The rich benefited MOST from the Bush tax cuts.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Do You Still Believe Only The Rich Benefitted From The Bush Tax-cuts??

- Thread starter mudwhistle

- Start date

- Thread starter

- #22

The rich benefited MOST from the Bush tax cuts.

Nope.

But thanks for playing.

The bottom half of Americans are paying far less than their "fair share".

Kiplinger.com

The unnatural concentration of wealth is not being caused by the tax rates.

That's not correct, according to the Centre on Budge and Policy Priorities. According to their statstics, which take into consideration ALL federation, state and municipal taxes, the those in the bottom 20% of family income are paying a much higher percentage of their income in federal payroll taxes, than the top 1% of households and that overall, those in the bottom 20% are paying the highest percentage of their total income to governments at all levels, because most state and local taxes are regressive.

So while the bottom 20% may not be paying federal income tax, in 2011 the bottom 20% paid, on average, 12.3% of the total income in taxes to all level of government versus 7.99% for the top 1% of income earners. Admittedly, the top 1% are paying more dollars but here's question for you. The person making $30K a year is paying only $3690 in taxes, whereas the person making $3 million is paying $23,700 but who is going to have the more difficult time making ends meet after paying their taxes, and is it really fair that the lowest levels of income have the highest overall tax rates?

Misconceptions and Realities About Who Pays Taxes — Center on Budget and Policy Priorities

Last edited:

- Thread starter

- #24

The bottom half of Americans are paying far less than their "fair share".

Kiplinger.com

The unnatural concentration of wealth is not being caused by the tax rates.

That's not correct, according to the Centre on Budge and Policy Priorities. According to their statstics, which take into consideration ALL federation, state and municipal taxes, the those in the bottom 20% of family income are paying a much higher percentage of their income in federal payroll taxes, than the top 1% of households and that overall, those in the bottom 20% are paying the highest percentage of their total income to governments at all levels, because most state and local taxes are regressive.

So while the bottom 20% may not be paying federal income tax, in 2011 the bottom 20% paid, on average, 12.3% of the total income in taxes to all level of government versus 7.99% for the top 1% of income earners. Admittedly, the top 1% are paying more dollars but here's question for you. The person making $30K a year is paying only $3690 in taxes, whereas the person making $3 million is paying $23,700 but who is going to have the more difficult time making ends meet after paying their taxes, and is it really fair that the lowest levels of income have the highest overall tax rates?

Misconceptions and Realities About Who Pays Taxes — Center on Budget and Policy Priorities

When did Bush become Mayor and Governor?

Bush has no control over changes by state and local governments. Bush reduced the taxes of everyone. If a person making $30k has a reduction of $3600 in federal taxes that is still a reduction of $3600.....period. This Kabuki dance you insist on is a bogus argument.

Last edited:

Bush has no control over changes by state and local governments. Bush reduced the taxes of everyone. If a person making $30k has a reduction of $3600 in federal taxes that is still a reduction of $3600.....period. This Kabuki dance you insist on is a bogus argument.

Did you even LOOK at the figures or the link?

The person making $30K is PAYING $3600 in federal payroll taxes, state and local taxes. That's what they paid in 2011. They got no reduction on state or local taxes and they're paying federal withholding and payroll taxes.

Are you seriously suggesting that it doesn't matter how much of your income you're paying out to other levels of government, you should pay the same federal income tax as the 1% even if you're paying far more in withholding, excise and state taxes than people at higher income levels? And that's in addition to the 29% loss of purchasing power the lowest income levels are dealing with because of static income levels.

This is simple math. It's not rocket science. I know Republicans are math challenged, but really!

BillyV

Antidisestablishmentarian

- Oct 31, 2011

- 592

- 118

- 78

More fantacy articals. How about getting the facts straight for once from the tax collectors who actually have the correct data.

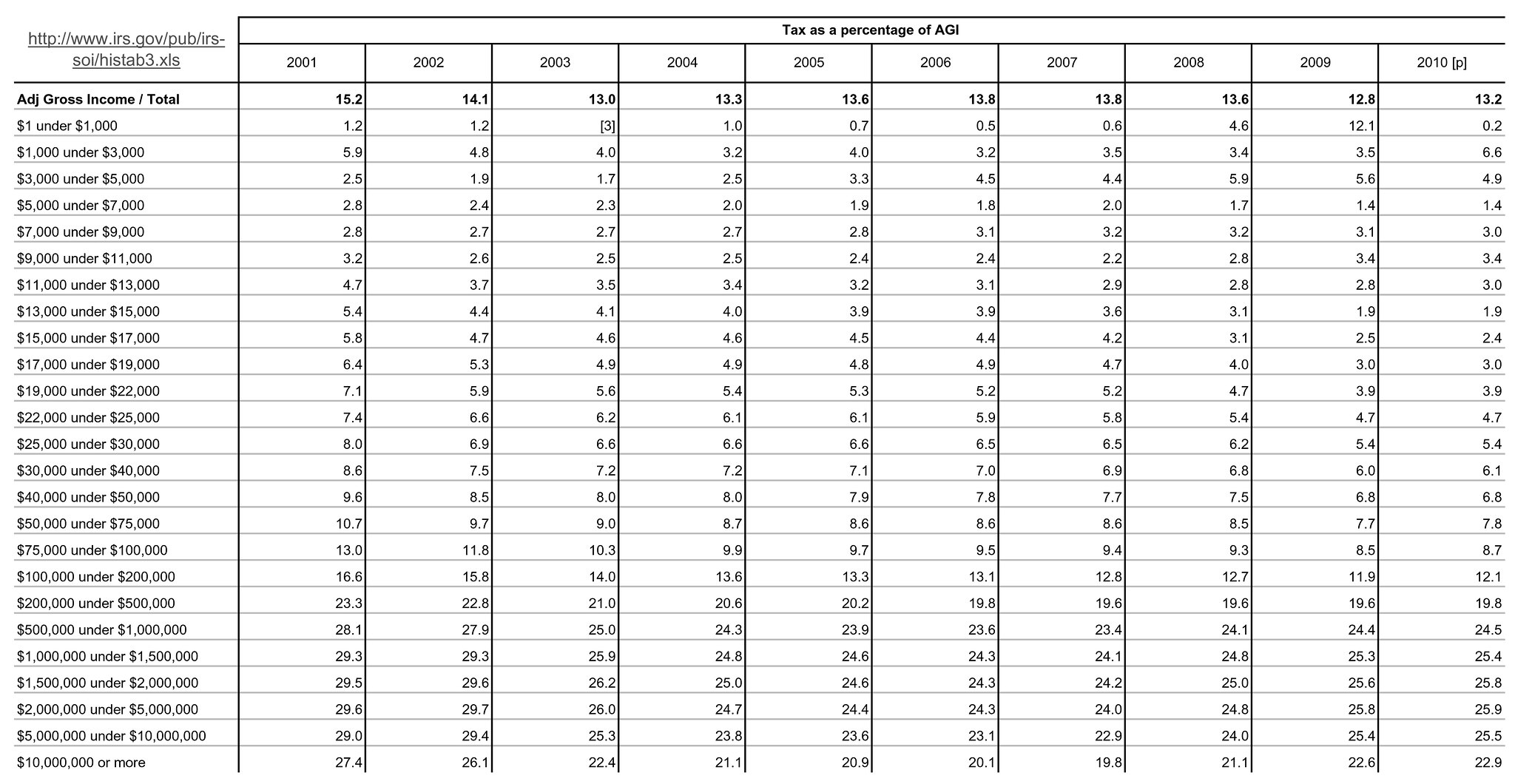

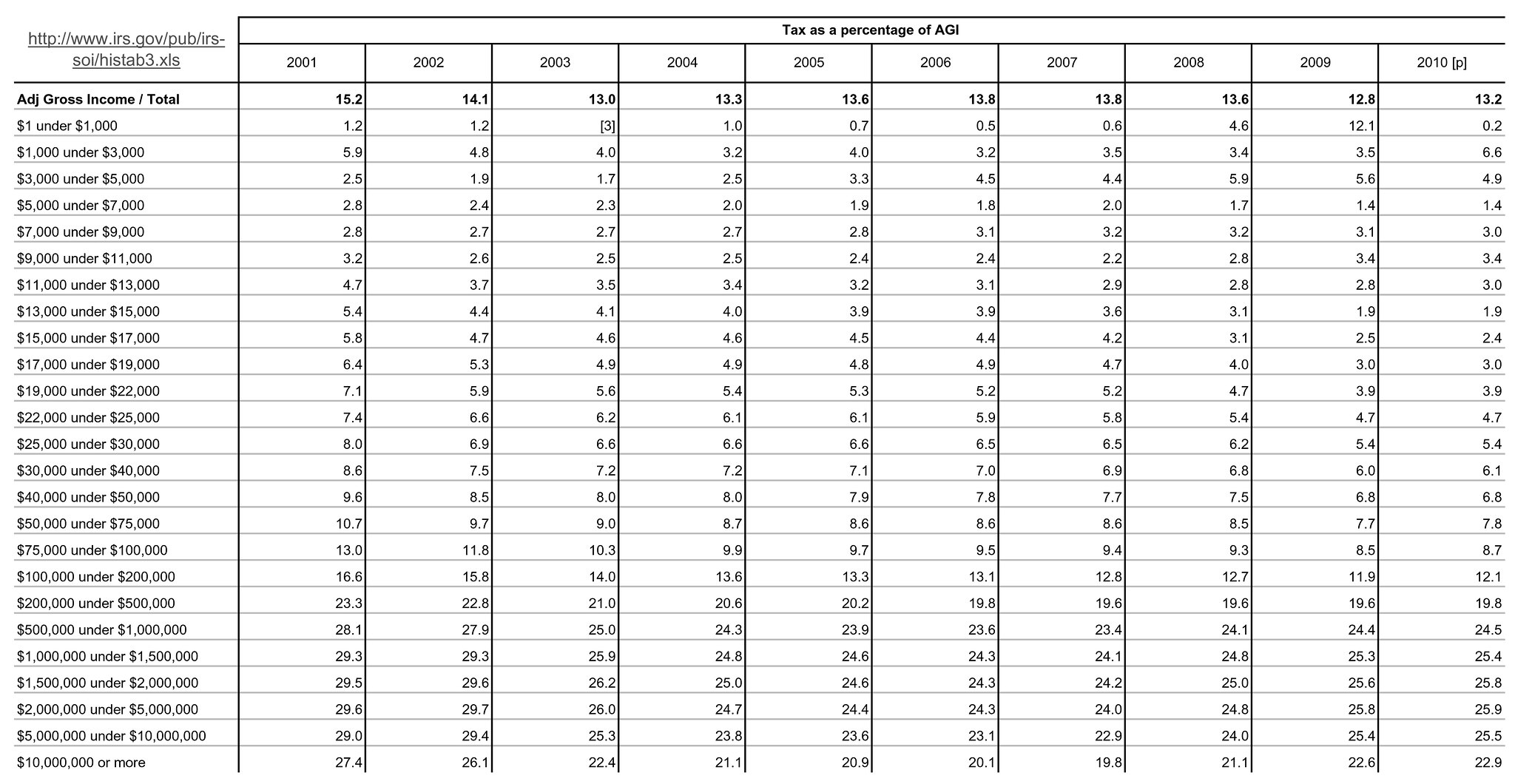

Facts from the IRS: From 2001 to 2007 the people with the highest income got the biggest percentage cuts in their actual tax payments. The middle class had to subsidize the rich even more than before. It is time to end the tax subsidy to the rich. The middle class is tired of carrying your fat ass. BTW the poor are also paying taxes.

You've posted this table in a couple of threads. Interesting that you want to make your case based on data from 2001-2007, when the table includes years through 2010; I guess because the data through 2010 doesn't bear out your argument. The annual percentage decrease per year from 2001-2010, on average, is about 1.5% for taxpayers in the upper incomes (over $200,000). The average for those making $75-100K was almost 4.25%, with similar averages for all those under $200,000 until you get to incomes under $10,000, where they are severely skewed due to taxpayers who aren't poor, but have little AGI and fall subject to the AMT (alternative minimum tax). Did you really think the average poor taxpayer making $1-$1,000 in 2009 paid an effective rate of 12.1%, as indicated in your table? Even if you do a simple percentage change between 2001 and 2010, no income group under $200,000 had less than a 27% reduction, while no income group over $200,000 had more than a 16% reduction. If you look at the simple change between 2001 and 2007 (the years you want to focus on), you still have the lowest reductions, from 15-19%, in the $200,000-$5 million range and the largest in the $9K-$22K range and the $75K-$200K range, at close to 30%.

Not enough? The same table (yours is just an excerpt) shows that those earning over $10 million in 2001 paid $45 billion in taxes; in 2007 that same group paid $110 billion. In fact, no group under $100K paid more tax in 2007 than in 2001, and no group over $100K paid less.

Last edited:

- Thread starter

- #27

Bush has no control over changes by state and local governments. Bush reduced the taxes of everyone. If a person making $30k has a reduction of $3600 in federal taxes that is still a reduction of $3600.....period. This Kabuki dance you insist on is a bogus argument.

Did you even LOOK at the figures or the link?

The person making $30K is PAYING $3600 in federal payroll taxes, state and local taxes. That's what they paid in 2011. They got no reduction on state or local taxes and they're paying federal withholding and payroll taxes.

Are you seriously suggesting that it doesn't matter how much of your income you're paying out to other levels of government, you should pay the same federal income tax as the 1% even if you're paying far more in withholding, excise and state taxes than people at higher income levels? And that's in addition to the 29% loss of purchasing power the lowest income levels are dealing with because of static income levels.

This is simple math. It's not rocket science. I know Republicans are math challenged, but really!

I read it. You can't lump state and local taxes into the equation because the Bush Tax-cut was a federal tax-cut.

The only way your figures work is if you throw in taxes from state and local....and the federal government didn't pass a state and local tax-cut because they don't have the power.

Anyone who's paid taxes knows that most taxes we all pay is state and local taxes. Federal taxes are mostly collected as excise taxes, gasoline taxes, FICA and medicare taxes, and income taxes. So of course if you lump state sales taxes and income-taxes, property taxes, and county taxes all together one tax (income) isn't all that much.

Last edited:

Jarhead

Gold Member

- Jan 11, 2010

- 20,670

- 2,378

- 245

I wonder what is taking the Republican House so long to pass an extension for the Bush tax cuts for the middle class.

I guess their printer must be broken.

.

Nah..they are ready to do it and they have made it clear. Obama is the one saying he will veto it. The house can pass a bill right now giving the middle class the tax cuts. The senate majority leader said he will not allow a vote on it and the President swore to veto it anyway. What do you think the problem is? Maybe Obamas pen is out of ink?

AmericanFirst

Gold Member

- Dec 17, 2009

- 12,204

- 1,062

- 175

The idiot left who refuses to believe the truth.I don't believe that. Who are you talking to?

The Heritage Foundation is a conservative think tank whose mandate is to produce position papers to promote conservative values. Hardly an unbiased source.

Tax revenue collected by the IRS is not conservative or liberal.

All THF did in this matter was copy the numbers from the IRS and report them.

Similar to balancing your check book.

AmericanFirst

Gold Member

- Dec 17, 2009

- 12,204

- 1,062

- 175

Yep, and then the idiots on the left place blame on the right when it is the left preventing it.I wonder what is taking the Republican House so long to pass an extension for the Bush tax cuts for the middle class.

I guess their printer must be broken.

.

Nah..they are ready to do it and they have made it clear. Obama is the one saying he will veto it. The house can pass a bill right now giving the middle class the tax cuts. The senate majority leader said he will not allow a vote on it and the President swore to veto it anyway. What do you think the problem is? Maybe Obamas pen is out of ink?

NYcarbineer

Diamond Member

The Bush tax cuts are a very large part of the reason that 47% pay no income taxes.

If you take the rate cuts, plus the doubling of the child tax credit, plus some other items that were in the Bush tax cuts,

you knocked a lot of low income filers with kids off the tax rolls.

- Thread starter

- #33

I wonder what is taking the Republican House so long to pass an extension for the Bush tax cuts for the middle class.

I guess their printer must be broken.

.

Nah..they are ready to do it and they have made it clear. Obama is the one saying he will veto it. The house can pass a bill right now giving the middle class the tax cuts. The senate majority leader said he will not allow a vote on it and the President swore to veto it anyway. What do you think the problem is? Maybe Obamas pen is out of ink?

The problem is Obama already has sequestration which is what he wanted in the first place (he signed it into law Feb. 2010) but he's trying to blame the Republicans for what he's getting ready to do.

Last edited:

NYcarbineer

Diamond Member

The idiot left who refuses to believe the truth.I don't believe that. Who are you talking to?

Can you name me some real life people who have said the Bush tax cuts ONLY benefited the Rich,

and link to them saying that?

The biggest thing that stands out about the Bush tax cuts is the of millions of Americans that were TAKEN OFF of the Federal income tax roles. And these were lower middle class and lower income people that used to pay some Federal income tax.

NYcarbineer

Diamond Member

I wonder what is taking the Republican House so long to pass an extension for the Bush tax cuts for the middle class.

I guess their printer must be broken.

.

Nah..they are ready to do it and they have made it clear. Obama is the one saying he will veto it. The house can pass a bill right now giving the middle class the tax cuts. The senate majority leader said he will not allow a vote on it and the President swore to veto it anyway. What do you think the problem is? Maybe Obamas pen is out of ink?

The problem is Obama already has sequestration which is what he wanted in the first place but he's trying to blame the Republicans for what he's getting ready to do.

The Republicans passed sequestration and Boehner said the GOP got 98% of what they wanted.

- Thread starter

- #37

Yep, and then the idiots on the left place blame on the right when it is the left preventing it.I wonder what is taking the Republican House so long to pass an extension for the Bush tax cuts for the middle class.

I guess their printer must be broken.

.

Nah..they are ready to do it and they have made it clear. Obama is the one saying he will veto it. The house can pass a bill right now giving the middle class the tax cuts. The senate majority leader said he will not allow a vote on it and the President swore to veto it anyway. What do you think the problem is? Maybe Obamas pen is out of ink?

Well, Obama can blame the GOP just like he blames the GOP for Benghazi. He says even though his White House screwed the pooch the GOP shouldn't be politicizing it. And they're racists.

BallsBrunswick

Fair and Balanced

Wow... people are really defending the Bush tax cuts? Well, I guess there's still Nazis in this world despite all the history and evidence that they were evil.

More fantacy articals. How about getting the facts straight for once from the tax collectors who actually have the correct data.

Facts from the IRS: From 2001 to 2007 the people with the highest income got the biggest percentage cuts in their actual tax payments. The middle class had to subsidize the rich even more than before. It is time to end the tax subsidy to the rich. The middle class is tired of carrying your fat ass. BTW the poor are also paying taxes.

You've posted this table in a couple of threads. Interesting that you want to make your case based on data from 2001-2007, when the table includes years through 2010; I guess because the data through 2010 doesn't bear out your argument. The annual percentage decrease per year from 2001-2010, on average, is about 1.5% for taxpayers in the upper incomes (over $200,000). The average for those making $75-100K was almost 4.25%, with similar averages for all those under $200,000 until you get to incomes under $10,000, where they are severely skewed due to taxpayers who aren't poor, but have little AGI and fall subject to the AMT (alternative minimum tax). Did you really think the average poor taxpayer making $1-$1,000 in 2009 paid an effective rate of 12.1%, as indicated in your table? Even if you do a simple percentage change between 2001 and 2010, no income group under $200,000 had less than a 27% reduction, while no income group over $200,000 had more than a 16% reduction. If you look at the simple change between 2001 and 2007 (the years you want to focus on), you still have the lowest reductions, from 15-19%, in the $200,000-$5 million range and the largest in the $9K-$22K range and the $75K-$200K range, at close to 30%.

Not enough? The same table (yours is just an excerpt) shows that those earning over $10 million in 2001 paid $45 billion in taxes; in 2007 that same group paid $110 billion. In fact, no group under $100K paid more tax in 2007 than in 2001, and no group over $100K paid less.

I liked his point on fantasy "articals"

NYcarbineer

Diamond Member

The biggest thing that stands out about the Bush tax cuts is the of millions of Americans that were TAKEN OFF of the Federal income tax roles. And these were lower middle class and lower income people that used to pay some Federal income tax.

That happens because the Republicans' job is to cut taxes for the Rich. That is job one.

BUT, they could never cut taxes just for the Rich that would be political poison. So they cut taxes for lower income Americans every time they cut taxes for the Rich, to make it politically palatable.

Problem is, lower income Americans started from a lower level of taxation, obviously, so pretty soon, the Republicans were cutting low income Americans' taxes to zero.

Get it?

Similar threads

- Replies

- 275

- Views

- 2K

- Replies

- 49

- Views

- 499

- Replies

- 47

- Views

- 660

- Replies

- 69

- Views

- 626

Latest Discussions

- Replies

- 0

- Views

- 1

- Replies

- 559

- Views

- 2K

- Replies

- 23

- Views

- 28

Forum List

-

-

-

-

-

Political Satire 8045

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-