Dad2three

Gold Member

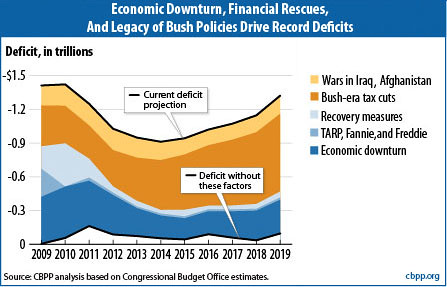

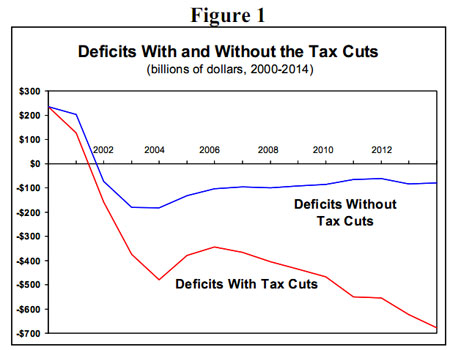

The problem being that Bush Jr. didn't put the cost of the wars, he started, into the budget. Obama did.And this....its fun blowing up left wing propaganda...

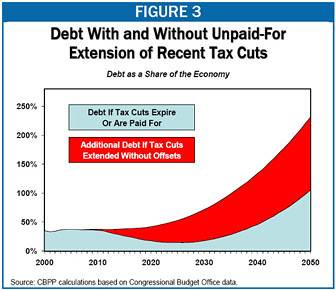

“The federal debt has already grown more during Obama’s first six years than under all previous U.S. presidents combined, at least in nominal dollars with no adjustment for inflation. The debt owed to the public stands at about $13 trillion, an increase of 106 percent since Obama first took office. Total debt, counting money the government owes to itself, stands at $18.1 trillion, up 70 percent. Both debt figures continue to grow, though less rapidly than during Obama’s first few years when annual deficits topped $1 trillion for four years running.

Letter: National debt is out of control

And he didn't fund Medicare Part D....

Not even that, the GOP rammed it through in the middle of the night down our throats, AND FORBID THE GOV'T TO NEGOTIATE WITH PHARMA!!