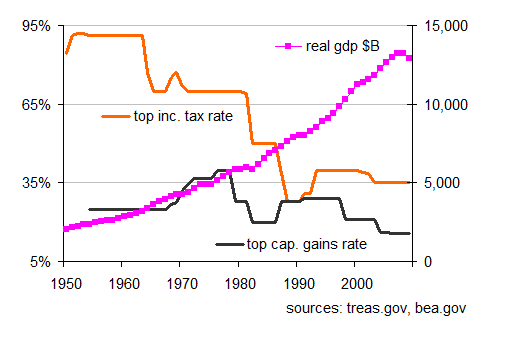

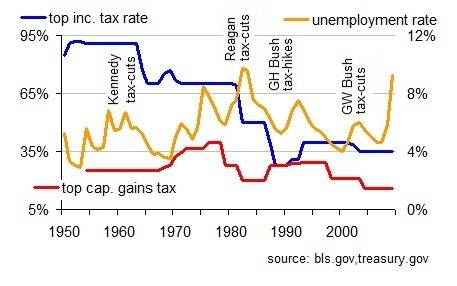

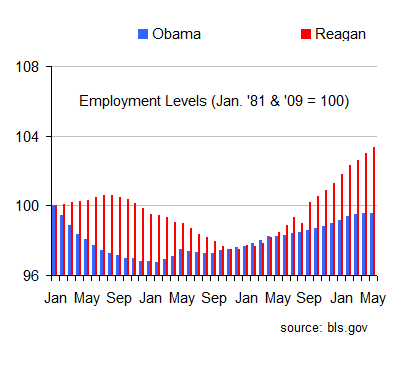

No, actually it's pseudo-scientific scam, just like that goofy con that Star posted at http://thinkprogress.org/wp-content/uploads/2011/06/taxratesgrowth.jpg . The main difference between Star's chart and mine is not what they say about taxes, but rather the fact that most of know they're both laughable and he doesn't.The graph is a reflection of technological and process improvements over time. (And probably inflation.)On the other hand, history is very kind to the theory that lower marginal rates come with higher GDP...

I think at the very least the thinkprogress graph shows that lowering taxes does not automatically create growth.

Last edited:

or

or  ?

?