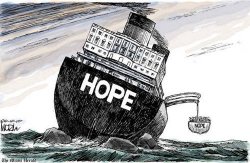

Here's the hurdle that the GOP and its cherished love of the superwealthy are facing.

The rich keep getting richer and richer while the rest of us starve?

Fuck them!

It's going to take one shitload of propaganda to convince the American public that they deserve to keep getting poorer while the MASTERS keep getting richer.

Apparently 70% of the public thinks the rich ought to pay more taxes.

I think it unwise to impose additional taxes, right now, but in the longer run I quite agree with the majority on this issue.

We've given the rich far too much in the last 40 years.

Our current fibrilating economy is the end result of those stupid policies.

The rich keep getting richer and richer while the rest of us starve?

Fuck them!

It's going to take one shitload of propaganda to convince the American public that they deserve to keep getting poorer while the MASTERS keep getting richer.

Apparently 70% of the public thinks the rich ought to pay more taxes.

I think it unwise to impose additional taxes, right now, but in the longer run I quite agree with the majority on this issue.

We've given the rich far too much in the last 40 years.

Our current fibrilating economy is the end result of those stupid policies.

Then there is the retirement account, life insurance etc...

Then there is the retirement account, life insurance etc...