Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Since we know that trickledown economics is a GOP lie, why are republicans still opposed to taxing the very wealthy more?

- Thread starter Billy000

- Start date

- Sep 19, 2020

- 7,038

- 8,159

- 2,138

>My FICA sent down, meanwhile my Medicare went up to not only make up for it but it surpassed the cutCorrect. Trump's tax cuts were across the board. He doubled the standard deduction as well, which the vast majority of low and middle income earners use.No reply to a straight forward question? Trump didn't raise taxes on the Middle Class...so your claim that he "broke you" is a flat out lie!Explain how Trump's taxes broke you! I'd really like to hear how that worked.The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

What is also a myth or outright lie is when Democrats tell the Middle Class that no one making under $(Fill in the number) will pay an increase in taxes. Invariably and necessarily, the Middle Class pays more in taxes. Case in point, Biden is getting rid of the 2017 tax cuts. Under Trump’s plan, the Middle Class kept more of a percentage of its take home pay than they did under Obama or will under Biden.

I went from Middle Class to lower Middle Class and yet I pay more taxes under Rump than before. Not much but a few dollars. When you add up over 100 millionof us, that few dollars adds up. Then take those few hundred millions and give them to the Uber Rich in tax breaks. That was the Rump Tax Break. He broke my taxes (which broke me) and broke the Uber Rich's taxes which paid for their new luxury toys and such.

Ah, the Vinnie Barbarino defense. Gotcha.

They have been fed talking points and they just regurgitate them without thinking.

My FICA sent down, meanwhile my Medicare went up to not only make up for it but it surpassed the cut. I lost money on the deal.

That makes no sense. FICA did go down for everyone, while Medicare rate was unchanged, but the income limit to which it applied did increase substantially more than inflation recently.

The reason yours went up is probably because you made more money, or you already made lots of money (>>$100k)). Congratulations & strive for even more.

sartre play

Gold Member

- May 4, 2015

- 9,884

- 3,070

- 210

Not talking about small & mid size business, for the middle class to grow we need them, for choices in the market place we need them. Talking about BIG BIG BUSINESS killing the little guy & scooping up the big bucks. Here is one more of them I don't feel sorry for if they pay a little more taxes.

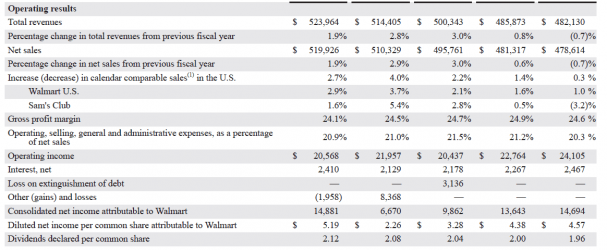

Wall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

Wall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

The real question should be, why are you bastards so intent on taking what others have earned?The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

Ray From Cleveland

Diamond Member

- Aug 16, 2015

- 97,215

- 37,438

- 2,290

Not talking about small & mid size business, for the middle class to grow we need them, for choices in the market place we need them. Talking about BIG BIG BUSINESS killing the little guy & scooping up the big bucks. Here is one more of them I don't feel sorry for if they pay a little more taxes.

Wall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

Many of the people who work for Walmart work part time. Walmart pays their management and assistant management pretty well. Their warehouse people make a pretty good living, and office personnel the same. Before the virus, Walmart announced it was going to hire hundreds of truck drivers offering close to 90K a year.

22 million for a CEO? Given the fact that Walmart has 1.5 million employees in the US alone, how would reducing the CEO pay benefit those other 1.5 million workers?

Billy000, many people who worked a lifetime feed a lot of mouths if their businesses prosper. Hands off, PLZ. THX.

BluesLegend

Diamond Member

The wealth disparity in the US is the widest in the world.

The wealthy is why losers have jobs, why do you want to punish them with higher taxes? They already pay umpteen times their fair share. Grow a freaking pair losers, start a business, take the risks, generate your own damn wealth and stop mooching off others.

If that’s the case why didn’t the Transocrats give each person $6k vs $1.4K with the $1.9trn stimulus? After all we all have $6k extra of debt now? LOLThe wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

Instead they gave you $6k of debt for $1.4K of cash and you kiss their ass.

- Thread starter

- #269

What, policy, specifically reflects what you are talking about?The real question should be, why are you bastards so intent on taking what others have earned?The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

- Sep 19, 2020

- 7,038

- 8,159

- 2,138

Walmart did not "make" $559+B last year. They made $20.5B gross profit, $14.9B net..Not talking about small & mid size business, for the middle class to grow we need them, for choices in the market place we need them. Talking about BIG BIG BUSINESS killing the little guy & scooping up the big bucks. Here is one more of them I don't feel sorry for if they pay a little more taxes.

