- Thread starter

- #561

Bernie's home state is about to find out if you're right.Bush didn't add a few hundred million people to Medicare.Bush beat him to it.I see Bernie's proposals as a way of bankrupting the country.

I suspect Bernie's proposals would make things worse.

"Vermont hired Harvard economist William Hsiao to come up with three alternatives to the current system. The single-payer system, Hsiao wrote, 'will produce savings of 24.3 percent of total health expenditure between 2015 and 2024.

"An analysis by Don McCanne, M.D., of Physicians for a National Health Program, pointed out that 'these plans would cover everyone without any increase in spending since the single-payer efficiencies would be enough to pay for those currently uninsured or under-insured. So this is the really good news single payer works.'

"Vermont Gov. Peter Shumlin explained to me his intention to sign the bill into law: 'Heres our challenge. Our premiums go up 10, 15, 20 percent a year. This is true in the rest of the country as well.

"'They are killing small business.

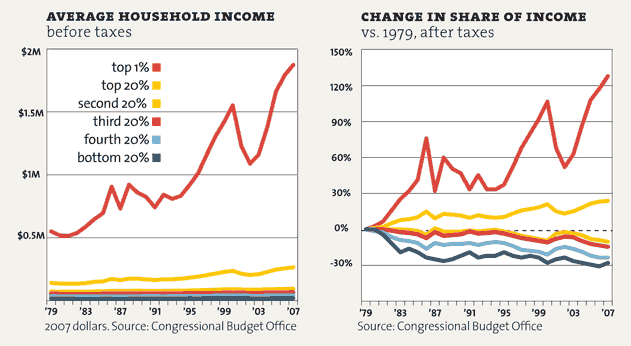

"'Theyre killing middle-class Americans, who have been kicked in the teeth over the last several years.

"'What our plan will do is create a single pool, get the insurance company profits, the pharmaceutical company profits, the other folks that are mining the system to make a lot of money on the backs of our illnesses, and ensure that were using those dollars to make Vermonters healthy.'

Single-Payer in Vermont, A State of Healthy Firsts | Common Dreams