Sure, cause the Benicia California refinery that processes tar sands uses all Chinese employees?Keystone XL is a tax dodge that only benefits the Chinese owners of Canadian tar sands.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Politifact: Claim that Biden's Keystone pipeline order drove gas prices up is rated "FALSE""

- Thread starter pyetro

- Start date

Sure, cause the Benicia California refinery that processes tar sands uses all Chinese employees?

No stupid. In Canada the Chinese own the tar sands strip mining operations.

Everything you say is either fiction or fiction with very little fact.No stupid. In Canada the Chinese own the tar sands strip mining operations.

You dodged the last assertion you made.

Bullshit, part owners of syncrude which is owned by 4 total corporations.No stupid. In Canada the Chinese own the tar sands strip mining operations.

Keystone XL is a tax dodge that only benefits the Chinese owners of Canadian tar sands.

Which taxes does it dodge?

Which taxes does it dodge?

TAX FREE ZONE .... FREE TRADE ZONE..

Bullshit, part owners of syncrude which is owned by 4 total corporations.

Chinese in $2 Billion Tar Sands Deal - Oil Change International

To paraphrase the great writer Samuel Langhorne Clemens, better known as Mark Twain: “Rumors of my death have been greatly exaggerated!" And so it is with

priceofoil.org

Chinese in $2 Billion Tar Sands Deal To paraphrase the great writer Samuel Langhorne Clemens, better known as Mark Twain: “Rumors of my death have been greatly exaggerated!” And so it is with the tar sands, one of the hottest debates in the energy industry.

Chinese in $2 Billion Tar Sands Deal - Oil Change ...

Bullshit, part owners of syncrude which is owned by 4 total corporations.

Chinese companies commit to Alberta oilsands despite setbacks | Globalnews.ca

While some European and U.S. companies cut their exposure to the Canadian oilsands, China's Big Three oil giants -- CNOOC, PetroChina and Sinopec -- seem content to let their bets ride even if the results haven't been spectacular.

TAX FREE ZONE .... FREE TRADE ZONE..

Which tax? Say it.

Which tax? Say it.

Try this.

FTZ Basics & Benefits - NAFTZ

Basics & Benefits

of the U.S. Foreign-Trade Zones Program What is a Foreign-Trade Zone? Foreign-Trade Zones (FTZ) are secured, designated locations around the United States in or near a U.S. Customs Port of Entry where foreign and domestic merchandise is generally considered to be in international commerce and...

www.naftz.org

www.naftz.org

Foreign-Trade Zones (FTZ) are secured, designated locations around the United States in or near a U.S. Customs Port of Entry where foreign and domestic merchandise is generally considered to be in international commerce and outside of US Customs territory. As a result, activated businesses in an FTZ can reduce or eliminate duty on imports and take advantage of other benefits to encourage foreign commerce within the United States. Created by Congress in the Foreign-Trade Zones Act of 1934, Forei…

See more on naftz.org

How can a Free-Trade Zone benefit your business ...

Feb 24, 2020 · When it comes to moving, processing or assembling imported products, using a Free-Trade Zone has considerable economic benefits. Situated within Free-Trade Zone areas, our processing centres in the US, Dubai, Asia and Latin America give importers, manufacturers and distributors the opportunity to experience these advantages. Also known as a ‘Foreign-Trade Zone’ in the US, a Free-Trade Zone …

USA Free Trade Zones: Everything you need to know | Tetra ...

USA Free Trade Zones: Everything you need to know | Tetra Consultants

Register your company in USA Free Trade Zones for multiple benefits. Find out whether your business belongs to General Purpose Zones or Subzones.

www.tetraconsultants.com

www.tetraconsultants.com

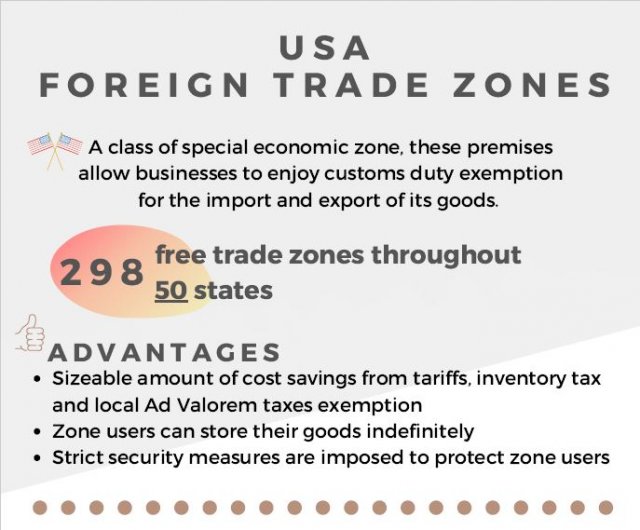

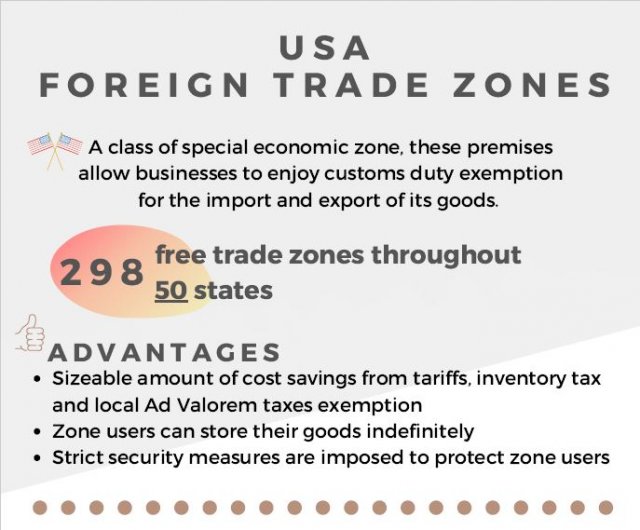

Image

A class of special economic zone, USA Free Trade Zones are also commonly referred to as “Foreign Trade Zones”. Businesses receive multiple benefits of USA free trade zones. Within its premises, businesses get to enjoy customs duty exemption for their goods. Generally organized around major seaports, it also holds many trade advantages. According to the Free trade zone directory of the United States Department of Commerc…

See more on tetraconsultants.com

About Foreign-Trade Zones and Contact Info | U.S. Customs ...

An Introduction to Foreign-Trade ZonesThe Advantages of Using A Foreign-Trade ZoneEstablishing A Foreign-Trade ZoneRole of CBPWhat May Be Placed in ZonesWhat May Be Done in ZonesEntering Merchandise from A Zone Into The United States For ConsumptionPrivileged Foreign StatusZone Restricted StatusNonprivileged Foreign Status

Image

Foreign-Trade Zones (FTZ) are secure areas under U.S. Customs and Border Protection (CBP) supervision that are generally considered outside CBP territory upon activation. Located in or near CBP ports of entry, they are the United States' version of what are known internationally as free-trade zones. Authority for establishing these facilities is granted by the Foreign-Trade Zones Board under the Foreign-Trade Zones Act of 1934, …

See more on cbp.gov

NBSO Texas FAQ :Free Trade Zones

Foreign-Trade Zones Board

Foreign-Trade Zones Resources. Formats, guidance and instructions on requests for FTZ authority and site and subzone designations. Provides information on each foreign-trade zone such as contact information, sites, subzones and Federal Register notices. This is …

Free-trade zone - Wikipedia

Free-trade zone - Wikipedia

A free-trade zone (FTZ) is a class of special economic zone. It is a geographic area where goods may be imported, stored, handled, manufactured, or reconfigured and re-exported under specific customs regulation and generally not subject to customs duty. Free trade zones are generally organized around major seaports, international airports, and national frontiers—areas with many geographic advantages for trade.

Wikipedia · Text under CC-BY-SA license

FTZ Basics & Benefits - Inbound Logistics

FTZ Basics and Benefits - Inbound Logistics

As global trade expands, foreign trade zones (FTZs) grow in importance.

An FTZ's primary advantage is its ability to improve a company's competitive position. Businesses can avoid import duties if goods that enter the FTZ are stored, sorted, tested, repackaged, and otherwise handled within the FTZ, then exported without ever entering the U.S. marketplace. For those products that do enter the U.S. marketplace, duty payments are due only once. Postponing payment provides a cash-flow advantage to importers and exporters. In addition, duty and tax rates on merchandise admitted to a…

See more on inboundlogistics.com

How to Set up a Foreign-Trade Zone

Jun 27, 2019 · Free-Trade Zone . A free-trade zone, on the other hand, is a dedicated area where goods can land, be repackaged, modified, manipulated and relabeled, along with the performance of a number of other operations, in some cases excluding manufacturing (similar to a bonded warehousing situation), and re-exported without customs authorities stepping ...

