Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Taxes: 101

- Thread starter P@triot

- Start date

- Thread starter

- #2

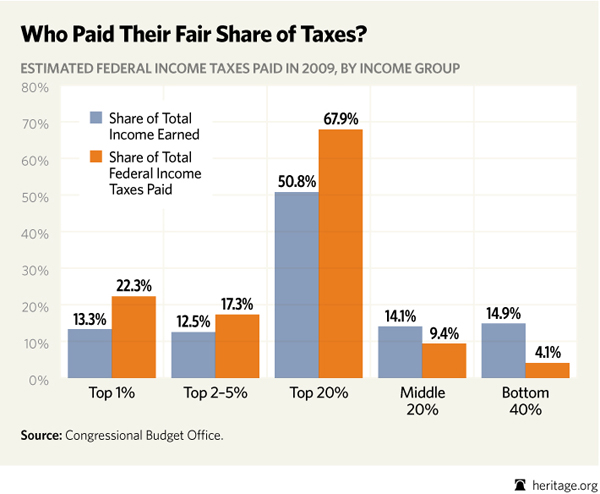

Because dumbocrats are so profoundly stupid, please allow me to explain this simple chart to you.

In each section, the bar on the left (since most dumbocrats can't tell their left from their right, they color-coded it for you - so the left is the gray bar) is the percentage of wealth that group has accumulated (in this case, the first one is the top 1%). The bar on the right (again, color-coded for the dumbocrats - so look for the orange bar) is the percentage of taxes that group has paid.

So in the first example, the Top 1% of the wealthy (think Bill Gates level) has accumulated 13% of the wealth. Now, if they were to pay their "fair share" like the idiot liberal dumbocrats scream they want, then they should pay 13% of the taxes. Instead, they pay 22% of the taxes.

In each case, the taxes (ie bar on the right) exceeds the wealth earned (ie bar on the left) for the upper class. It's not until you get to the middle class that this trend ends.

So you see, as I've long been saying, in order for the wealthy to pay their "fair share", we would have to drastically reduce taxes on the wealthy.

This demonstrates how profoundly stupid the dumbocrats are....

In each section, the bar on the left (since most dumbocrats can't tell their left from their right, they color-coded it for you - so the left is the gray bar) is the percentage of wealth that group has accumulated (in this case, the first one is the top 1%). The bar on the right (again, color-coded for the dumbocrats - so look for the orange bar) is the percentage of taxes that group has paid.

So in the first example, the Top 1% of the wealthy (think Bill Gates level) has accumulated 13% of the wealth. Now, if they were to pay their "fair share" like the idiot liberal dumbocrats scream they want, then they should pay 13% of the taxes. Instead, they pay 22% of the taxes.

In each case, the taxes (ie bar on the right) exceeds the wealth earned (ie bar on the left) for the upper class. It's not until you get to the middle class that this trend ends.

So you see, as I've long been saying, in order for the wealthy to pay their "fair share", we would have to drastically reduce taxes on the wealthy.

This demonstrates how profoundly stupid the dumbocrats are....

- Thread starter

- #3

Given that long, well-publicized history, there isn't much news to be found in Buffett's latest Times op-ed this morning, calling once again for a minimum tax on millionaires. Except that Buffett opens this one with a rifle shot at Grover Norquist specifically, and supply-side economics generally:

Suppose that an investor you admire and trust comes to you with an investment idea. This is a good one, he says enthusiastically. Im in it, and I think you should be, too.

Would your reply possibly be this? Well, it all depends on what my tax rate will be on the gain youre saying were going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent. Only in Grover Norquists imagination does such a response exist.

It's a catchy opener, attracting headlines and guffaws from the expected quarters. But I'm struck by his opener because I can think of at least one real-world example in which a rich investor nearly spiked a deal due to taxes: Warren Buffett himself, as recounted in Alice Schroeder's terrific biography, The Snowball (pages 230-232).

Early in his career, Buffett invested heavilyalmost one third of his early fund's capitalin Sanborn Map, a company that mapped utility lines and such. But he soon grew frustrated with the company's leadership, which "operated more like a club than a business," and which refused to return greater dividends to investors. So Buffett amassed more and more stock, and with control of the company finally in hand he pressed the board of directors to split the company in two (one for the mapping business, and one to hold the company's other outsized investments).

Finally, the board capitulated. But with victory finally at hand, Buffett nearly scuttled the deal because of ... taxes. As Schroeder recounts, quoting Buffett, one director proposed that the company just cleanly break the company, despite the tax consequences"let's just swallow the tax," he suggested.

To which Buffett replied (as he recounted to Schroeder):

And I said, 'Wait a minute. Let's -- "Let's" is a contraction. It means "let us." But who is this us? If everyone around the table wants to do it per capita, that's fine, but if you want to do it in a ratio of shares owned, and you get ten shares' worth of tax and I get twenty-four thousand shares' worth, forget it.'

