Campbell

Gold Member

- Aug 20, 2015

- 3,866

- 646

- 255

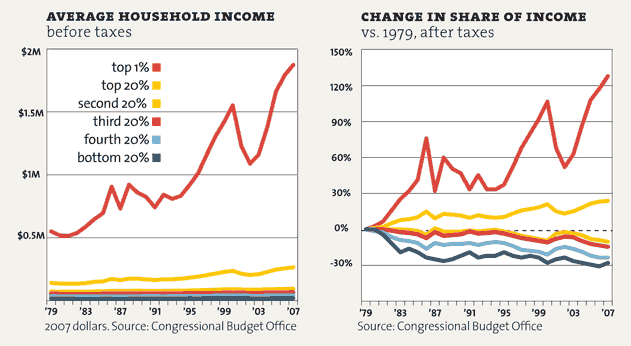

Warren Buffett says the super-rich pay lower tax rates than others

It's not often you see someone stand up and say, "Tax me more!"

Yet that's just what famed investor Warren Buffett has done in an op-ed in the New York Times headlined, "Stop Coddling the Super-Rich." Buffett says that very wealthy people like himself pay lower tax rates than the middle class, thanks to special tax categories for investment income.

The part Buffet didn't mention is that not only payroll taxes the poorest of the poor pay a much higher percentage of their income than others. When every kind of local tax, fee, registration charge, license and other government and normal living required costs are added the rich are getting off and making out like a bandit when observed as a percentage of their total.

For example in Tennessee there is a state sales tax and in the county where I live there's also a local retail tax on everything one purchases. A poor bastard earning $30,000 a year pays the same gasoline tax as a millionaire and if one looks closely there's another form of taxation or fee being charged every time the poor man/woman opens his/her billfold/purse.

It's not often you see someone stand up and say, "Tax me more!"

Yet that's just what famed investor Warren Buffett has done in an op-ed in the New York Times headlined, "Stop Coddling the Super-Rich." Buffett says that very wealthy people like himself pay lower tax rates than the middle class, thanks to special tax categories for investment income.

The part Buffet didn't mention is that not only payroll taxes the poorest of the poor pay a much higher percentage of their income than others. When every kind of local tax, fee, registration charge, license and other government and normal living required costs are added the rich are getting off and making out like a bandit when observed as a percentage of their total.

For example in Tennessee there is a state sales tax and in the county where I live there's also a local retail tax on everything one purchases. A poor bastard earning $30,000 a year pays the same gasoline tax as a millionaire and if one looks closely there's another form of taxation or fee being charged every time the poor man/woman opens his/her billfold/purse.

Last edited: