NYcarbineer

Diamond Member

That is what the progressive taxation is about -- the more income you earn, the larger share of it you have to pay in taxes. That how it works in every developed country.

And that is not unfair. We have to make it more progressive, not less.

First of all, progressive anything is an epic failure. It's just another bullshit way of saying Socialism/Marxism/Communism.

Second, a flat tax (say 10%) ensures that the wealthy do pay more (10% of a billion is a fuck load more than 10% of $30,000).

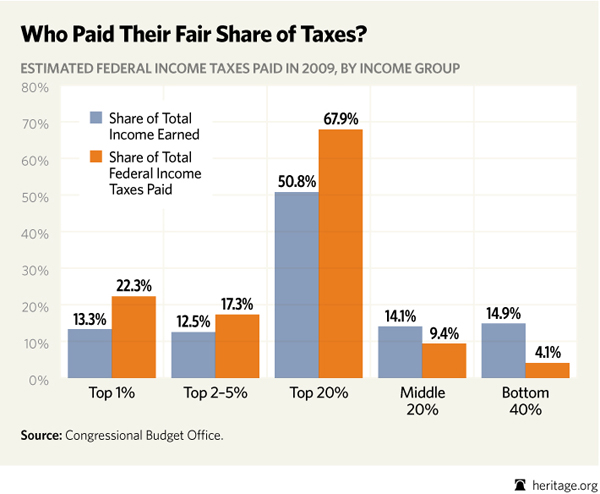

The fact that you want the wealthy, who already pay more on a percentage (that's why we use percentage) to also pay a higher percentage is sheer ugly, nasty, greed on your part.

Why is percentage of income 'fair', even if it's flat?

Should we price goods and services on a percentage basis? Would that be 'fair'? Should someone who earns 10 times what I earn pay 20.00 for a cup of coffee that I pay 2.00 for?