Great. So what does the Fed need to do to easily double prices, now?

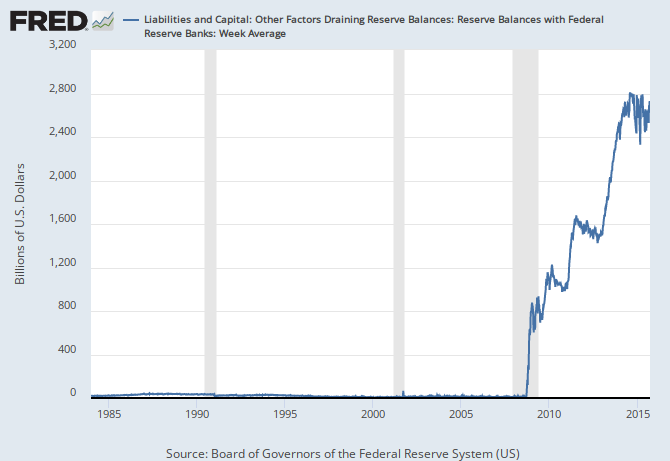

The fed has manipulated the situation, by paying banks a substantial amount of interest on deposits with the Fed.

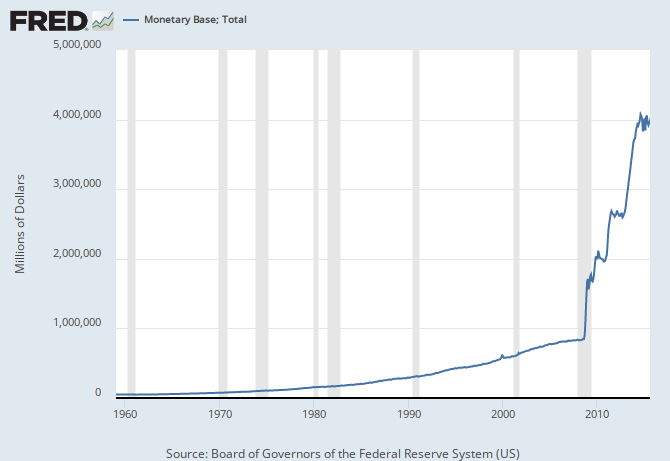

Currently, they have masterfully played a numbers game, by depositing as reserves into the banks accounts, money that they do not want them to use, and kept them from using it, by paying them money to keep those reserves there.

The ploy has worked. Banks kept the deposits at the Federal Reserve, and did not spend them or withdraw them, because of the payments the Fed has made.

The purpose of this seemingly pointless exercises, was to prevent them from going bankrupt due to a loss of reserves. This was in reference to AIG. AIG never had a money flow problem. Nor did they have a lack of operating revenue. The primary issue at AIG, was that the reserves that AIG held against against it's liabilities, was unfortunately tied to mortgage backed securities, which unfortunately was tied to the housing market, which as you know dropped in value.

The loss of value of the reserves, meant that AIG broke the capital reserve requirements, triggering the crisis and bailout. (which was not required. Bankruptcy court would have handled it just fine).

But the point was that AIG never had a money problem. It was a collateral problem. The value of the assets backing the transaction drastically fell in value, upsetting the entire system.

The main purpose of the QE was to place Treasury assets on the banks balance sheets, to prevent them from having a collateral problem. The Treasury allowed them to place these deposits on the books, to avoid any failure of maintaining collateral backing.

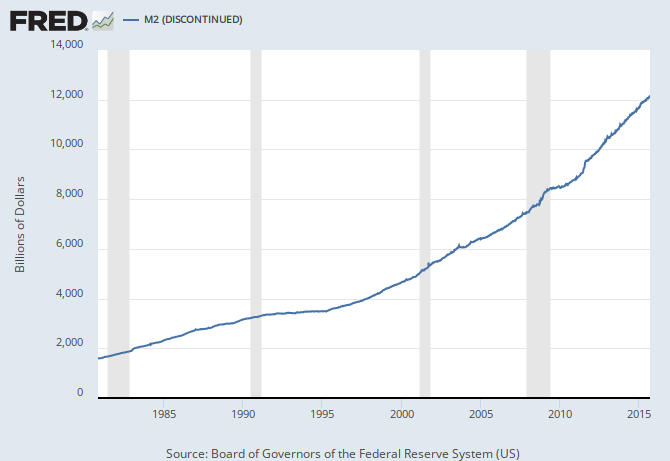

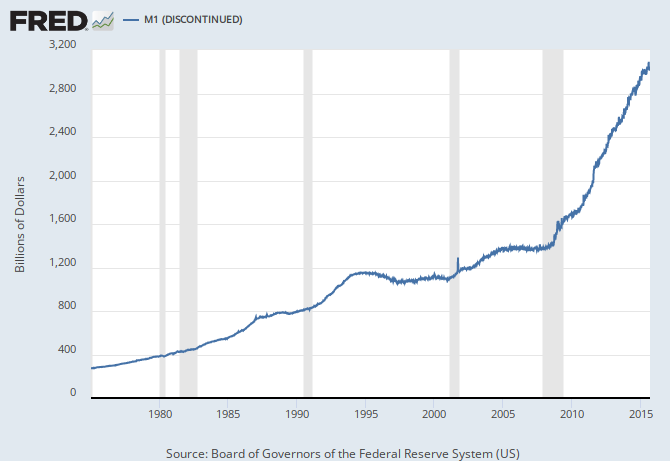

However, the treasury didn't want them pulling the money out, and making loans, or investing in real assets with the money either, because flooding the market with tons of new cash, would result in the inflation described prior.

So instead, the Fed started paying the bank a small but significant amount, to keep the funds on deposit at the Reserve and not use them. Additionally, the Dodd-Frank bill also increased capital requirements, but made an exception that Federal Reserves counted towards those Capital requirements.

This kept the banks from flooding the market, driving up costs with massive inflation.

The problem..... is that there really isn't an exist strategy at the moment. Nor is there any way to recoup the costs of those interest payments to the banks. Once the market comes back, banks could very well realize they could make more money investing with decent rates of return, over holding the money at the Fed. The fed would then have to pay out those funds, which right now it can't.

But actually the much bigger problem, is the moral hazard this has created. Banks have less reason than ever before, to be prudent and fiscally responsible. Now that they know the Fed is more than willing to make up false assets, and dump them on banks balance sheets, and even pay the bank for having the assets the Fed gave them..... why would they ever consider how risky an investment is? Government will bail us out, and it costs them nothing, with phantom assets.