Toro

Diamond Member

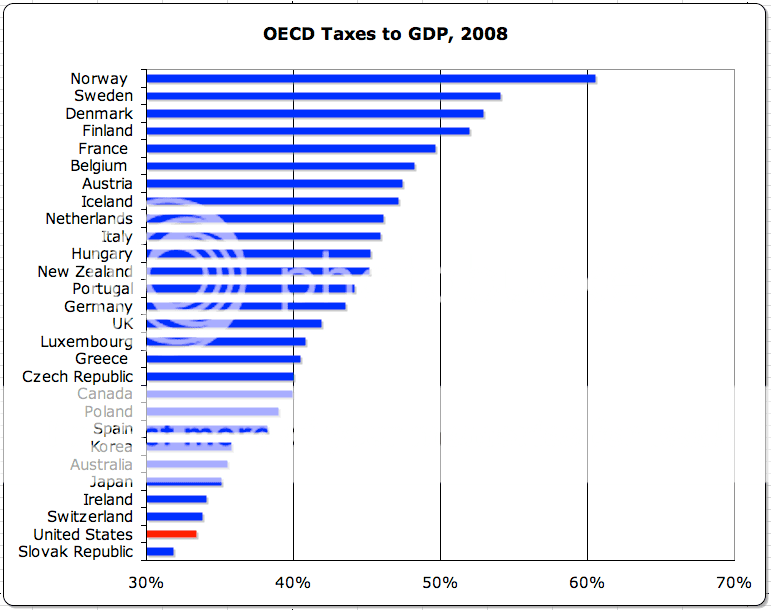

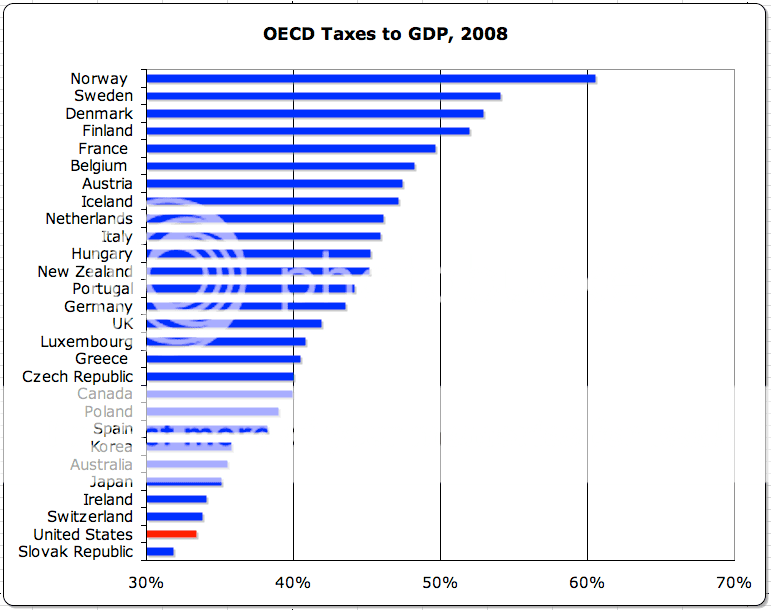

This data comes from the OECD, specifically this spreadsheet.

Only Slovakia has a lower tax take relative to GDP than the United States.

Only Slovakia has a lower tax take relative to GDP than the United States.

Last edited: