barryqwalsh

Gold Member

- Sep 30, 2014

- 3,397

- 250

- 140

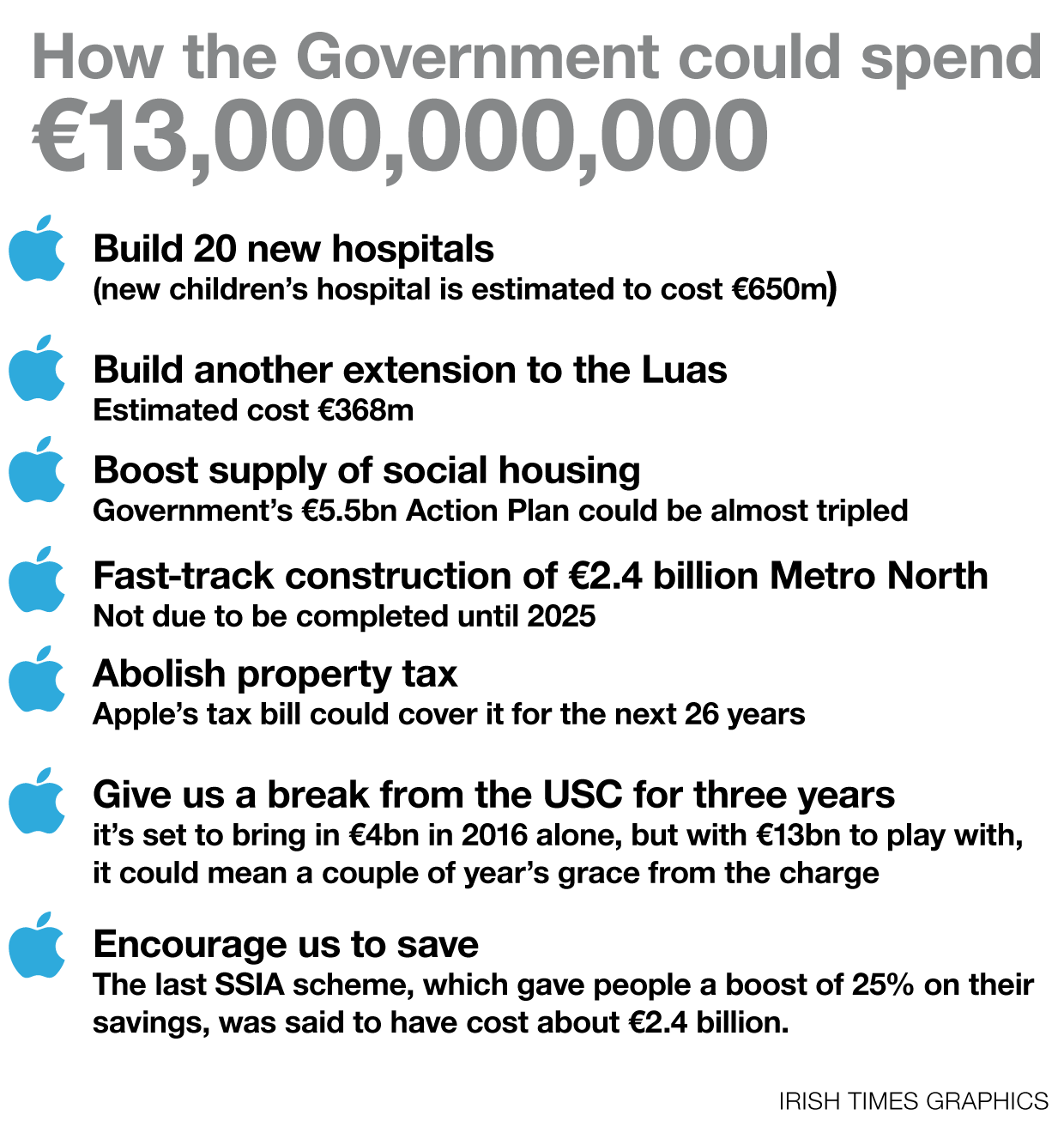

Paul Krugman stopped by Business Insider to talk to senior editor Josh Barro. Krugman discussed the EU ruling ordering Apple to pay $14.5 billion in taxes to Ireland.

Paul Krugman weighs in on the Apple tax debate

Paul Krugman weighs in on the Apple tax debate