill Clinton left office the last time that we had a

surplus it was a Democratic President. So you have to look at the fact that Democrats have

made some tough decisions in the past. They got us into a balanced budget. And we can make

the tough decisions this time.

SENATOR JEFF SESSIONS: Well, Bob, Lindsey was there when the last budget was balanced.

He was there with Newt Gingrich.

BOB SCHIEFFER: Yeah.

SENATOR JEFF SESSIONS: And there was blood politically on the floor. People slept in their

offices. The government was shut down. Bill Clinton then claims credit for balancing the budget,

but people living there could see that was the Congress that made that happened in many

ways.

You're self-serving hallucination as to what constitutes the unquantifiable "society" is as irrelevant as your opinion as to what the mythical and royal "we" get out of it.Your premise relies upon the fiction of "society" as tangible at the outset.It's far more than that. The entire society rather voluntarily subscribes to public fictions, like money, gravity, math, statistics, the authority of scientists and clergy, GOD. The moral distinction between war and cold blooded murder, the right of states to engage in violence, spy on citizens and keep secret from us that which we must know to vote as actual citizens in a democratic process.

Truth is I suspect that almost everything you believe is a public fiction. You just don't know it.

Try again.

No it doesn't, my premise relies on any any set of people whose lives intersect regardless of whether it is a family, tribe, clan, village, city, state, one man and one woman on an island etc.

In order to speak we depend on social fictions. In order to sell and honor bonds on a macro scale we rely on the same edifis, bonds and money; social fictions.

You're self-serving hallucination as to what constitutes the unquantifiable "society" is as irrelevant as your opinion as to what the mythical and royal "we" get out of it.Your premise relies upon the fiction of "society" as tangible at the outset.

Try again.

No it doesn't, my premise relies on any any set of people whose lives intersect regardless of whether it is a family, tribe, clan, village, city, state, one man and one woman on an island etc.

In order to speak we depend on social fictions. In order to sell and honor bonds on a macro scale we rely on the same edifis, bonds and money; social fictions.

Keep swingin'.

The surest sign of losing is self-declarations of victory.

Got a couple buckets of society you can lend me?.....I promise to pay you back at the end of the month with a truckload of it.

The surest sign of losing is self-declarations of victory.

Sure...Under the laws written by that those who rely upon defining money that they don't have, and might possibly not ever have, as an "asset".

Nice work, if you can get it.

Those are unsecured loans.Yep, why they want to know your job status and income, etc.

This is relevant how?

Pension funds buy government debt and hold them as assets. Banks buy government debt and hold them as assets. Insurance companies buy government debt and hold them as assets. Individuals buy government debt and hold them as assets. The social security trusts buy government debt and hold them as assets. What's the problem?

Those are unsecured loans.

This is relevant how?

Pension funds buy government debt and hold them as assets. Banks buy government debt and hold them as assets. Insurance companies buy government debt and hold them as assets. Individuals buy government debt and hold them as assets. The social security trusts buy government debt and hold them as assets. What's the problem?

I do have to say that I KNOW its the system but a corrupted system rigged so as take money from the left hand pocket, put in the right, spend it, then put a piece paper back in the left saying I owe myself ex-amount of dollars and I'll pay myself back in real dollars buy printing money or taking more back from my 'employees'......this thing was due for a catastrophe from day one.

i agree with you, and have also posted CBO as my source...and yes, the budget has been greatly misunderstood....and it is simply not true that Clinton did not have a surplus when measured by the same means every president has been measured on balancing the budget....because he DID have a surplus according to those measures.

He, along with his Congress....reduced the huge deficit he inherited, every year he was in office...

The CBO, the official bipartisan agency in Congress reporting on the budget (and that many conservatives have referred to frequently regarding the current budget) reports there were surpluses. And the total debt decreases by over $100 billion in Clinton's last year.

Yet I hear over and over that the surplus was a "myth". So I don't get where the claim there was no "surplus" comes from, other than Murdoch outlets I mean.

Thus this thread.

So far, none of the several people that claimed the surplus was a "myth" which has been according to some proved over and over here have shown up. It's telling.

oh, you will get a response, from divecon and diamond dave for certain! patience is a virtue!

they just are not online now....!

they honestly believe that clinton didn't have a surplus based on opinions which they have read on the subject, so i don't think you will get far with them on this!!!! hahahahaha!

....even with the OMB statistics...I don't know what else to tell ya, except that someday, it may sink in with them...???

