OohPooPahDoo

Gold Member

- Thread starter

- #61

For the record, a tax credit is an amount of money that can be offset against a tax liability. A tax cut is an actual reduction in the tax liability. A tax credit is available to people who meet a certain guidelines, a tax cut is available to everyone.

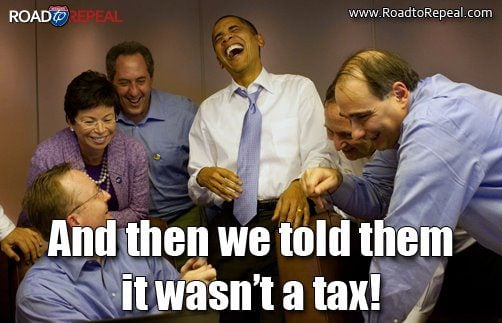

In that case, the individual mandate isn't a tax increase, because it applies only "to people who meet a certain guidelines"

But hey - I don't expect the right to ever be consistent with anything.

Tell that to the Supreme Court, I am sure they will be happy to here the USMB resident expert in taxes and cosmology correct them.

You're the expert here. You said that something's not a tax cut if it applies only "to people who meet a certain guidelines". Doesn't that mean something's not a tax hike if it applies only "to people who meet a certain guidelines"? Yes or no?