eflatminor

Classical Liberal

- May 24, 2011

- 10,643

- 1,669

- 245

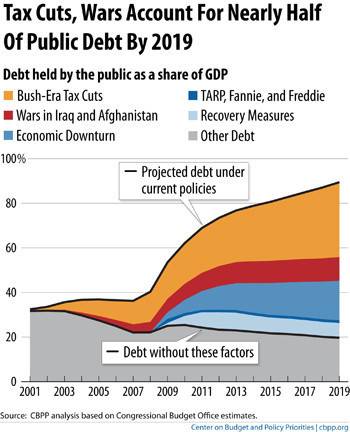

the three biggest drivers of the current debt and deficits are:Tax cuts aren't the problem - spending is...

1 - Wars in Iraq and Afghanistan

2 - Medicare Part D

3 - 2001 & 2003 Tax Cuts

now which one of those were proposed by a democrat?

Bullshit. First, you cannot prove #3 and there is volumes of historical evidence to suggest tax cuts may have increased revenues to the government. Either way, it's IMPOSSIBLE to state with specificity how tax cuts effect revenue. So, on point 3, you are full of shit.

Second, the 2011 budget spent as follows:

$895 billion Defense

$788 billion Medicare and Medicade

$740 billion Social Security

$612 billion mandatory "other"

$520 billion discretionary "other"

$251 billion interest on debt

Facts elude you.