Because I believe, that they believe, they are being honest on the subject, I usually just agree to disagree on the subject....but that's just me....it took a bit of arguing and debating the subject before i resided to this position and have just resorted to praying that they will see the truth someday!

Good luck on your part though....maybe you will succeed?

Care

People have difficulty wrapping their minds around this concept. What is currently in the SS trusts are promissory notes from the government, i.e. "IOUs." It is a promise by the government to make whole the obligations of the SS trust. But an actual Treasury bond is also just a promissory note. It is a promise by the government to make your loan to the government whole. The difference between SS and a "real" pension fund is that SS cuts out the middleman. It doesn't tap the market.

Now, I think this is not a good system, least of all is because it confuses otherwise smart people. More importantly, government bonds are considered "safe" and politicians don't want to be seen as doing anything other than "safe." But that's a mis-characterization because the interest earned in the trust over time is 3%-6% whereas a "real" pension fund invested across a broad spectrum of investments earns 6%-10%. And that difference in compound interest over time is enormous.

But there are at least 3 significant reasons why they do it that way instead of buying secondary market bonds and holding a diverse portfolio.

I agree that SS returns are a pittance of what they would be if they were managed according to industry standards, but there is more involved in the calculus than just simple risk and ROI.

All things considered the current SS pension system sucks. But really, what is the alternative?

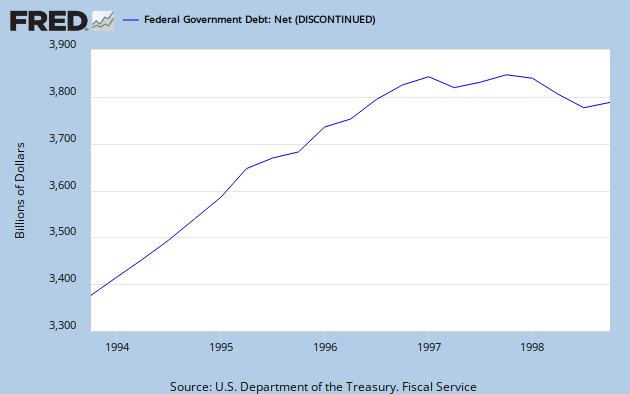

Some are confused about what occurred in the late 90s regarding the budgetary surplus and the national debt. Some have argued that there was no surplus because national debt rose in the final years of the Clinton Presidency. As has been demonstrated, this characterization is incorrect. The budget balance is the difference between government revenues and spending, nothing more. It does not include changes in the national debt.

Thus, the question is why did the national debt rise even though there was a surplus? And the next question is it a bad thing? The answers may surprise some people.

Why did the national debt rise when there was a surplus?

Counter-intuitively, the reason why the national debt rose was because the economy was doing well. When the economy is doing better than expected, payroll taxes flowing into the SS trust funds are greater than expected. The SS trust funds can only "buy" special issuance nonmarketable government bonds. Thus, when payroll tax revenues are greater than expected, issuance of these special issuance government bonds rises and the national debt rises. Likewise, when the economy is doing poorly, payroll tax inflows are less than expected. The amount of funds in the SS trusts is lower, the SS trusts buy fewer special-issue government bonds and the national debt is less than expected.

Understand, though, that this is merely an accounting function. It affects assets and liabilities of the government and trust fund recipients. It does not affect cash flows, and thus does not affect the budgetary balance.

So was rise in the national debt a bad thing?

It is true that in the last half of the 1990s, total government debt rose. But did it negatively affect the balance sheet of the United States government? In other words, was the rise in the national debt during the last 1990s a bad thing?

To help us understand this question, it is best to use an example.

Let us say that in the first year, the government has total debt of $1,000, including $100 of debt in the social security trust. This is the breakdown of the governments debt.

Total government debt, year 1

Social security debt -$100

All other government debt -$900

Total government debt -$1,000

Now, lets say that in the second year, the government runs a $20 surplus and payroll taxes are $30 all of which go into the SS trusts. Payroll taxes are used to buy government debt in the SS trusts and the surplus is used to pay down other government debt. There is no change in any other debt. The breakdown of the governments total debt is as follows.

Total government debt, year 2

Social security debt -$130

All other government debt -$880

Total government debt -$1,100

The debt has gone up even though the government has run a surplus.

This is bad, right?

In this case, no.

Why?

Because we are only looking at one side of the balance sheet.

What the critics fail to recognize is that they are looking only at gross debt.

What matters is not gross debt but net debt, which is total debt less total assets.