Motiva is now owned by Saudi Arabia alone.

Excerpt:

The refineries that are linked to the Keystone XL tar sands pipeline as committed shippers will receive between $1 billion and $1.8 billion in tax breaks. They are paid specifically for investing in equipment to process the heavy sour oil the pipeline promises to deliver.

The largest of these refineries, Motiva, is half owned by Saudi Refining Inc., and will receive between $680 million and $1.1 billion in U.S. taxpayer support.

Keystone XL, like all oil industry projects, is enabled by substantial taxpayer subsidies. Three of the refineries that are planning to process the pipeline’s oil have invested in special equipment to handle the extra heavy tar sands oil. According to our conservative estimates, the U.S. taxpayer is subsidizing these investments to the tune of $1.0-1.8 billion. Here’s how it works.

Tar sands oil is not like most other crude oil. It is a semi-solid bituminous sludge that has to be diluted with much lighter oil in order to be transported by pipeline. Once it arrives at a refinery, the diluent is removed and the bitumen is refined into petroleum products using special equipment. The equipment required includes cokers and hydrocrackers.

In anticipation of the Keystone XL pipeline, three refineries in Port Arthur, Texas have added this equipment in order to be able to profitably process the bitumen. Their goal is to maximize their production of high value fuels such as gasoline and diesel rather than be left with less valuable fuels such as residual oil (for shipping and industrial burners) and Petroleum Coke, a coal like substance that is burned in aluminum smelters and the like. Heavy oil yields high proportions of these less valuable fuels if you do not have the specific equipment to increase the higher value yield.

Special tax rules apply to these investments that are unique to the refining industry. Title 179C of the tax code allows the refining companies to deduct the value of these investments from their tax returns at a highly accelerated rate. Rather than spread the expense over the life time of the equipment, say 20-30 years, the refiners are allowed to expense (i.e., deduct from their taxable income) 50% in the first year and expense the rest through the next 9 years. This is tantamount to a massive interest free loan from the taxpayer to big oil refiners, making it cheaper for them to process a particularly dirty form of foreign oil. In the case of the three Port Arthur refineries preparing to process Keystone XL crude, we calculate this to cost the taxpayer between $1.0 billion and $1.8 billion.

In the case of the Valero Port Arthur refinery’s hydrocracker project, the company has described the project to investors as one that will enable the refinery to process Canadian heavy oil into diesel and jet fuel for the export market. See below.

Keystone XL benefits from taxpayer subsidies - Oil Change International

Sen. Mitch McConnell claimed recently that the Keystone XL Pipeline “doesn’t require a penny of our taxpayer money all the president has to do is approve

priceofoil.org

Excerpt:

The refineries that are linked to the Keystone XL tar sands pipeline as committed shippers will receive between $1 billion and $1.8 billion in tax breaks. They are paid specifically for investing in equipment to process the heavy sour oil the pipeline promises to deliver.

The largest of these refineries, Motiva, is half owned by Saudi Refining Inc., and will receive between $680 million and $1.1 billion in U.S. taxpayer support.

Keystone XL, like all oil industry projects, is enabled by substantial taxpayer subsidies. Three of the refineries that are planning to process the pipeline’s oil have invested in special equipment to handle the extra heavy tar sands oil. According to our conservative estimates, the U.S. taxpayer is subsidizing these investments to the tune of $1.0-1.8 billion. Here’s how it works.

Tar sands oil is not like most other crude oil. It is a semi-solid bituminous sludge that has to be diluted with much lighter oil in order to be transported by pipeline. Once it arrives at a refinery, the diluent is removed and the bitumen is refined into petroleum products using special equipment. The equipment required includes cokers and hydrocrackers.

In anticipation of the Keystone XL pipeline, three refineries in Port Arthur, Texas have added this equipment in order to be able to profitably process the bitumen. Their goal is to maximize their production of high value fuels such as gasoline and diesel rather than be left with less valuable fuels such as residual oil (for shipping and industrial burners) and Petroleum Coke, a coal like substance that is burned in aluminum smelters and the like. Heavy oil yields high proportions of these less valuable fuels if you do not have the specific equipment to increase the higher value yield.

