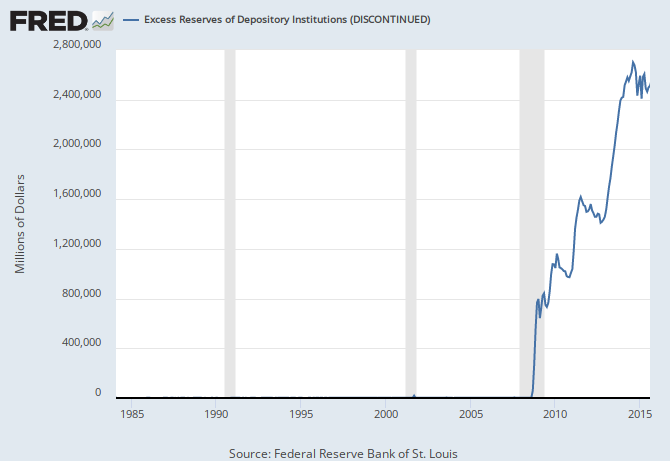

The fed has manipulated the situation, by paying banks a substantial amount of interest on deposits with the Fed.

Currently, they have masterfully played a numbers game, by depositing as reserves into the banks accounts, money that they do not want them to use, and kept them from using it, by paying them money to keep those reserves there.

The ploy has worked. Banks kept the deposits at the Federal Reserve, and did not spend them or withdraw them, because of the payments the Fed has made.

The purpose of this seemingly pointless exercises, was to prevent them from going bankrupt due to a loss of reserves. This was in reference to AIG. AIG never had a money flow problem. Nor did they have a lack of operating revenue. The primary issue at AIG, was that the reserves that AIG held against against it's liabilities, was unfortunately tied to mortgage backed securities, which unfortunately was tied to the housing market, which as you know dropped in value.

The loss of value of the reserves, meant that AIG broke the capital reserve requirements, triggering the crisis and bailout. (which was not required. Bankruptcy court would have handled it just fine).

But the point was that AIG never had a money problem. It was a collateral problem. The value of the assets backing the transaction drastically fell in value, upsetting the entire system.

The main purpose of the QE was to place Treasury assets on the banks balance sheets, to prevent them from having a collateral problem. The Treasury allowed them to place these deposits on the books, to avoid any failure of maintaining collateral backing.

However, the treasury didn't want them pulling the money out, and making loans, or investing in real assets with the money either, because flooding the market with tons of new cash, would result in the inflation described prior.

So instead, the Fed started paying the bank a small but significant amount, to keep the funds on deposit at the Reserve and not use them. Additionally, the Dodd-Frank bill also increased capital requirements, but made an exception that Federal Reserves counted towards those Capital requirements.

This kept the banks from flooding the market, driving up costs with massive inflation.

The problem..... is that there really isn't an exist strategy at the moment. Nor is there any way to recoup the costs of those interest payments to the banks. Once the market comes back, banks could very well realize they could make more money investing with decent rates of return, over holding the money at the Fed. The fed would then have to pay out those funds, which right now it can't.

But actually the much bigger problem, is the moral hazard this has created. Banks have less reason than ever before, to be prudent and fiscally responsible. Now that they know the Fed is more than willing to make up false assets, and dump them on banks balance sheets, and even pay the bank for having the assets the Fed gave them..... why would they ever consider how risky an investment is? Government will bail us out, and it costs them nothing, with phantom assets.

The fed has manipulated the situation, by paying banks a substantial amount of interest on deposits with the Fed.

Holy bad math, Batman!

Currently, they have masterfully played a numbers game, by depositing as reserves into the banks accounts, money that they do not want them to use, and kept them from using it, by paying them money to keep those reserves there.

You know that the banking system can't use up reserves, right?

The main purpose of the QE was to place Treasury assets on the banks balance sheets, to prevent them from having a collateral problem.

QE took Treasury securities off the banks balance sheets.

The Treasury allowed them to place these deposits on the books, to avoid any failure of maintaining collateral backing.

What deposits? And what does "allow" have to do with a bank putting a deposit on their books?

However, the treasury didn't want them pulling the money out, and making loans

They would LOVE banks to loan that money out. Low rates are what borrowers like.

The problem..... is that there really isn't an exist strategy at the moment.

Exit strategy for what?

Nor is there any way to recoup the costs of those interest payments to the banks.

Ummmm....the banks get 0.25% and the Fed used that money to buy bonds paying 2%-4%.

The fed would then have to pay out those funds, which right now it can't.

Wow, you really don't understand how this stuff works!!

and even pay the bank for having the assets the Fed gave them..

The Fed didn't give any bank an asset.

It's possible that I'm not relaying the information correctly. I'm not exactly a Ph.D at banking speak.

But....

