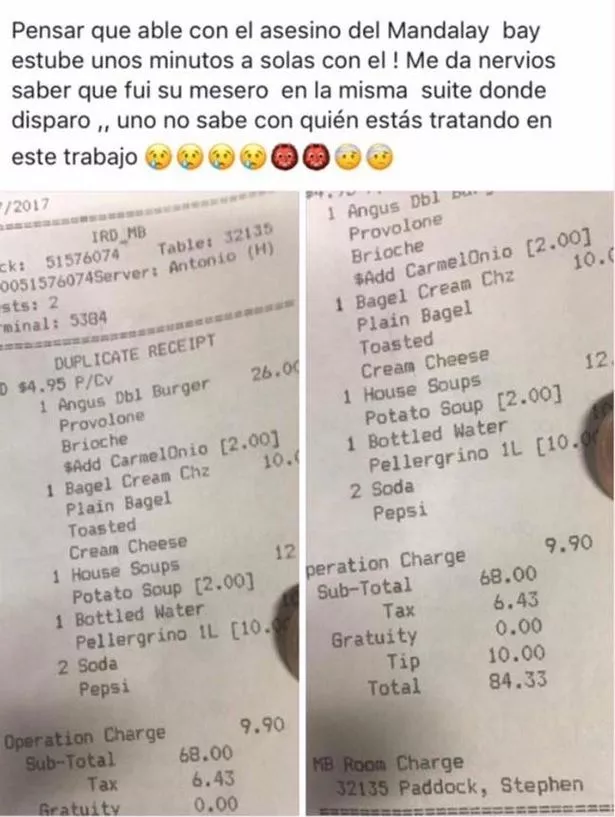

why would the waiter take a picture of the receipt on the 27th, three days before the mass murder? All those receipts get turned in that night, for the Night Auditor to balance the books? The waiter would not have the capabilities to get to this receipt after the attack, 3 days later?

was he taking phone pics of who he served to keep track of his tips???

That pisses me off if waiters do that....taking photos of receipts with your name and room number and maybe a charge card info?

It's possible HE checked in on Monday, and the suite/room adjoining was not available then, and on Thursday the suite next door opened up and he checked in on Thursday for that room....

the cops are holding off telling the public on him checking in earlier for the initial room because they are chasing leads on a possible suspect that helped him and don't want the suspect to know?

It would make sense that the investigators are holding back certain key points of information. I agree. And I would assume that the waiter would keep a copy of receipts to track his tips.

I thought they usually use an abacus!. You goofball, they use computers

Really? They have to use forms provided for them by the IRS. Each employee has different methods of record keeping.

Tip Recordkeeping & Reporting

Tips are discretionary (optional or extra) payments determined by a customer that employees receive from customers.

Tips include:

- Cash tips received directly from customers.

- Tips from customers who leave a tip through electronic settlement or payment. This includes a credit card, debit card, gift card, or any other electronic payment method.

- The value of any noncash tips, such as tickets, or other items of value.

- Tip amounts received from other employees paid out through tip pools or tip splitting, or other formal or informal tip sharing arrangement.

All cash and non-cash tips an employee receives are income and are subject to Federal income taxes. All cash tips received by an employee in any calendar month are subject to social security and Medicare taxes and must be reported to the employer, unless the tips received by the employee during a single calendar month while working for the employer total less than $20. Cash tips include tips received from customers, charged tips (e.g., credit and debit card charges) distributed to the employee by his or her employer, and tips received from other employees under any tip-sharing arrangement.

Employee Responsibilities

As an employee who receives tips, you must do three things:

- Keep a daily tip record.

- Report tips to the employer, unless less than $20.

- Report all tips on an individual income tax return.

Keep a daily tip record

Employees must keep a daily record of tips received. You can use Form 4070A, Employee's Daily Record of Tips, included in

Publication 1244. In addition to the information asked for on Form 4070A, you also need to keep a record of the date and value of any noncash tips you get, such as tickets, passes, or other items of value. Although you do not report these tips to your employer, you must report them on your tax return.

Report tips to the employer, unless less than $20

The Internal Revenue Code requires employees to report to their employer in a written statement, all cash tips received except for the tips from any month that do not total at least $20. Cash tips include tips received from customers, charged tips (e.g., credit and debit card charges) distributed to the employee by his or her employer, and tips received from other employees under any tip-sharing arrangement. No particular form must be used. The statement must be signed by the employee and must include:

- Employee's name, address, and social security number,

- Employer's name and address (establishment name if different),

- Month or period the report covers, and

- Total of tips received during the month or period.

The employee may use Form 4070, Employee's Report of Tips to Employer, (available only in

Pub. 1244, Employee's Daily Record of Tips and Report to Employer), unless some other form is provided by the employer. You can use an electronic system provided by your employer to report your tips.

Both directly and indirectly tipped employees must report tips to the employer.

Report all tips on an individual income tax return

An employee must use

Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to report the amount of any unreported tip income to include as additional wages on their

Form 1040, U.S. Individual Income Tax Return, and the employee share of social security and Medicare tax owed on those tips.

Tip Recordkeeping and Reporting | Internal Revenue Service