xsited1

Agent P

Don't know where you got your facts about people supporting higher taxes. No "people" around where I live are in favor of higher taxes. They are in favor of less government spending though...

I got the facts from a website which posted many polls conducted over the past half year. It links all the polls. You can click on the links in all of them.

Yes, from the highly respect capitalgainsandgames.com, of course every knows of that prestigious organization.

How about Gallup? What does that more respected polling organization say?

Attention to Debt Ceiling Debate Doesn't Affect Policy Views

"Echoing resistance to raising the nation's debt ceiling among the public at large, 53% of Americans who say they are following the issue very closely in the news want their member of Congress to vote against raising the debt limit, while 37% urge a vote in favor."

Federal Budget Deficit

"From what you know or have read about the discussion of raising the debt ceiling, would you want your member of Congress to -- [ROTATED: vote in favor of raising the debt ceiling, vote against raising the debt ceiling] -- or don't you know enough to say?"

Vote for 19%

Vote against 47%

2011 May 5-8

*

* Less than 0.5%

Which do you think is more to blame for the federal budget deficit -- [ROTATED: spending too much money on federal programs that are either not needed or wasteful, (or) not raising enough money in taxes to pay for needed federal programs]?

Spending too much 73%

on programs

Not raising enough 22%

money in taxes

2011 Apr 20-23

Toro, you are either purposing lying, or just cherry picking polls from organizations no has ever heard because you are wrong--WRONG--when you say a majority of Americans want higher taxes.

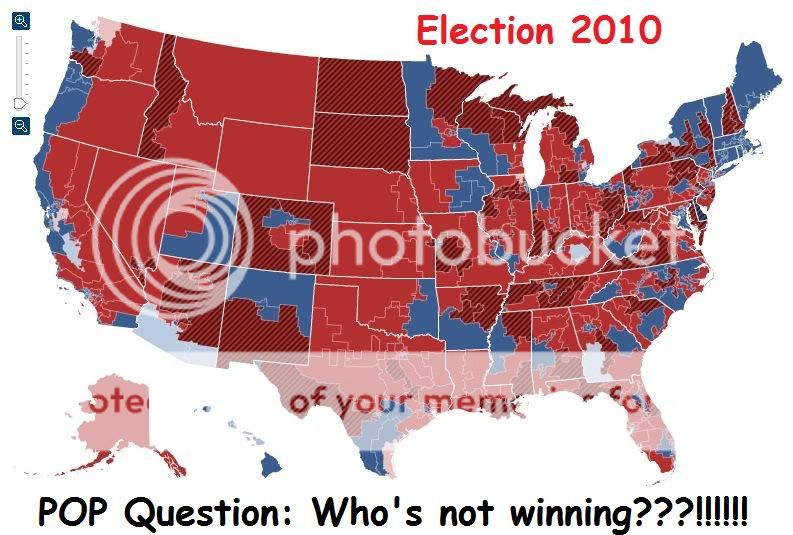

The plurality of Americans are against this administration and you are on the losing end of this debate.

Correct. Toro likes Bruce Bartlett because their beliefs are similar. Unfortunately, Bruce Bartlett is wrong.

Correct. Toro likes Bruce Bartlett because their beliefs are similar. Unfortunately, Bruce Bartlett is wrong.