Buffett was willing to walk away from a deal because the taxes would have taken too much of a bite out of it. Fortunately for him, the board gave in and allowed him to structure the deal that he liked, saving him from his own Norquistian response.

Hypocrisy... it is the cornerstone of the idiot liberal dumbocrat. As Andrew Wilkow so brilliantly stated: "Buffett wants to pull the ladder up behind him". He's made his billions, now he wants to pull the ladder up so that no one else can climb to the same level he did through business and personal wealth crushing taxes. It ensures his wealth and power for himself and future generations of his family.

Watch What Warren Buffett Does, Not What He Says | The Weekly Standard

Suppose that an investor you admire and trust comes to you with an investment idea. This is a good one, he says enthusiastically. Im in it, and I think you should be, too.

Would your reply possibly be this? Well, it all depends on what my tax rate will be on the gain youre saying were going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent. Only in Grover Norquists imagination does such a response exist.

It's a catchy opener, attracting headlines and guffaws from the expected quarters. But I'm struck by his opener because I can think of at least one real-world example in which a rich investor nearly spiked a deal due to taxes: Warren Buffett himself, as recounted in Alice Schroeder's terrific biography, The Snowball (pages 230-232).

Early in his career, Buffett invested heavilyalmost one third of his early fund's capitalin Sanborn Map, a company that mapped utility lines and such. But he soon grew frustrated with the company's leadership, which "operated more like a club than a business," and which refused to return greater dividends to investors. So Buffett amassed more and more stock, and with control of the company finally in hand he pressed the board of directors to split the company in two (one for the mapping business, and one to hold the company's other outsized investments).

Finally, the board capitulated. But with victory finally at hand, Buffett nearly scuttled the deal because of ... taxes. As Schroeder recounts, quoting Buffett, one director proposed that the company just cleanly break the company, despite the tax consequences"let's just swallow the tax," he suggested.

To which Buffett replied (as he recounted to Schroeder):

And I said, 'Wait a minute. Let's -- "Let's" is a contraction. It means "let us." But who is this us? If everyone around the table wants to do it per capita, that's fine, but if you want to do it in a ratio of shares owned, and you get ten shares' worth of tax and I get twenty-four thousand shares' worth, forget it.'

Buffett was willing to walk away from a deal because the taxes would have taken too much of a bite out of it. Fortunately for him, the board gave in and allowed him to structure the deal that he liked, saving him from his own Norquistian response.

Hypocrisy... it is the cornerstone of the idiot liberal dumbocrat. As Andrew Wilkow so brilliantly stated: "Buffett wants to pull the ladder up behind him". He's made his billions, now he wants to pull the ladder up so that no one else can climb to the same level he did through business and personal wealth crushing taxes. It ensures his wealth and power for himself and future generations of his family.

Watch What Warren Buffett Does, Not What He Says | The Weekly Standard

- Thread starter

- #4

Look at the two bars in the middle of the graph - the top 20% are paying nearly 70% of the taxes. That is an outrage.

It's time the parasite class start paying their fair share. We need to drastically reduce taxes on the wealthy, substantially reduce taxes on the middle class, and drastically increase taxes on the parasite class (as well as end entitlements for them that are allowing them to live off of the American tax payer).

It's time the parasite class start paying their fair share. We need to drastically reduce taxes on the wealthy, substantially reduce taxes on the middle class, and drastically increase taxes on the parasite class (as well as end entitlements for them that are allowing them to live off of the American tax payer).

Mr. H.

Diamond Member

And the middle/bottom have a share of total earned income at the same % as the top 1-5. LOL

- Thread starter

- #6

And the middle/bottom have a share of total earned income at the same % as the top 1-5. LOL

Yeah, which means they've been more successful. What's wrong with that? If bottom class actually got up off their lazy ass and did something, they would earn a lot more. "LOL"

- Sep 14, 2011

- 63,931

- 9,965

- 2,040

And the middle/bottom have a share of total earned income at the same % as the top 1-5. LOL

Yeah, which means they've been more successful. What's wrong with that? If bottom class actually got up off their lazy ass and did something, they would earn a lot more. "LOL"

IOW, the reason YOU are not one of the 1% is that YOU are lazy.

Would it be fitting here to remind all that, since possessions are not federally taxed, the greatest impediment to anyone- anyone!- becoming wealthy is taxation.

Who needs facts when rhetoric works?

I hate to point this out but someone at the CBO can't count, the percentages of total income taxes adds up to more than 100%. How did they do that?

- Thread starter

- #11

And the middle/bottom have a share of total earned income at the same % as the top 1-5. LOL

Yeah, which means they've been more successful. What's wrong with that? If bottom class actually got up off their lazy ass and did something, they would earn a lot more. "LOL"

IOW, the reason YOU are not one of the 1% is that YOU are lazy.

