Why bother? If you had cancer and the cure was sitting in front of you, would you refuse to take it?

We do have a cure to debt. It's called 'Making the rich pay their fair share".

Works every time it's tried.

What is the rich's fair share?

Whatever it takes to not have a deficit and to pay down the national debt over the next 50 years.

So you don't really know you just think more. You are like the a wife who spends and spends and tells her husband just to go out and earn more money. With the mindset of the liberal left there NEVER will be enough money.

So paying the majority isn't enough. But you are right, to keep on with the wreck less spending of Washington the rich will have to pay more because they are the ones with the money. :

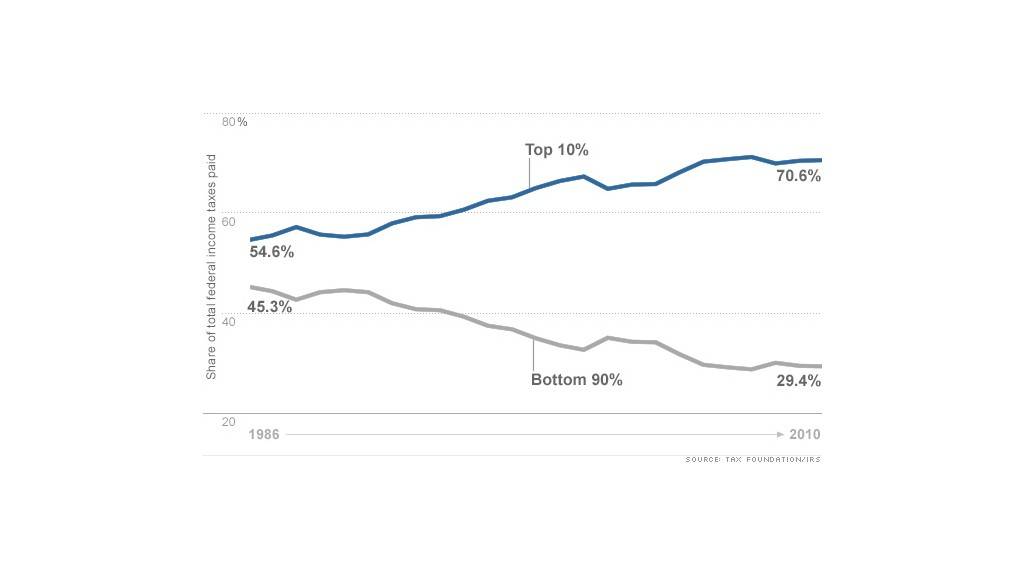

The rich pay majority of U.S. income taxes

Many people think that the rich are able to weasel their way out of taxes, but they actually pay an overwhelming majority of the taxes in the United States.

What's more, their share of the tax burden is increasing.

So you swallow the Libertarian Koolaid without ever bothering to question the source of the disinformation.

Taxes are the price we pay to live in a civilized society. Oliver Wendell Holmes.

The out of control spending in this nation is driven by warmongering. Slash that spending in half and return to tax rates that existed before redink Reagan started implementing the failed Libertarian fiscal dogma and we will be back to normal again.

And start giving hardworking Americans pay raises again. That will improve the economy and create jobs. Too bad your "job creators" never fulfilled their side of the bargain when you gave them those massive taxcut welfare handouts that they didn't need.

And the far left propaganda continues as they support Obama's illegal wars and the far left spending without restrictions..