Trajan

conscientia mille testes

And he won't be the first to do so. Because, as the article states and Willie Sutton would rejoin- "thats where the money is".

I clearly remember Clinton getting spanked by even the NY Times for raising taxes in 93 that hit the 'middle class'. We'll see how this works out.

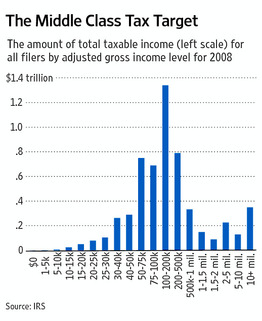

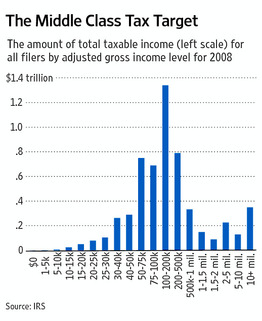

Where the Tax Money Is

Obama targets the middle class while pretending to tax only the rich.

snip-

Since he's asking, imagine that instead of proposing to raise the top income tax rate well north of 40%, the President decided to go all the way to 100%.

But it's still a useful experiment because it exposes the fiscal futility of raising rates on the top 2%, or even the top 5% or 10%, of taxpayers to close the deficit.

The mathematical reality is that in the absence of entitlement reform on the Paul Ryan model, Washington will need to soak the middle classbecause that's where the big money is.

snip-

he top 1% of taxpayersthose with salaries, dividends and capital gains roughly above about $380,000paid 38% of taxes. But assume that tax policy confiscated all the taxable income of all the "millionaires and billionaires" Mr. Obama singled out. That yields merely about $938 billion, which is sand on the beach amid the $4 trillion White House budget, a $1.65 trillion deficit, and spending at 25% as a share of the economy, a post-World War II record.

snip-

Say we take it up to the top 10%, or everyone with income over $114,000, including joint filers. That's five times Mr. Obama's 2% promise. The IRS data are broken down at $100,000, yet taxing all income above that level throws up only $3.4 trillion. And remember, the top 10% already pay 69% of all total income taxes, while the top 5% pay more than all of the other 95%.

This is politically risky, however, so Mr. Obama's game has always been to pretend not to increase taxes for middle class voters while looking for sneaky ways to do it. His first budget in 2009 included a "climate revenues" section from the indirect carbon tax of cap and trade, which of course would be passed down to all consumers. Such Democratic luminaries as Nancy Pelosi have often chattered about a European-style value-added tax, or VAT, which from a liberal perspective has the virtue of applying to every level of production or service and therefore is largely hidden from the people who pay it.

Now that those two ideas have failed politically, Mr. Obama is turning as he did last week to limiting tax deductions and other "loopholes," such as for mortgage interest payments. We support doing away with these distortions too, and so does Mr. Ryan, but in return for lower tax rates. Mr. Obama just wants the extra money, which he says will reduce the deficit but in practice will merely enable more spending.

Keep in mind that the most expensive tax deductions, in terms of lost tax revenue, go mainly to the middle class. These include the deductions for state and local tax payments (especially property taxes), mortgage interest, employer-sponsored health insurance, 401(k) contributions and charitable donations. The irony is that even as Mr. Obama says he merely wants the rich to pay a little bit more, his proposals would make the tax code less progressive than it is today.

more at-

Review & Outlook: Where the Tax Money Is - WSJ.com

I clearly remember Clinton getting spanked by even the NY Times for raising taxes in 93 that hit the 'middle class'. We'll see how this works out.

Where the Tax Money Is

Obama targets the middle class while pretending to tax only the rich.

snip-

Since he's asking, imagine that instead of proposing to raise the top income tax rate well north of 40%, the President decided to go all the way to 100%.

But it's still a useful experiment because it exposes the fiscal futility of raising rates on the top 2%, or even the top 5% or 10%, of taxpayers to close the deficit.

The mathematical reality is that in the absence of entitlement reform on the Paul Ryan model, Washington will need to soak the middle classbecause that's where the big money is.

snip-

he top 1% of taxpayersthose with salaries, dividends and capital gains roughly above about $380,000paid 38% of taxes. But assume that tax policy confiscated all the taxable income of all the "millionaires and billionaires" Mr. Obama singled out. That yields merely about $938 billion, which is sand on the beach amid the $4 trillion White House budget, a $1.65 trillion deficit, and spending at 25% as a share of the economy, a post-World War II record.

snip-

Say we take it up to the top 10%, or everyone with income over $114,000, including joint filers. That's five times Mr. Obama's 2% promise. The IRS data are broken down at $100,000, yet taxing all income above that level throws up only $3.4 trillion. And remember, the top 10% already pay 69% of all total income taxes, while the top 5% pay more than all of the other 95%.

This is politically risky, however, so Mr. Obama's game has always been to pretend not to increase taxes for middle class voters while looking for sneaky ways to do it. His first budget in 2009 included a "climate revenues" section from the indirect carbon tax of cap and trade, which of course would be passed down to all consumers. Such Democratic luminaries as Nancy Pelosi have often chattered about a European-style value-added tax, or VAT, which from a liberal perspective has the virtue of applying to every level of production or service and therefore is largely hidden from the people who pay it.

Now that those two ideas have failed politically, Mr. Obama is turning as he did last week to limiting tax deductions and other "loopholes," such as for mortgage interest payments. We support doing away with these distortions too, and so does Mr. Ryan, but in return for lower tax rates. Mr. Obama just wants the extra money, which he says will reduce the deficit but in practice will merely enable more spending.

Keep in mind that the most expensive tax deductions, in terms of lost tax revenue, go mainly to the middle class. These include the deductions for state and local tax payments (especially property taxes), mortgage interest, employer-sponsored health insurance, 401(k) contributions and charitable donations. The irony is that even as Mr. Obama says he merely wants the rich to pay a little bit more, his proposals would make the tax code less progressive than it is today.

more at-

Review & Outlook: Where the Tax Money Is - WSJ.com