Wall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

CEO base salary is less than $1.5M. Rest is stock options and stuff.. Looks like he is delivering 24% gross profit margin. That's quite wonderful on billions in sales.

Attachments

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."What, policy, specifically reflects what you are talking about?The real question should be, why are you bastards so intent on taking what others have earned?The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

Oldestyle

Diamond Member

Were you going to explain how Trump's tax plan "broke you"?Correct. Trump's tax cuts were across the board. He doubled the standard deduction as well, which the vast majority of low and middle income earners use.No reply to a straight forward question? Trump didn't raise taxes on the Middle Class...so your claim that he "broke you" is a flat out lie!Explain how Trump's taxes broke you! I'd really like to hear how that worked.The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

What is also a myth or outright lie is when Democrats tell the Middle Class that no one making under $(Fill in the number) will pay an increase in taxes. Invariably and necessarily, the Middle Class pays more in taxes. Case in point, Biden is getting rid of the 2017 tax cuts. Under Trump’s plan, the Middle Class kept more of a percentage of its take home pay than they did under Obama or will under Biden.

I went from Middle Class to lower Middle Class and yet I pay more taxes under Rump than before. Not much but a few dollars. When you add up over 100 millionof us, that few dollars adds up. Then take those few hundred millions and give them to the Uber Rich in tax breaks. That was the Rump Tax Break. He broke my taxes (which broke me) and broke the Uber Rich's taxes which paid for their new luxury toys and such.

Ah, the Vinnie Barbarino defense. Gotcha.

They have been fed talking points and they just regurgitate them without thinking.

My FICA sent down, meanwhile my Medicare went up to not only make up for it but it surpassed the cut. I lost money on the deal.

- Dec 9, 2013

- 16,806

- 4,771

- 265

Smarter than you boy.So you're really this stupid.You call others stupid but cannot back up your idiotic claims.Wow. Are you really this stupid, or do you act this way on the internet?Which is irrelevant.Reported income isn't the same as wealth. The top 1% own as much wealth as the bottom 90%.Link?

Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.taxfoundation.org

PolitiFact - Warren: Top 0.1% own about as much as the bottom 90%

Sen. Elizabeth Warren’s plan to tax the wealthiest Americans has drawn immediate fire. Former Starbucks CEO Howard Schulwww.politifact.com

You still have an epic fail demonstrating that inequality of wealth harms anyone

Cool, I won't bother with you anymore.

You cannot post evidence to support your claim hence your lack of trying.

Were you going to explain how Trump's tax plan "broke you"?Correct. Trump's tax cuts were across the board. He doubled the standard deduction as well, which the vast majority of low and middle income earners use.No reply to a straight forward question? Trump didn't raise taxes on the Middle Class...so your claim that he "broke you" is a flat out lie!Explain how Trump's taxes broke you! I'd really like to hear how that worked.The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

What is also a myth or outright lie is when Democrats tell the Middle Class that no one making under $(Fill in the number) will pay an increase in taxes. Invariably and necessarily, the Middle Class pays more in taxes. Case in point, Biden is getting rid of the 2017 tax cuts. Under Trump’s plan, the Middle Class kept more of a percentage of its take home pay than they did under Obama or will under Biden.

I went from Middle Class to lower Middle Class and yet I pay more taxes under Rump than before. Not much but a few dollars. When you add up over 100 millionof us, that few dollars adds up. Then take those few hundred millions and give them to the Uber Rich in tax breaks. That was the Rump Tax Break. He broke my taxes (which broke me) and broke the Uber Rich's taxes which paid for their new luxury toys and such.

Ah, the Vinnie Barbarino defense. Gotcha.

They have been fed talking points and they just regurgitate them without thinking.

My FICA sent down, meanwhile my Medicare went up to not only make up for it but it surpassed the cut. I lost money on the deal.

Already did. Your brain can't accept it. Accepting it would make your head explode.

WTH_Progs?

Diamond Member

- Feb 19, 2019

- 12,229

- 10,319

- 2,140

In Billy, you're more likely to get a raise if your boss earns less.

Mac-7

Diamond Member

- Oct 9, 2019

- 62,042

- 45,116

- 3,565

As Ray already pointed out $22 mil is is not that much considering the size of the companyWall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

As Ray already pointed out $22 mil is is not that much considering the size of the companyWall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

No one, outside of the owner of the Company that makes what Walley World does is worth anywhere near that. Maybe 1.3 mil but not 22 mil. Plus, the company isn't doing as well as it did 5 years ago with Amazon taking a chunk out of their sales.

