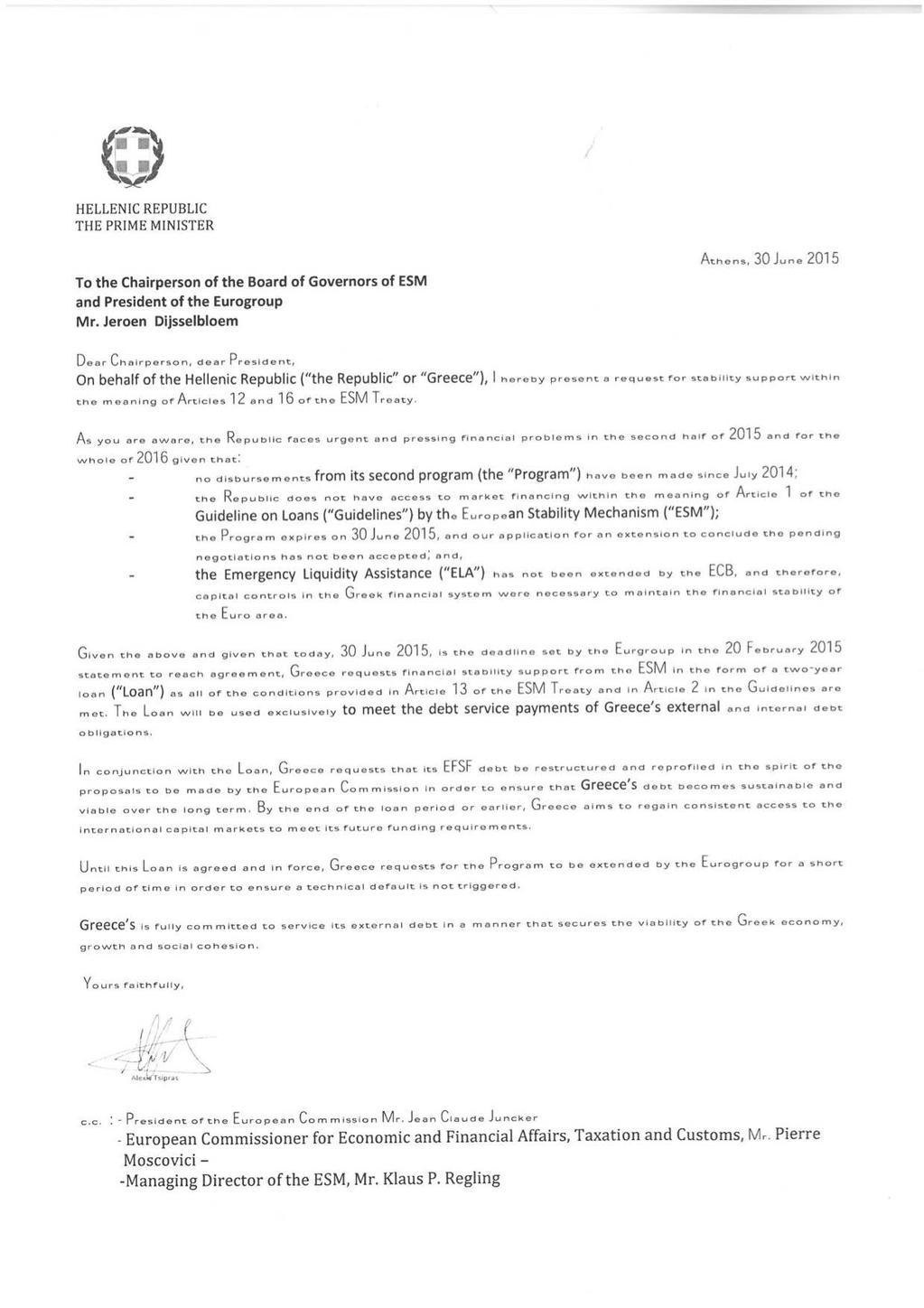

- May 17, 2013

- 67,605

- 32,743

- 2,290

DebtClocks.eu - Debt clocks of the EU Member States - comparison

Estonia

Germany

Luxembourg.

are the only 3 countries in the EU to have positive surplus/debt ratios......

all else have to borrow to pay the bills.

aka we are not the only ones needing to throw the fucking ring into the fire.

Estonia

Germany

Luxembourg.

are the only 3 countries in the EU to have positive surplus/debt ratios......

all else have to borrow to pay the bills.

aka we are not the only ones needing to throw the fucking ring into the fire.