Critics who decry the governments total national debt rising in the last years under Clinton are only looking at total debt, not net debt. This is intellectually flawed. An analogy would be to look only at mortgage debt when assessing an individual's financial health without looking at the value of the house. According to the critics, if you take out a $200,000 mortgage, thats bad. But it is not bad if the value of your house is $300,000.

It works the same way for the social security trusts. This is what the critics omit.

If you earn $100 and you buy a government bond for $100, your assets now include a government bonds worth $100. The SS trusts do the same thing. Money comes in and they buy bonds from the government.

Lets look at our example again. Lets say that in the first year, the government has assets worth $400. The SS trusts are government agencies, and government debt in the SS trust funds is an asset of the SS trust fund. Since the government has $100 in debt outstanding issued to the SS trusts, the SS trusts now have assets worth $100. Thus, the balance sheet of the government looks like this.

Government debt issued to the SS trusts is an asset of the SS trusts. The SS trusts are essentially buying government bonds. If you buy a government bond for $100, you now own a government bond. The SS trusts effectively do the same thing

Total government debt, year 1

Social security debt -$100

All other government debt -$900

Total government debt -$1,000

Total government assets, year 1

Debt issued by the government to the SS trusts $100

All other government assets $300

Total government assets $400

Net government debt, year 1 -$600

Net debt is total debt less total assets. In this case $1,000 in government debt less $400 in government assets means the governments net debt is -$600.

It is no different than you owning your house. If you own your house, your balance sheet looks like this.

House $300,000

Less: Mortgage -$200,000

Net equity $100,000

We do the same thing for the government. What matters is not gross debt but net debt.

Now, lets look at the example above in year 2, where the government runs a $20 surplus with $30 in payroll taxes, which go directly into buying government debt in the SS trusts. The balance sheet of the government would look like this.

Total government debt, year 2

Social security debt -$130

All other government debt -$880

Total government debt -$1,100

Total government assets, year 2

Debt issued by the government to the SS trusts $130

All other government assets $300

Total government assets $430

Net government debt, year 2 -$580

As you can see, even though total debt rises, because there is a budgetary surplus, net debt declines when there is a surplus because the value of assets rises.

When one is assessing the fiscal health of the government, one must look at net debt, not total debt. This is what the conservative critics fail to understand.

Mr. Clinton's plan is based on the idea that by using the Social Security surplus to pay down the national debt, the Government's interest bill will decline substantially.

By the White House's estimate, the Government's interest expense will be $107 billion lower in 2011 than it would be if the Social Security surplus were not used, starting this year, to reduce the debt. Mr. Clinton's proposal would take the money saved because of the lower amount of debt, starting in 2011, and earmark it to shore up Social Security.

Source: CLINTON ABANDONS IDEA OF INVESTING RETIREMENT FUNDS - NYTimes.com

This despicable gimmick used by the White House and Congress to cover up the huge federal budget deficit was the looting of the Social Security Trust Fund, Medicaid, Civil Service and military retirements funds[1]. This money may very well not be available to many of us when we grow old.

Its not a despicable gimmick because its not a gimmick at all. It is how all cash flows into and out the SS trusts have been accounted for since the early 1980s when the government revamped the operations of the SS trusts.

Both parties routinely agreed for decades to spend excess Social Security payroll tax revenues on general Government operations.

But this year the two parties have both pledged to balance the budget without using any of the Social Security money, and they have been trading bitter accusations about the inability of the other to show how to do it.

Total social security cash receipts in the fiscal year was $620 billion. Total social security cash outlays was $442 billion.

Mr. Clinton's plan is based on the idea that by using the Social Security surplus to pay down the national debt, the Government's interest bill will decline substantially.

By the White House's estimate, the Government's interest expense will be $107 billion lower in 2011 than it would be if the Social Security surplus were not used, starting this year, to reduce the debt. Mr. Clinton's proposal would take the money saved because of the lower amount of debt, starting in 2011, and earmark it to shore up Social Security.

President Clinton dropped one of the most contentious elements of his plan for bolstering Social Security's finances today, and called on Congress to break the partisan deadlock over how to prepare the retirement system for the aging of the baby boom generation.

In his weekly radio address, Mr. Clinton said he would send Congress legislation next week based on a proposal he first floated earlier this year to shore up Social Security with projected Federal budget surpluses. But the new version will not include Mr. Clinton's longstanding call for the Government to invest some Social Security taxes in the stock market. ...

In a signal of his desire for bipartisan cooperation, White House officials said Mr. Clinton was withdrawing for now his plan to seek higher returns for the system by having the Government invest as much as 15 percent of Social Security's reserves in the stock market.