Given that the economy grew in 2018, and in the absence of another policy that could have caused a large revenue loss, the data imply that the 2017 tax cut substantially reduced revenues.

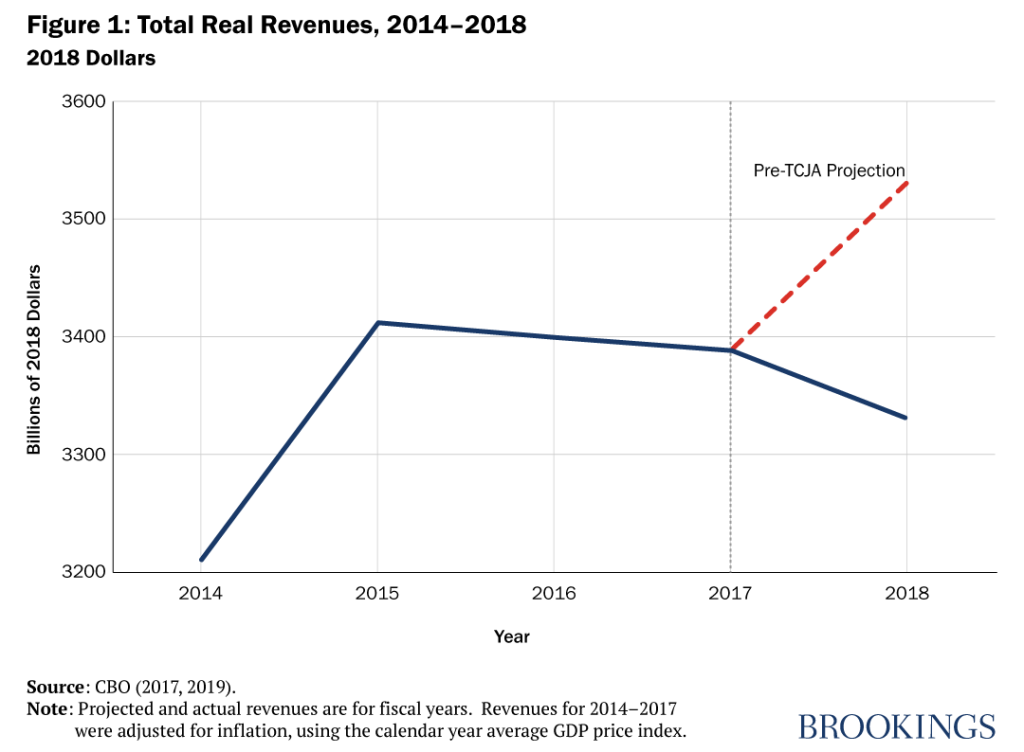

While some TCJA supporters observe that nominal revenues were higher in fiscal year 2018 (which began Oct. 1, 2017) than in FY2017, that comparison does not address the question of the TCJA’s effects. Nominal revenues rise because of inflation and economic growth. Adjusted for inflation, total revenues

fell from FY2017 to FY2018 (Figure 1). Adjusted for the size of the economy, they fell even more.

William Gale disproves a popular mischaracterization of the 2017 Tax Cuts and Jobs Act.

www.brookings.edu