JimBowie1958

Old Fogey

- Sep 25, 2011

- 63,590

- 16,753

- 2,220

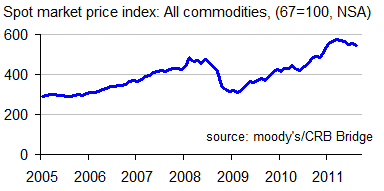

I keep hearing this phrase in the news related to the European markets banks that are on the verge of collapse.

'Recapitalization' I understand means 'to receive more money/capital in order to increase credit to capital ratios' that a bank must maintain in order to legally engage in fractional reserve lending. Right?

But where is this money supposed to come from?

Answer: government debt.

But who is responsible for that debt?

Answer: taxpayers.

So ineffect 'bank recapitalization' means to shift the burden of poor business decisions by some massive, too-big-to-fail banks onto tax payers instead through the act of governments simply giving/loaning trillions of dollars to banks that have proven they cannot competently compete in the free market. The banks in turn then 'restructure' their debts so they do not have to repay the loans at a reasonable rate if at all.

OK, now the follow up question:

Why do we tax payers put up with banks stealing trillions of dollars from future tax payers, our children and grand children?

While the first question puzzles me, the second question just leaves me stunned.

'Recapitalization' I understand means 'to receive more money/capital in order to increase credit to capital ratios' that a bank must maintain in order to legally engage in fractional reserve lending. Right?

But where is this money supposed to come from?

Answer: government debt.

But who is responsible for that debt?

Answer: taxpayers.

So ineffect 'bank recapitalization' means to shift the burden of poor business decisions by some massive, too-big-to-fail banks onto tax payers instead through the act of governments simply giving/loaning trillions of dollars to banks that have proven they cannot competently compete in the free market. The banks in turn then 'restructure' their debts so they do not have to repay the loans at a reasonable rate if at all.

OK, now the follow up question:

Why do we tax payers put up with banks stealing trillions of dollars from future tax payers, our children and grand children?

While the first question puzzles me, the second question just leaves me stunned.