Oldestyle

Diamond Member

Oh, you're one of THOSE guys? Guys that claim things they can't back up...but when they're challenged on them...you lie and say you've already done so? Noted...Were you going to explain how Trump's tax plan "broke you"?Correct. Trump's tax cuts were across the board. He doubled the standard deduction as well, which the vast majority of low and middle income earners use.No reply to a straight forward question? Trump didn't raise taxes on the Middle Class...so your claim that he "broke you" is a flat out lie!Explain how Trump's taxes broke you! I'd really like to hear how that worked.The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

What is also a myth or outright lie is when Democrats tell the Middle Class that no one making under $(Fill in the number) will pay an increase in taxes. Invariably and necessarily, the Middle Class pays more in taxes. Case in point, Biden is getting rid of the 2017 tax cuts. Under Trump’s plan, the Middle Class kept more of a percentage of its take home pay than they did under Obama or will under Biden.

I went from Middle Class to lower Middle Class and yet I pay more taxes under Rump than before. Not much but a few dollars. When you add up over 100 millionof us, that few dollars adds up. Then take those few hundred millions and give them to the Uber Rich in tax breaks. That was the Rump Tax Break. He broke my taxes (which broke me) and broke the Uber Rich's taxes which paid for their new luxury toys and such.

Ah, the Vinnie Barbarino defense. Gotcha.

They have been fed talking points and they just regurgitate them without thinking.

My FICA sent down, meanwhile my Medicare went up to not only make up for it but it surpassed the cut. I lost money on the deal.

Already did. Your brain can't accept it. Accepting it would make your head explode.

- Oct 18, 2011

- 22,336

- 12,851

- 1,405

Oh, you're one of THOSE guys? Guys that claim things they can't back up...but when they're challenged on them...you lie and say you've already done so? Noted...Were you going to explain how Trump's tax plan "broke you"?Correct. Trump's tax cuts were across the board. He doubled the standard deduction as well, which the vast majority of low and middle income earners use.No reply to a straight forward question? Trump didn't raise taxes on the Middle Class...so your claim that he "broke you" is a flat out lie!Explain how Trump's taxes broke you! I'd really like to hear how that worked.The wealth disparity in the US is the widest in the world. We KNOW corporate subsidies and tax breaks do not benefit the middle class or poor on any significant level. It's simply a myth they would choose to invest the extra money into lower level work forces. Why pay the fast food worker more if republican policy allows the fat cats to just keep the money they save from tax loopholes or meat subsidies? No point in that for them. There is no incentive.

"Under this legislation," the proposal noted above a list of billionaires in America, "the families of all 657 billionaires in America who have a combined net worth of over $4.26 trillion would owe up to $2.7 trillion in estate taxes."

Estate tax proposal from Bernie Sanders would mean big bills for America's wealthiest

Senate Budget Committee Chairman Bernie Sanders (I-VT) recently introduced an estate tax plan that specifically lists the wealthiest Americans.www.yahoo.com

What is also a myth or outright lie is when Democrats tell the Middle Class that no one making under $(Fill in the number) will pay an increase in taxes. Invariably and necessarily, the Middle Class pays more in taxes. Case in point, Biden is getting rid of the 2017 tax cuts. Under Trump’s plan, the Middle Class kept more of a percentage of its take home pay than they did under Obama or will under Biden.

I went from Middle Class to lower Middle Class and yet I pay more taxes under Rump than before. Not much but a few dollars. When you add up over 100 millionof us, that few dollars adds up. Then take those few hundred millions and give them to the Uber Rich in tax breaks. That was the Rump Tax Break. He broke my taxes (which broke me) and broke the Uber Rich's taxes which paid for their new luxury toys and such.

Ah, the Vinnie Barbarino defense. Gotcha.

They have been fed talking points and they just regurgitate them without thinking.

My FICA sent down, meanwhile my Medicare went up to not only make up for it but it surpassed the cut. I lost money on the deal.

Already did. Your brain can't accept it. Accepting it would make your head explode.

How could anyone in the Middle or Lower Classes get broken by Trump Tax Plan? Percentage wise across the board, people kept a higher rate vs. how much they kept under Obama-Biden. How does one lose or is it just their personal hatred of Trump that impacts their ability to do basic math?

Mac-7

Diamond Member

- Oct 9, 2019

- 62,042

- 45,116

- 3,565

You are entitled to your opinionAs Ray already pointed out $22 mil is is not that much considering the size of the companyWall Mart made 559+ Billion last year, Average pay of wall mart worker 25.000 a year CEO pay for the year 22.8 Million.

No one, outside of the owner of the Company that makes what Walley World does is worth anywhere near that. Maybe 1.3 mil but not 22 mil. Plus, the company isn't doing as well as it did 5 years ago with Amazon taking a chunk out of their sales.

but unless you are a manor stockholder on the board of directors its not your call

Similar threads

- Replies

- 17

- Views

- 2K

- Replies

- 129

- Views

- 6K

- Replies

- 2

- Views

- 658

T

Latest Discussions

- Replies

- 72

- Views

- 388

- Replies

- 2

- Views

- 10

- Replies

- 10

- Views

- 71

Forum List

-

-

-

-

-

Political Satire 8040

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-