Special tax rules apply to these investments that are unique to the refining industry. Title 179C of the tax code allows the refining companies to deduct the value of these investments from their tax returns at a highly accelerated rate. Rather than spread the expense over the life time of the equipment, say 20-30 years, the refiners are allowed to expense (i.e., deduct from their taxable income) 50% in the first year and expense the rest through the next 9 years. This is tantamount to a massive interest free loan from the taxpayer to big oil refiners, making it cheaper for them to process a particularly dirty form of foreign oil. In the case of the three Port Arthur refineries preparing to process Keystone XL crude, we calculate this to cost the taxpayer between $1.0 billion and $1.8 billion.

In the case of the Valero Port Arthur refinery’s hydrocracker project, the company has described the project to investors as one that will enable the refinery to process Canadian heavy oil into diesel and jet fuel for the export market. See below.

Try this.

FTZ Basics & Benefits - NAFTZ

What Is A Foreign-Trade Zone?What Can Be Done in A Foreign-Trade Zone?What Are The Benefits of A Foreign-Trade Zone?Benefits of A Foreign-Trade Zone in DepthBasics & Benefits

of the U.S. Foreign-Trade Zones Program What is a Foreign-Trade Zone? Foreign-Trade Zones (FTZ) are secured, designated locations around the United States in or near a U.S. Customs Port of Entry where foreign and domestic merchandise is generally considered to be in international commerce and...www.naftz.org

Foreign-Trade Zones (FTZ) are secured, designated locations around the United States in or near a U.S. Customs Port of Entry where foreign and domestic merchandise is generally considered to be in international commerce and outside of US Customs territory. As a result, activated businesses in an FTZ can reduce or eliminate duty on imports and take advantage of other benefits to encourage foreign commerce within the United States. Created by Congress in the Foreign-Trade Zones Act of 1934, Forei…

See more on naftz.org

How can a Free-Trade Zone benefit your business ...

Feb 24, 2020 · When it comes to moving, processing or assembling imported products, using a Free-Trade Zone has considerable economic benefits. Situated within Free-Trade Zone areas, our processing centres in the US, Dubai, Asia and Latin America give importers, manufacturers and distributors the opportunity to experience these advantages. Also known as a ‘Foreign-Trade Zone’ in the US, a Free-Trade Zone …

USA Free Trade Zones: Everything you need to know | Tetra ...

Free Trade Zones in The United StatesAdvantages of USA Free Trade ZonesGeneral Purpose ZonesSubzonesHow to proceed with Registering A Company in USA Free Trade Zones?FAQs

USA Free Trade Zones: Everything you need to know | Tetra Consultants

Register your company in USA Free Trade Zones for multiple benefits. Find out whether your business belongs to General Purpose Zones or Subzones.www.tetraconsultants.com

Image

A class of special economic zone, USA Free Trade Zones are also commonly referred to as “Foreign Trade Zones”. Businesses receive multiple benefits of USA free trade zones. Within its premises, businesses get to enjoy customs duty exemption for their goods. Generally organized around major seaports, it also holds many trade advantages. According to the Free trade zone directory of the United States Department of Commerc…

See more on tetraconsultants.com

About Foreign-Trade Zones and Contact Info | U.S. Customs ...

An Introduction to Foreign-Trade ZonesThe Advantages of Using A Foreign-Trade ZoneEstablishing A Foreign-Trade ZoneRole of CBPWhat May Be Placed in ZonesWhat May Be Done in ZonesEntering Merchandise from A Zone Into The United States For ConsumptionPrivileged Foreign StatusZone Restricted StatusNonprivileged Foreign Status

Image

Foreign-Trade Zones (FTZ) are secure areas under U.S. Customs and Border Protection (CBP) supervision that are generally considered outside CBP territory upon activation. Located in or near CBP ports of entry, they are the United States' version of what are known internationally as free-trade zones. Authority for establishing these facilities is granted by the Foreign-Trade Zones Board under the Foreign-Trade Zones Act of 1934, …

See more on cbp.gov

NBSO Texas FAQ :Free Trade Zones

Free Trade Zones The climate for international trade can change, and the future is a bit unclear right now as power and the dynamics of foreign business are shifting. There are, however, certain designations that can help facilitate foreign trade through easement of import duties and other predetermined benefits.

Foreign-Trade Zones Board

Foreign-Trade Zones Resources. Formats, guidance and instructions on requests for FTZ authority and site and subzone designations. Provides information on each foreign-trade zone such as contact information, sites, subzones and Federal Register notices. This is …

Free-trade zone - Wikipedia

OverviewDefinitionExport-processing zoneBackgroundUS Foreign-Trade Zone Board and ASFUAE Free ZonesKuwait Free Trade ZoneCriticismFree-trade zone - Wikipedia

en.wikipedia.org

A free-trade zone (FTZ) is a class of special economic zone. It is a geographic area where goods may be imported, stored, handled, manufactured, or reconfigured and re-exported under specific customs regulation and generally not subject to customs duty. Free trade zones are generally organized around major seaports, international airports, and national frontiers—areas with many geographic advantages for trade.

Wikipedia · Text under CC-BY-SA license

FTZ Basics & Benefits - Inbound Logistics

Improving CompetitivenessCutting Down on PaperworkChoosing The Right Type of FTZThe Alternative AdvantageThe Combination ApproachPitfalls and ChallengesFuture of FTZs

FTZ Basics and Benefits - Inbound Logistics

As global trade expands, foreign trade zones (FTZs) grow in importance.www.inboundlogistics.com

An FTZ's primary advantage is its ability to improve a company's competitive position. Businesses can avoid import duties if goods that enter the FTZ are stored, sorted, tested, repackaged, and otherwise handled within the FTZ, then exported without ever entering the U.S. marketplace. For those products that do enter the U.S. marketplace, duty payments are due only once. Postponing payment provides a cash-flow advantage to importers and exporters. In addition, duty and tax rates on merchandise admitted to a…

See more on inboundlogistics.com

How to Set up a Foreign-Trade Zone

Jun 27, 2019 · Free-Trade Zone . A free-trade zone, on the other hand, is a dedicated area where goods can land, be repackaged, modified, manipulated and relabeled, along with the performance of a number of other operations, in some cases excluding manufacturing (similar to a bonded warehousing situation), and re-exported without customs authorities stepping ...

As a result, activated businesses in an FTZ can reduce or eliminate duty on imports

Within its premises, businesses get to enjoy customs duty exemption for their goods.

It is a geographic area where goods may be imported, stored, handled, manufactured, or reconfigured and re-exported under specific customs regulation and generally not subject to customs duty.

Businesses can avoid import duties if goods that enter the FTZ are stored, sorted, tested, repackaged, and otherwise handled within the FTZ, then exported without ever entering the U.S. marketplace. For those products that do enter the U.S. marketplace, duty payments are due only once.

So now you see the error in your claim?

An article from 2009? That was 3 presidents ago? Is not Murhpy Corp a 54% stake holder.

Chinese in $2 Billion Tar Sands Deal - Oil Change International

To paraphrase the great writer Samuel Langhorne Clemens, better known as Mark Twain: “Rumors of my death have been greatly exaggerated!" And so it is withpriceofoil.org

Chinese in $2 Billion Tar Sands Deal To paraphrase the great writer Samuel Langhorne Clemens, better known as Mark Twain: “Rumors of my death have been greatly exaggerated!” And so it is with the tar sands, one of the hottest debates in the energy industry.

Chinese in $2 Billion Tar Sands Deal - Oil Change ...

And the tar sands, the largest oil reserve in world, there are a lot more companies involved, than just one Chinese company as you stated.

You h

So????? You stated only the Chinese profit from Canadian tar sands. This link you provided states the Chinese are losing money. The article also states some US and European companies are pulling back.

Chinese companies commit to Alberta oilsands despite setbacks | Globalnews.ca

While some European and U.S. companies cut their exposure to the Canadian oilsands, China's Big Three oil giants -- CNOOC, PetroChina and Sinopec -- seem content to let their bets ride even if the results haven't been spectacular.globalnews.ca

The article surada provided proves surada wrong!

The article states China is losing money, not making money as surada has stated.

The article also show there are US and European companies invested in the tar sands. Not only the Chinese.

Surada and so many others education is nothing more than Democrat talking points. When challenged they go to Google and cling on to the search result as if it validates what they believe. What they were told. It takes a better education than that the democrats recieve to know how to use Google to find answers.

At the least you must understand Google is paid to have paid results on the first pages. Google is very much a political propaganda platform.

So????? You stated only the Chinese profit from Canadian tar sands. This link you provided states the Chinese are losing money. The article also states some US and European companies are pulling back.

The article surada provided proves surada wrong!

The article states China is losing money, not making money as surada has stated.

The article also show there are US and European companies invested in the tar sands. Not only the Chinese.

Surada and so many others education is nothing more than Democrat talking points. When challenged they go to Google and cling on to the search result as if it validates what they believe. What they were told. It takes a better education than that the democrats recieve to know how to use Google to find answers.

At the least you must understand Google is paid to have paid results on the first pages. Google is very much a political propaganda platform.

Tar Sands Action » Key Facts on Keystone XL

Keystone XL is an export pipeline. According to presentations to investors, Gulf Coast refiners plan to refine the cheap Canadian crude supplied by the pipeline into diesel and other products for export to Europe and Latin America. Proceeds from these exports are earned tax-free. Much of the fuel refined from the pipeline’s heavy crude oil will never reach U.S. drivers’ tanks.

- Jun 29, 2013

- 22,551

- 14,819

- 1,405

Sorry dude PolitiFact needs schooling in commodities trading. Futures are a very big part of the commodities market. Removal of the future produce from that pipeline had a direct effect and an immediate effect on the price of the petroleum commodities in fact all of the hydrocarbon commodities.The independent Pulitzer winning website notes that the pipeline wasn't even operational, despite the fake news spread by Facebook right winger Ted Nugent.

Facebook flagged the fake news too.

The good news is that if you like fake news, the false claim is widely available in USMB, where right wing nicknames gladly copy and paste what Ted Nugent types.

No, gas isn’t up 50 cents and food isn’t up 10% under Biden

Are President Joe Biden’s executive orders so powerful that, in the less than two months he’s held office, they have spiwww.politifact.com

PolitiFact gets five Pinocchio's from me.

Jo

- Jun 29, 2013

- 22,551

- 14,819

- 1,405

Another one who's completely illiterate in commodities trading especially on the global scale. When it comes to hydrocarbons there is only a global market you moron... There are no local markets for petroleum anymore.Tar Sands Action » Key Facts on Keystone XL

tarsandsaction.org

Keystone XL is an export pipeline. According to presentations to investors, Gulf Coast refiners plan to refine the cheap Canadian crude supplied by the pipeline into diesel and other products for export to Europe and Latin America. Proceeds from these exports are earned tax-free. Much of the fuel refined from the pipeline’s heavy crude oil will never reach U.S. drivers’ tanks.

This is exactly why gas that is already in the tanks at the stations changes price even before it gets pumped overnight. It's sitting there in the tank in the ground and its price is moving up and down according to the commodities rate for the day.

Sorry dude PolitiFact needs schooling in commodities trading. Futures are a very big part of the commodities market. Removal of the future produce from that pipeline had a direct effect and an immediate effect on the price of the petroleum commodities in fact all of the hydrocarbon commodities.

PolitiFact gets five Pinocchio's from me.

Jo

Why is Keystone XL still in play after a decade? Its still a scam on the US taxpayer.

So know you agree the US will profit from the pipeline. Thank You.Tar Sands Action » Key Facts on Keystone XL

tarsandsaction.org

Keystone XL is an export pipeline. According to presentations to investors, Gulf Coast refiners plan to refine the cheap Canadian crude supplied by the pipeline into diesel and other products for export to Europe and Latin America. Proceeds from these exports are earned tax-free. Much of the fuel refined from the pipeline’s heavy crude oil will never reach U.S. drivers’ tanks.

This came out ten years ago. By now you should know keystone XL is tax dodge for the Chinese.Wait, are you telling me the oil market is a global commodity that is highly interconnected and that the President of 1 country doesn't pull a daily lever to set the oil prices after he puts his slippers on in the morning?

Yeah, okay dude, hahahaha. Next you'll be saying Biden won the fraudulent election. XD Sad!

Similar threads

- Replies

- 59

- Views

- 538

- Replies

- 24

- Views

- 250

- Replies

- 45

- Views

- 530

- Replies

- 445

- Views

- 3K

Latest Discussions

- Replies

- 45

- Views

- 185

Forum List

-

-

-

-

-

Political Satire 8040

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-