Richard Fisher on Too Big to Fail and the Fed | EconTalk | Library of Economics and Liberty

This is an interview with the Richard Fisher, President of the Federal Reserve Bank of Dallas.

He basically says that everything I just said is true.

You can listen to the interview, or just believe I'm lying... But this is what I'm going on, with a few other outside sources.

Banks put money on deposit with the Federal Reserve. Those deposits originally were only there as collateral against liabilities of the banks. The Federal Reserve did not lend out this money... this money is the emergency money of the banks. If they lend it out, that defeats the purpose of have a capital reserve.

Further, the Federal Reserve did not pay interest on those reserves. Ever. Paying interest on reserves is entirely new since the crash. Remember, the banks were required by law to have reserves, so there was no need to pay interest.

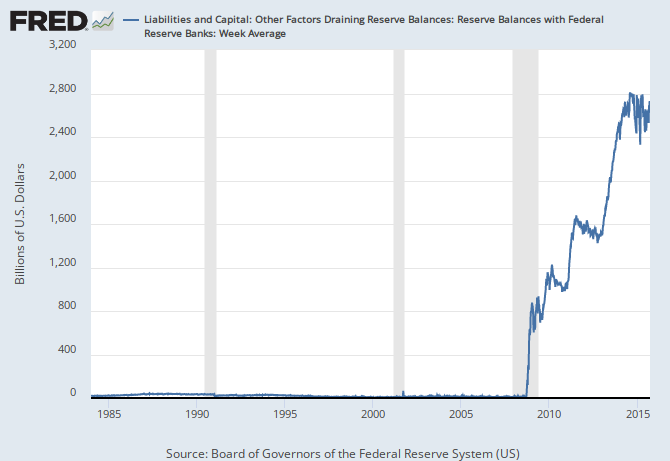

Now there is a need to pay interest. Why? Because the amount of money the Fed wanted them to hold in reserve, was higher than the amount required by law. Therefore to get banks to keep the deposits at the Fed, they had to pay the banks interest on their reserves, or the bank would pull out the extra reserves, and use it.

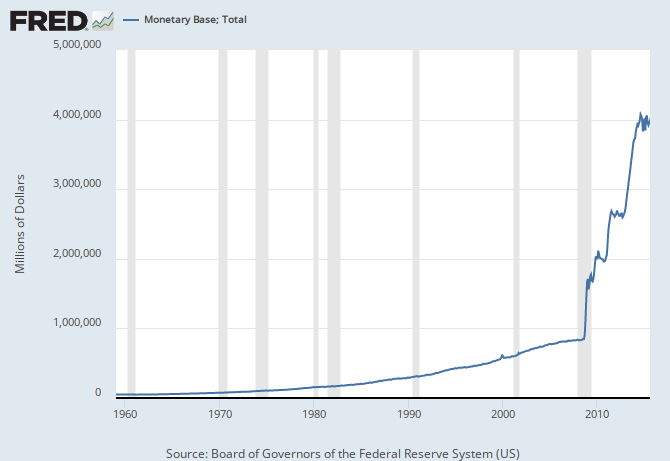

The amount of reserves at the Fed, was fairly flat and steady for decades prior to the QE. After QE, the Feds have trillions in reserves.

That's what they need an exit strategy for. How do they unload these trillions in reserves, without causing a problem in the market again? There is no good answer to that yet.

It's possible that I'm not relaying the information correctly

That must be it.

Banks put money on deposit with the Federal Reserve. Those deposits originally were only there as collateral against liabilities of the banks.

Required reserves and to clear checks and wires.

Paying interest on reserves is entirely new since the crash.

They were planning on paying interest, before the crash.

The Federal Reserve Banks pay interest on required reserve balances and on excess reserve balances. The Board of Governors has prescribed rules governing the payment of interest by Federal Reserve Banks in Regulation D (Reserve Requirements of Depository Institutions, 12 CFR Part 204).

The Financial Services Regulatory Relief Act of 2006 authorized the Federal Reserve Banks to pay interest on balances held by or on behalf of depository institutions at Reserve Banks, subject to regulations of the Board of Governors, effective October 1, 2011. The effective date of this authority was advanced to October 1, 2008, by the Emergency Economic Stabilization Act of 2008.

The interest rate on required reserves (IORR rate) is determined by the Board and is intended to eliminate effectively the implicit tax that reserve requirements used to impose on depository institutions. The interest rate on excess reserves (IOER rate) is also determined by the Board and gives the Federal Reserve an additional tool for the conduct of monetary policy.

FRB: Interest on Required Balances and Excess Balances

Because the amount of money the Fed wanted them to hold in reserve, was higher than the amount required by law. Therefore to get banks to keep the deposits at the Fed, they had to pay the banks interest on their reserves, or the bank would pull out the extra reserves, and use it.

Is 0.25% really enough to stop banks from lending extra reserves if they wanted?

The amount of reserves at the Fed, was fairly flat and steady for decades prior to the QE. After QE, the Feds have trillions in reserves.

The banks have trillions in cash reserves, the Fed has trillions in MBS and Treasury securities.

That's what they need an exit strategy for. How do they unload these trillions in reserves, without causing a problem in the market again?

Well, if they feel the need to raise rates on Treasuries, they can sell bonds outright.

If the want their exit to be more gentle, they can let the bonds mature without replacing them.

Or, they could keep the balance sheet steady and let the economy grow into it.

Yeah, I didn't know that. I'd be interested in reading up on the motivations for such a move. If the bank kept reserves themselves, they obviously wouldn't be earning interest on them. So why should the Fed pay them interest on reserves they are required to have? The only reason I can see for the Fed wanting to pay interest on reserves, is to encourage banks to hold excess reserves.

Nevertheless, if the interest payments were not enough to cause banks to keep excess reserves at the Fed, then how do you explain that fact they never had more then required reserves up until the point they started paying the interest?

Yeah, they can sell those treasuries.... I think that's where the rub comes. The Fed collected $115 Billion from the US Treasury for 2014. If that is actually true, and if the numbers we're getting from the Treasury is accurate, that means that 1/4th of the Federal debt is going to the Federal Reserve.

Now from what I understand of how the system works, is that the treasury sells bonds. Private buyers buy the bonds. Then Federal Reserve is buying those bonds from the private seller, and does so in exchange for "reserves". Then when the bank needs those reserves, for whatever reason, they simply get money from the Treasury, and pay them the reserves. So in a round-a-bout way, the Government is buying it's own bonds.

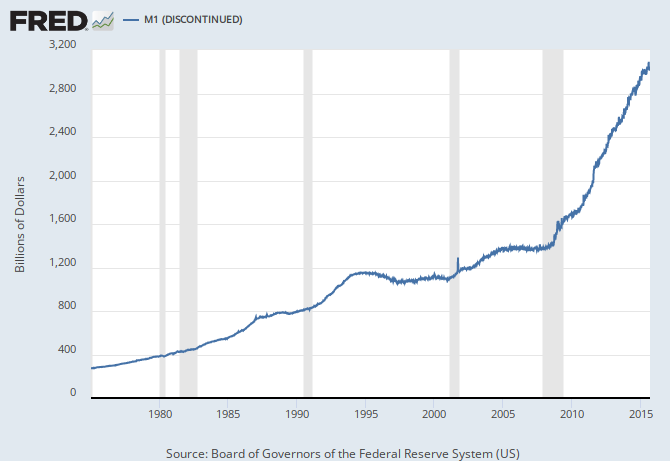

Money supply drastically increased.

Now the money supply had been under $1.4 Trillion, for years. And prior, it had been just under $1.2 Trillion for all of the 90s.

Over the course of the crisis, the Fed started buying treasuries at a rate of roughly $100 billion a month.

Tentative Outright Treasury Operation Schedule - Federal Reserve Bank of New York

Here is a schedule of Fed Treasury buying schedules, going back to 2010. If you look at Nov 2010, to Jun 2011, they were purchasing $100 Billion worth every month.

So clearly, and obviously, if you pumped in $700 Billion in new money, in a system of only $1.5 Trillion, that would be a dramatic increase in the money supply that would without any doubt cause major inflationary issues.

How then, did they avoid the hyper inflation people like Ron Paul were screaming about?

Again, they kept the money out of circulation. They kept it as reserves at the Fed. How did they convince banks to keep the money at the Fed? With interest payments.

I'm convinced, thus far, that this is what has happened.

Now you are correct they could sell off some US treasuries, and make the reserves simply disappear.... in theory.

The Fed has $2.3 Trillion in treasuries, which means there are more excess reserves than treasuries. But in the very act of selling them, they would lose value. This would not only cause the Fed to lose billions of dollars, but it would also jack up the interest rate on the government. The politicians would be screaming.

And of course the only other assets they have, are the toxic assets, which the idea they are going to get a ton of money for assets already known to be toxic, is ridiculous. Pennies on the dollar I wager.

Obviously the safest course of action, is to simply allow the bonds to mature, and use the money paid to the Fed, from the US government, to pay back the reserves.

No new money is introduced, and the system is stable.

The one issue there, is this assumes that banks draw down their reserves slow enough, that the bond payments cover the draw down.

And that requires two things.... A: there is no economic turbulence that causes banks to need to draw down those reserves, and B: there is no economic boom, that causes banks to want to draw down those reserves to invest elsewhere.

What do you see that I have missed in my analysis?

Can the Fed unload its toxic assets successfully?

I just happen to stumble onto this article, which largely says exactly the same thing I just did. Doesn't mean I'm right, or it's right. But at least I'm not the only one thinking this way.