Dad2three

Gold Member

stock-based performance pay pushes executives to focus on short-term profits

I'm glad Clinton punished rich execs by limiting deductible cash salary to $1 million.

$1 Million unless it qualified as performance based pay

The 1980s witnessed a flourishing of different types of compensation, following Reagan's deep cuts in the top rates of income tax. Some of the techniques were seemingly unrelated to performance, such as "signing bonuses" for new CEOs and "guaranteed bonuses."

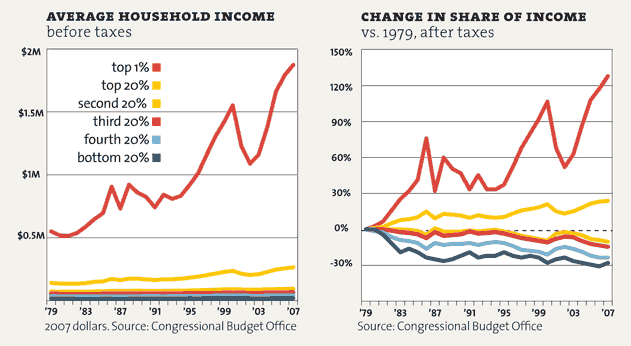

The highest federal marginal tax rate on income over $400,000 stood at 91 percent throughout the 1950s and early 1960s. Few executives in this era ever made more than 30 to 40 times the pay of their workers. By 1981, the year Ronald Reagan

entered the White House, this top rate had dropped to 70 percent. Under Reagan, the top rate quickly fell further,

first to 50, then to 28 percent.

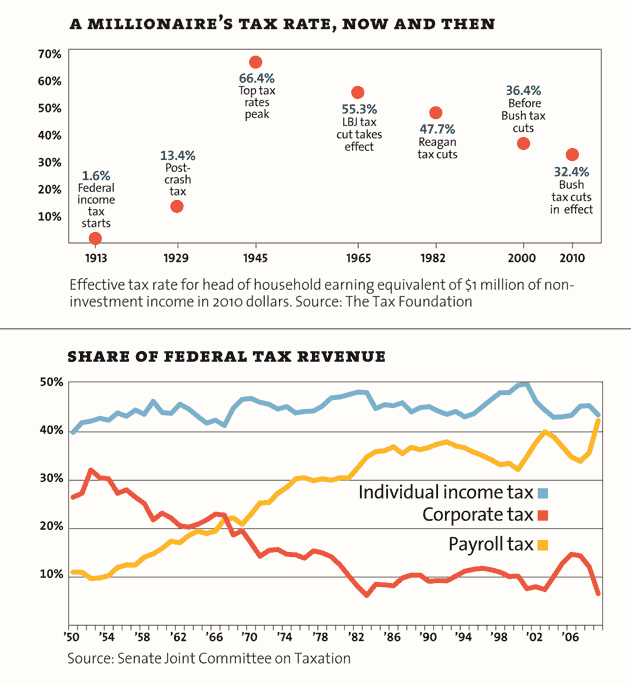

The current top federal tax rates: 35 percent on ordinary income and just 15 percent on dividends and capital gains (20% today).

The pay ratio between CEOs of S&P 500 Index companies and average U.S. workers widened to 380-to-1 in 2011. In 1980, the average large company CEO only received 42 times the average

workers pay.

One key reason why: Our nations tax code has become a powerful enabler of bloated CEO pay.

Some tax rules on the books today essentially encourage corporations to compensate their executives at unconscionably higher multiples of what their average workers are paid.

Other rules let executives who run major corporations routinely reduce their corporate tax bills. The fewer dollars these

corporations pay in taxes, the more robust their cash flow and eventual earnings. The more robust these cash and earnings

numbers, the higher the performance- based pay for the CEOs who produce them

....Unlimited tax deductibility of executive pay

The more corporations pay their CEO, the lower their tax bill

Annual cost to taxpayers: $9.7 billion

Our laws currently impose no meaningful limit on how much corporations can deduct off their income taxes for the expense of executive compensation

.

A 1993 law capped executive pay deductions at $1 million, but left a huge loophole.

Corporations can exempt performance-based pay. Most companies simply limit top executive salaries to $1 million or so and then add on to that total various performance-based awards, with stock options making up the largest share.

http://www.ips-dc.org/wp-content/up...xcess-2012-CEO-Hands-In-Uncle-Sams-Pocket.pdf

....Unlimited tax deductibility of executive pay

The more corporations pay their CEO, the lower their tax bill

Annual cost to taxpayers: $9.7 billion

And when the executives pay their taxes, the Treasury gets the $9.7 billion back. So what?

Sure they do *shaking head*