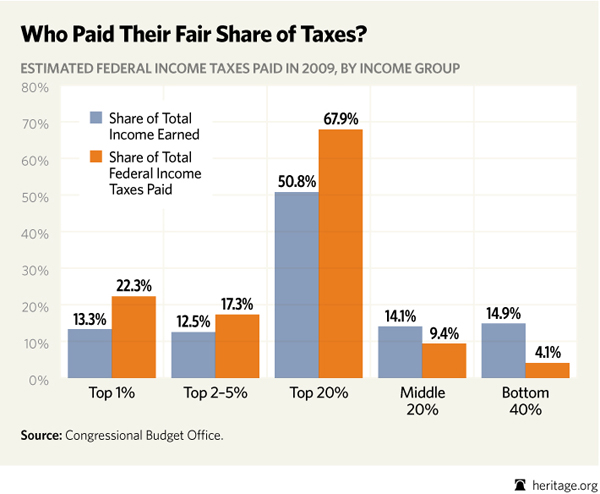

47% are paying nothing in federal income taxes....Why aren't you bitching about them not "paying their fair share"?

Because MOST of those people have incomes of less than $30,000 and they were given earned income credits to placate them over the huge tax cuts received by the wealthy, and to offset the fact that the minimum wage was frozen throughout Reagan's term of office, and through most of W's term of office as well.

Minimum wage workers saw the purchasing power of their pay erode by 29% from 1979 to 2003, so it's not like they could go out dancing on their tax savings. During the Reagan years, the minimum wage was $3.35 an hour or $134.00 a week for a 40 hour week before payroll taxes are deducted. Even in the 1980's you couldn't support a family on that amount of money.

The working poor still pay payroll taxes, state taxes, sales taxes and property taxes so they are paying taxes, just not federal income taxes. But large corporations are making record profits as they outsource American jobs and cut wages. Companies who pay poverty level wages while making record profits should be made to pay for the government programs their minimum wage workers are forced to rely upon to feed their families.

Corporate profits hit all-time high as wages drop to record low - Memphis Business Journal

The programs to provide medical care and food to low income workers have now become a subsidy to mega-corporations to pay the least amount possible. And then these same corporations complain that THEIR taxes should be cut (see Monsanto).

Last edited: