- Apr 5, 2010

- 80,490

- 32,453

- 2,300

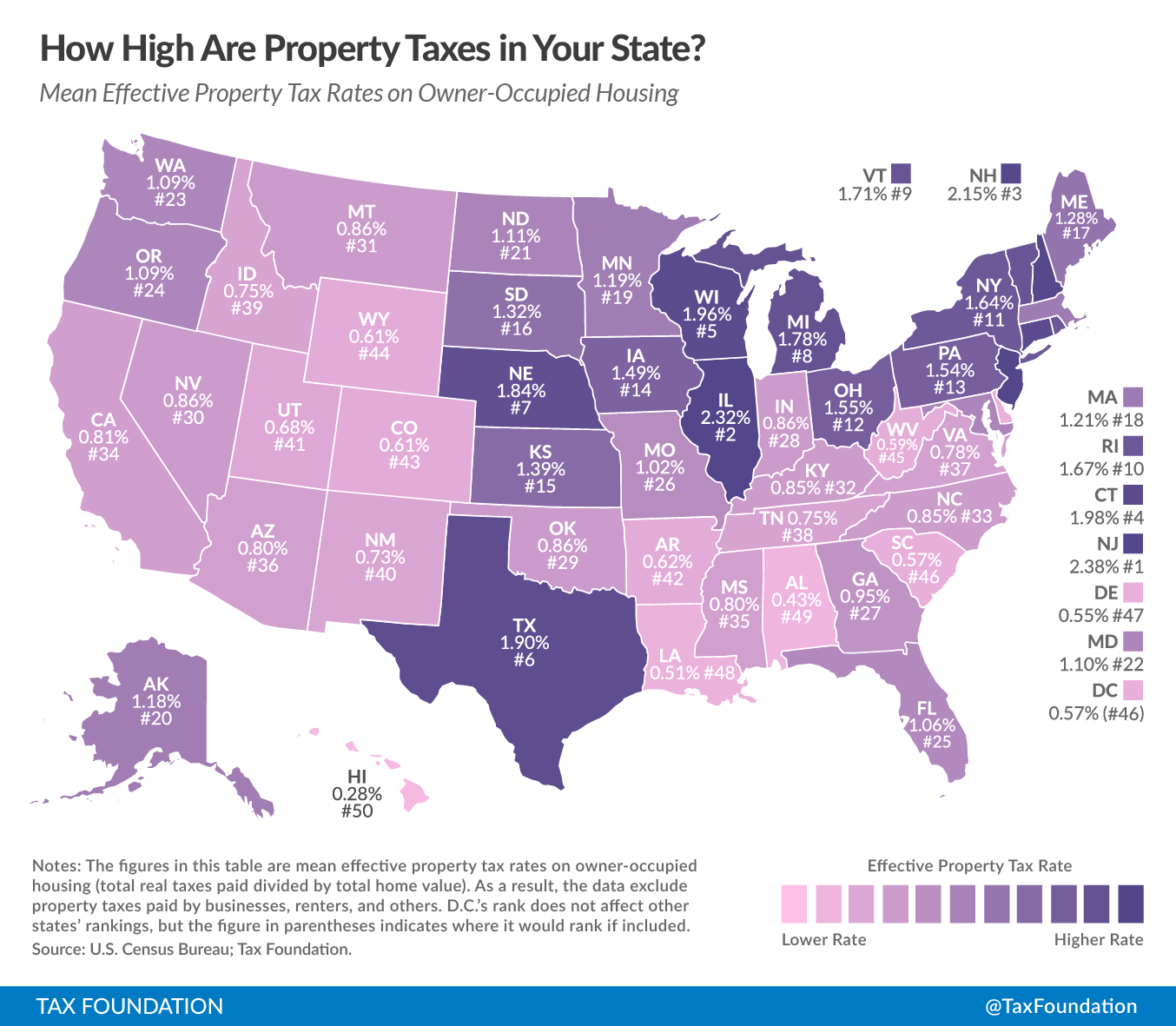

7 States With Highest Tax Burden...What do They Have in Common?

A better standard of living? A higher GDP? Better education?

NYC has better education?

LOLOLOLOL.

Unless of course you are in one of those gentrified neighborhoods, or have a sweet charter school hookup.

Or can afford to send your kids to private school.

NYC isn't a state. The highest earners in New York mostly live in the city. As a result tax dollars flow out of the city and into those gentrified suburban and rural areas to provide education funding. So you may be right. But not for the reasons you're alleging.

Remember we pay local income AND property taxes in the City, so we pay even more into education locally, not just via our State taxes.

And the suburbs also pay a pretty penny in property taxes to fund their own local education systems, even with additional State $$