Kilroy2

Gold Member

- Dec 22, 2018

- 7,486

- 2,713

- 210

The stock market had massive gains under Trump. Almost doubled from 16,000 to over 31000 in 4 years of Trump. The liberal shutdown of the economy to try to ensure his loss in the 2020 election is what caused the selloff. Not anything Trump did.

Today a massive tech bank declares bankruptcy, gets taken over by FDIC:

Regulators shut down Silicon Valley Bank in the second-largest U.S. bank failure ever

The FDIC took over the lender — the 16th largest U.S. bank and a tech industry favorite — after a run on deposits and concerns about a broader crisis that led investors to dump other bank stocks.www.nbcnews.com

Let's go Brandon!

You seem to want to give Trump all the credit and blame the liberals.

My response is that the stock market did crash under Trump. They say it was mostly due to the pandemic. yet we all know that Trump mishandled it in its early stages

Trump acknowledged to veteran journalist Bob Woodward that he knowingly downplayed the coronavirus, even though he knew it was more deadly than the seasonal flu.

"I wanted to always play it down," the president said in a March interview, the audio recording of which was made public in September.

Timeline: How Trump Has Downplayed The Coronavirus Pandemic

Here is a sampling of what the president has said and when, including that time he said a "miracle" might make the pandemic "disappear."

It was the FED's action that saved the day not Trump.

the Fed instituted a massive monetary stimulus program, cutting rates almost to zero, and unveiled plans for massive asset purchases. Yes it did go back up thanks to their actions.

The numbers for the drop are as follows:

The Dow industrials dropped 12.9%, the second biggest percentage loss post WWII (after 1987′s 22.6% drop).

The S&P 500 dropped 12%, its third biggest percentage loss.

The Nasdaq dropped 12.3%, its largest percentage loss ever.

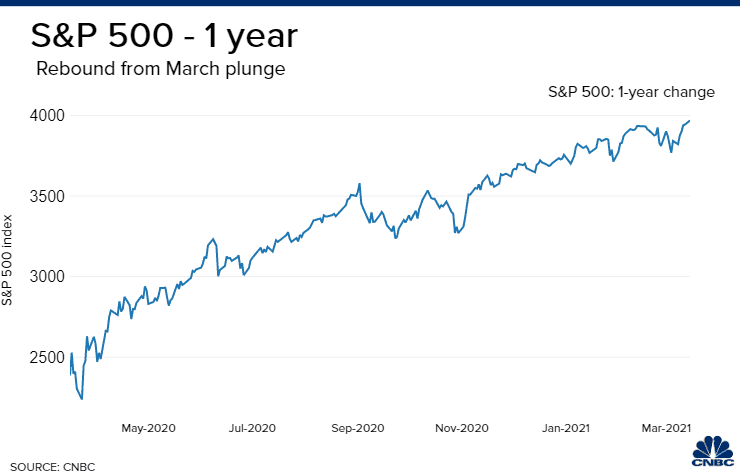

The S&P 500 would not bottom until March 23, a week later. From the Feb. 19, 2020, high to the March 23 bottom, the S&P would decline about 34%.

One year ago stocks dropped 12% in a single day. What investors have learned since then

March 16, 2020, was the day Covid got very real. It was the week everyone realized that we would be in for a prolonged shutdown.

So to blame or give the president too much credit is just a political thing. It goes up and then it goes down and then it goes back up again. Its the FED's job to maintain it in a political climate that inspires fear.

IMHO, none of these entities mentioned live on the same planet as i do ~S~

IMHO, none of these entities mentioned live on the same planet as i do ~S~