Dividends alone is not a determining factor.

Again... you own a share of the company itself. That has value, even without dividends. Warren Buffet's company, Berkshire Hathaway, pays no dividends. But the company itself has grown. That growth has value. You as owner, have part ownership in that company, which has value.

Let's spin this around into something easier.

I own a house. Do I get dividends? No. But that house is an investment. Why? Because it has value that increases. Even without dividends showing me direct value, I know that over time property values do increase. Again... why? Because we all know that people need places to live. We can look at the history of property values, and see the increase.

Just like we know that people will need a car, so owning shares in a car company will have value.

Just like we know that people will need food, so owning shares in a food company will have value.

Now I am NOT saying... 'there is no speculation'. Again, everything has some amount of speculation. Democrats could take over my city, and put in place section 8 housing in my area, and the value of my house will drop like a rock. It could happen.

Government could put in place terrible protectionism, that could kill the auto market, and the car company I own shares in, could close.

But again, there is a huge difference between speculating on a real assets, and a ponzi scheme that has no assets.

Just like we know that people will need a car, so owning shares in a car company will have value.

Just like we know that people will need food, so owning shares in a food company will have value.

Even if the car and food company are not paying dividends?

Tan Liu: Why Many Of Today's Most-Owned Stocks Are Ponzi Schemes | Seeking Alpha

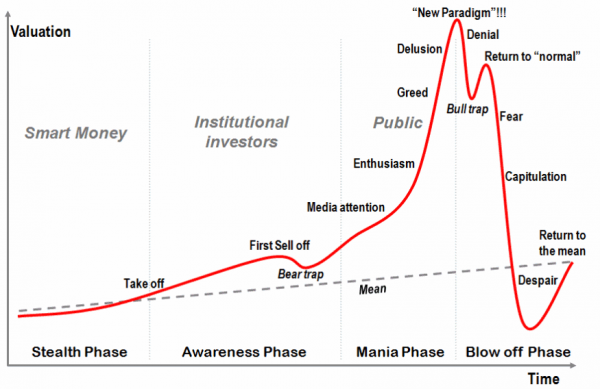

"So when one person buys low and sells high, another is also buying high and needs to sell for even higher.

And a system where current investors' profits are dependent on cash from new investors is by definition how a Ponzi scheme works.

"What's wrong with that is a lot of stocks don't pay dividends and why are you an owner of a company if the company never pays the so-called owners?

"that's exactly how it works because when

a stock doesn't pay dividends, there is no monetary connection between the revenues and profits of the company and the actual shares."

Of course there is. You directly own a share in a company. That ownership has value. Are you suggesting that I can own something, that produces value, but that ownership of that thing has no value?

Ridiculous. And I can prove it, by simply owning that stock, and seeing it's value increase in proportion to the profits of the company. Which it does. I own shares of Berkshire Hathaway.

There is always a monetary connection between revenues and profits of the company, and the actual shares.

Again... as long as there is an underlying asset, it simply can't be a ponzi scheme. The defining aspect of a ponzi scheme, is the fact there are no assets.

Of course there is. You directly own a share in a company. That ownership has value. Are you suggesting that I can own something, that produces value, but that ownership of that thing has no value?

Market value or par value?

Google currently trades for over $1200, but the corporation states in writing it doesn't pay dividends, there are no voting rights, and the par value of GOOG is only $0.001 per share. "The value of a stock is just an idea. It is something completely cerebral and imaginary. Real money on the other hand, is finite, traceable, and ...what investors ultimately care about."

How true is the statement that the stock market is essentially a Ponzi scheme? - Quora

Market value, is the only value.

See the problem shows up in your own post.

"Real money on the other hand, is finite, traceable, and ...what investors ultimately care about"

But real money has no value itself, except what you can trade it for.... such as stock.

Money itself only has a market value. We know this because money itself can go up and down in value. Point being, there is nothing in this world that has 'inherent' value. All value is a market value. It's all worth, only what other people are willing to exchange it for.

Money itself, has no more value to it, than what someone is willing to exchange for it..... just like stock has no value except for what people are willing to trade it for.

ALL THAT SAID...

When you said that Google has no voting rights... I found that rather unlikely.

Google Stock: A Tale of Two Share Classes (GOOG, GOOGL)

So a little background: There are different classes of shares. Class B, are the insider shares. These have 10 votes each, and are not sold publicly.

Class C shares, are the lowest class, and have no voting rights.

Class A shares, have voting rights. If you want voting rights, you can buy shares with them.

As for dividend payments...

You never know if the policy might change. Apple never paid a dividend from 1976 to 2011. Now they pay dividends.

More importantly, not paying dividends didn't stop people from owning stock in Apple, and making really good returns on it, from 1976 to 2011.

So I don't see a problem.

What is interesting just in thinking about it... it's fascinating how many hundreds of times left-wing people on here have complained about corporations giving money to the shareholders. Now you are pointing to companies that don't pay out to shareholders, and complaining about those companies.

Is there anything any company can do, that you won't find fault with? Just curious.

/cdn.vox-cdn.com/uploads/chorus_image/image/63915906/vpavic_190529_3458_0003.0.jpg)