I will cover two scenarios: 1. The current state of affairs where the US is the main reserve currency . 2. When the US is no longer the main currency reserve (this may take at least 15 years or it may never happen at all).

Scenario 1. The US is the issuer of the main reserve currency.

This means the US government can issue all the debt it needs to run whatever program it wants to run, there will always be someone willing to buy the bonds because the USD is seen as a safe haven.

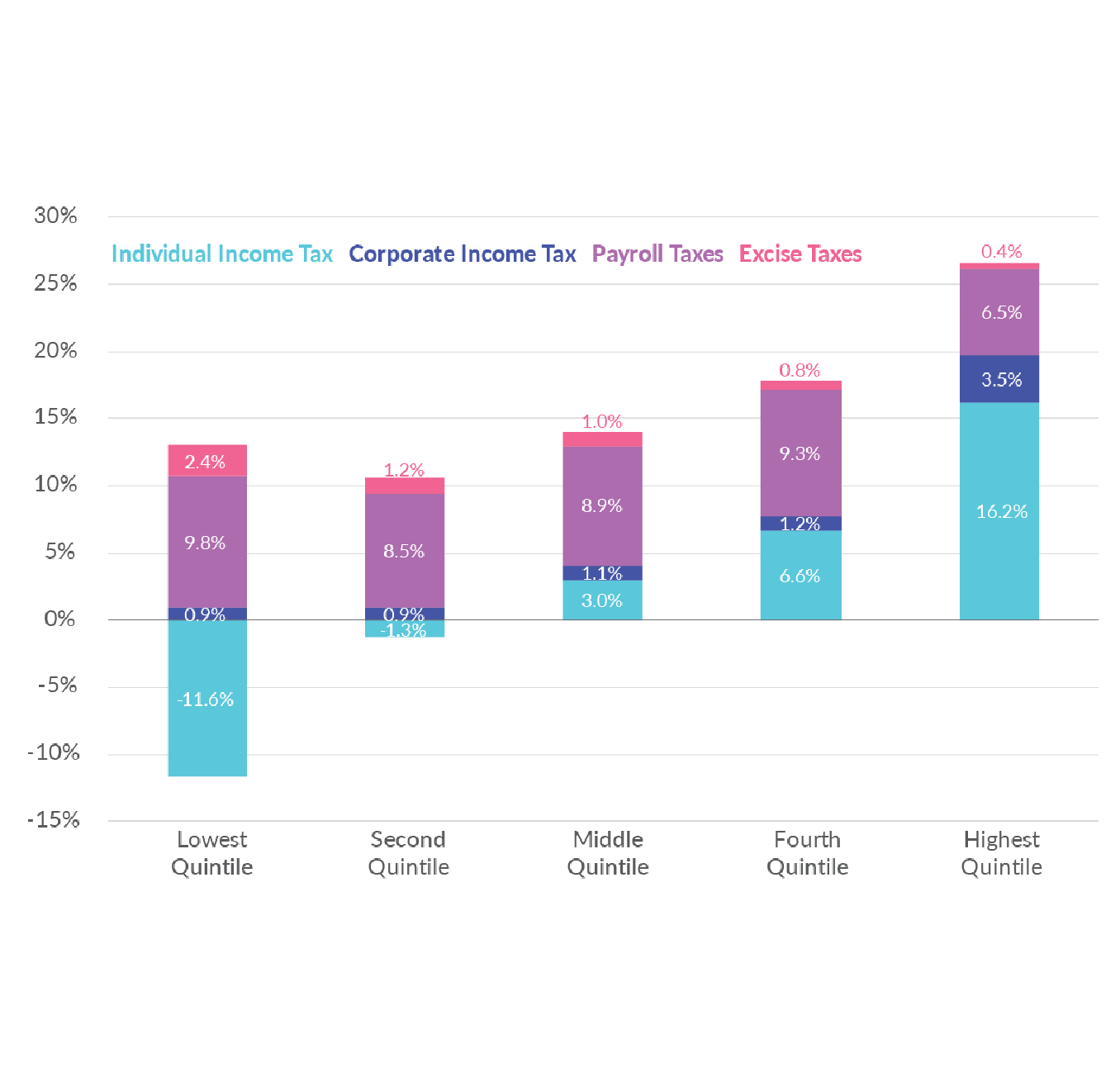

The problem is that since bondholders are mostly rich people trying to secure their assets, it increases wealth inequality.

This wealth disparity also translates into powerful lobbying groups that create laws that favor the ultra-rich (1%) and in all likelihood don't favor the rest of the 99%. This can include measures like cutting social spending and enacting controls in the healthcare system. This in turn creates a rentier class that is interested in extracting wealth instead of innovating, decreasing productivity. Alas when taxes are too high they can also discourage productivity.

In a nutshell: inequality, weakened internal consumption, the proliferation of a rentier class, decrease of productivity.

Scenario 2. The US is no longer the holder of the main reserve currency (far in the future).

This means the US has no longer a guaranteed positive capital flow.

In addition of the risks of scenario 1 there are new risks:

If interest rates are not high enough , investors may seek other countries to invest their capital. This in turn weakens the dollar increasing the costs of imports, which can also create inflation. The devaluation-> inflation cycle can be averted by applying an industrial policy directed towards securing critical inputs ( energy, minerals, oil, fertilizers) and rebuilding the industrial base.

In a nutshell: the risks of scenario 1 + devaluation risks, inflation risk.

Scenario 1. The US is the issuer of the main reserve currency.

This means the US government can issue all the debt it needs to run whatever program it wants to run, there will always be someone willing to buy the bonds because the USD is seen as a safe haven.

The problem is that since bondholders are mostly rich people trying to secure their assets, it increases wealth inequality.

This wealth disparity also translates into powerful lobbying groups that create laws that favor the ultra-rich (1%) and in all likelihood don't favor the rest of the 99%. This can include measures like cutting social spending and enacting controls in the healthcare system. This in turn creates a rentier class that is interested in extracting wealth instead of innovating, decreasing productivity. Alas when taxes are too high they can also discourage productivity.

In a nutshell: inequality, weakened internal consumption, the proliferation of a rentier class, decrease of productivity.

Scenario 2. The US is no longer the holder of the main reserve currency (far in the future).

This means the US has no longer a guaranteed positive capital flow.

In addition of the risks of scenario 1 there are new risks:

If interest rates are not high enough , investors may seek other countries to invest their capital. This in turn weakens the dollar increasing the costs of imports, which can also create inflation. The devaluation-> inflation cycle can be averted by applying an industrial policy directed towards securing critical inputs ( energy, minerals, oil, fertilizers) and rebuilding the industrial base.

In a nutshell: the risks of scenario 1 + devaluation risks, inflation risk.