First of all, who said I'm not in the top 1%?

Second, I'm in the exact class I've chosen to be in. Nothing less. Nothing more. Exactly where I've chosen. I've gotten here through work and a committment to excellence.

Third, speaks volumes that a parasite like you believes that everyone aspires to the top 1%. I've known many people who loved working (insert variable here - out doors, with their hands, with animals, etc.) and would not trade it for a suit or an office, no matter how much money it was worth.

LoneLaugher

Diamond Member

Funny chart.

Wacky Quacky

Gold Member

- May 16, 2011

- 2,103

- 377

- 130

Would it be fitting here to remind all that, since possessions are not federally taxed, the greatest impediment to anyone- anyone!- becoming wealthy is taxation.

Total, unbelievable, and complete bullshit. The greatest impediment to someone becoming rich is motivation and drive.

NYcarbineer

Diamond Member

Look at the two bars in the middle of the graph - the top 20% are paying nearly 70% of the taxes. That is an outrage.

It's time the parasite class start paying their fair share. We need to drastically reduce taxes on the wealthy, substantially reduce taxes on the middle class, and drastically increase taxes on the parasite class (as well as end entitlements for them that are allowing them to live off of the American tax payer).

How do you propose to get taxes out of people without earnings? or out of people who work, but only earn enough for basic necessities?

NYcarbineer

Diamond Member

So the rich and powerful conspire to keep the middle class and the low income working class and the poor as poor as possible,

and THEN you want the rich and powerful to pass off their tax burden to the same people they've made as poor as possible?

What century do you think this is?

and THEN you want the rich and powerful to pass off their tax burden to the same people they've made as poor as possible?

What century do you think this is?

Why do we need to learn about Texas?

According to the IRS - In 2007 the average Adjusted Gross Income over $10 million only paid 19% income tax while the average middle class AGI paid 24% income tax.

The rich don't pay federal Social Security tax, Unemployment Tax, Medicare Tax, Medicaid Tax, FICA tax, etc on amounts over $120k. That pushes the middle class tax rate even higher & the Rich's tax rates even lower. Then add in Federal use taxes, fuel taxes, State, County & City taxes that all smack the middle class even harder percentage wise.

Your chart is pure fiction & it also does not even add up to 100%.

Mitt Romney only paid 13% while the middle class paid 28%. How the hell can someone paying 28% compete with someone paying only 13%????? It is called subsidizing the rich!

Here is the real chart that squares with reality.

Last edited:

NYcarbineer

Diamond Member

"Those taxes had been levied according to ability to pay. But the succeeding Republican Administration did not believe in that principle. There was a reason.

They had political debts to those who sat at their elbows.

To pay those political debts, they reduced the taxes of their friends in the higher brackets and left the national debt to be paid by later generations.

Because they evaded their obligation, because they regarded the political debt as more important than the national debt."

Quick, who said that? Clinton? Obama?

lol

They had political debts to those who sat at their elbows.

To pay those political debts, they reduced the taxes of their friends in the higher brackets and left the national debt to be paid by later generations.

Because they evaded their obligation, because they regarded the political debt as more important than the national debt."

Quick, who said that? Clinton? Obama?

lol

NYcarbineer

Diamond Member

If you want to be 1) the world's policeman, and one of the world's so-called superpowers, and if you want to have 2) a modern day civilized society at home,

BUT,

you also want to be 3) a rock bottom low tax nation??

No. You can't be all three. Something has to give.

BUT,

you also want to be 3) a rock bottom low tax nation??

No. You can't be all three. Something has to give.

Look at the two bars in the middle of the graph - the top 20% are paying nearly 70% of the taxes. That is an outrage.

It's time the parasite class start paying their fair share. We need to drastically reduce taxes on the wealthy, substantially reduce taxes on the middle class, and drastically increase taxes on the parasite class (as well as end entitlements for them that are allowing them to live off of the American tax payer).

How do you propose to get taxes out of people without earnings? or out of people who work, but only earn enough for basic necessities?

I have made this statement several times and it drops like a lead balloon, there are thousands of individuals who pay zero in taxes and receive thousands in refunds off of fraudulent tax returns...

The IRS needs to fix this NOW!!

The Tax Preparer is well trained and knows the limit the IRS will audit, when you have a $60K household income and receive $11K refund, something is bad, real bad...

Similar threads

- Replies

- 178

- Views

- 1K

- Replies

- 0

- Views

- 59

- Replies

- 33

- Views

- 510

Latest Discussions

- Replies

- 332

- Views

- 2K

- Replies

- 38

- Views

- 195

- Replies

- 630

- Views

- 5K

Forum List

-

-

-

-

-

Political Satire 8039

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-