Liberals are still liberalsYep, the Founders those guys who chose a HEAVY protectionist policy?

you have told that lie before, stupid!! Please stop lying!!

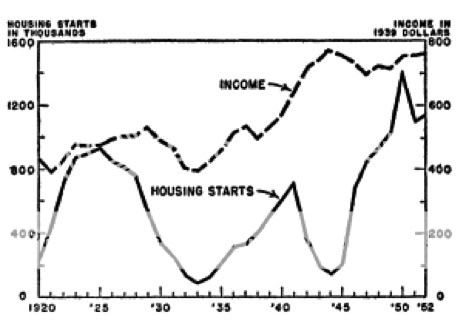

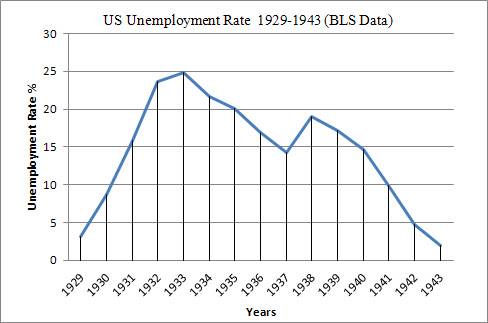

(Re-)Introducing: The American School of Economics

When the United States became independent from Britain it also rebelled against the British System of economics, characterized by Adam Smith, in favor of the American School based on protectionism and infrastructure and prospered under this system for almost 200 years to become the wealthiest nation in the world. Unrestrained free trade resurfaced in the early 1900s culminating in the Great Depression and again in the 1970s culminating in the current Economic Meltdown.

Closely related to mercantilism, it can be seen as contrary to classical economics. It consisted of these three core policies:

- protecting industry through selective high tariffs (especially 1861–1932) and through subsidies (especially 1932–70)

- government investments in infrastructure creating targeted internal improvements (especially in transportation)

- a national bank with policies that promote the growth of productive enterprises rather than speculation.

The American School of capitalism was intended to allow the United States to become economically independent and nationally self-sufficient.

Frank Bourgin's 1989 study of the Constitutional Convention shows that direct government involvement in the economy was intended by the Founders.

The goal, most forcefully articulated by Hamilton, was to ensure that dearly won political independence was not lost by being economically and financially dependent on the powers and princes of Europe. The creation of a strong central government able to promote science, invention, industry and commerce, was seen as an essential means of promoting the general welfare and making the economy of the United States strong enough for them to determine their own destiny

American School (economics) - Wikipedia, the free encyclopedia

Admit you lied or give us a good example of protectionism from our Founders. You idiot liberal they gave us the commerce clause which was designed to promote free trade. NOw do you see what a total idiot you are. That's why you though our founders were liberal and now you know even that was not true!!

The founding fathers were classic liberals. The people calling themselves "liberal" today are actually authoritarian leftists, there is nothing in common between the two

The founders were the greatest liberals of the day. They used liberal concepts to solve the issues of the day

Just like today's liberals

Today's liberals use authoritarian leftism to "solve the issues of the day," that is nothing like the founders who actually were liberals, comrade big guy. You are Marxists