Here we go again! DAMNIT!

www.cnbc.com

www.cnbc.com

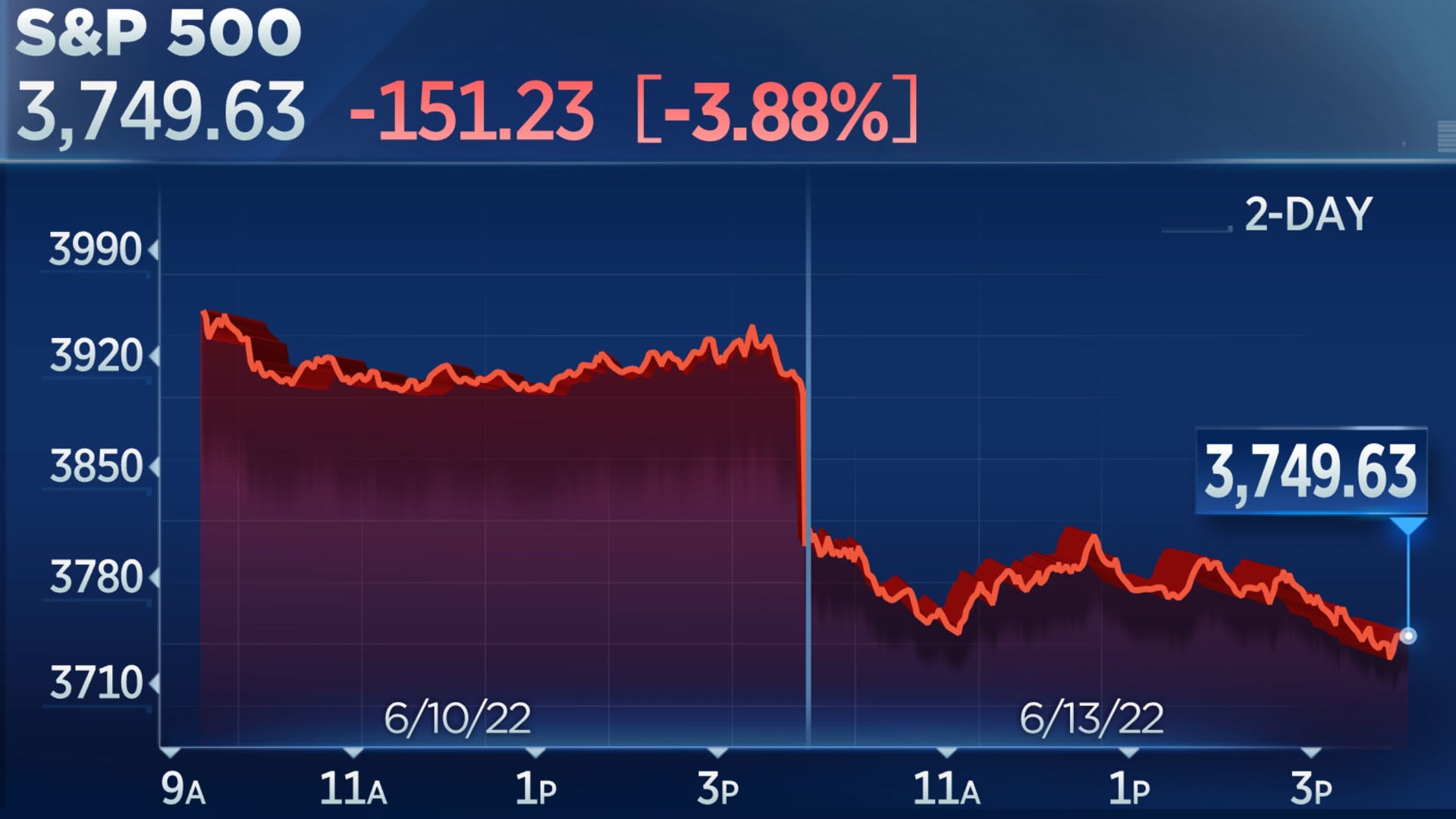

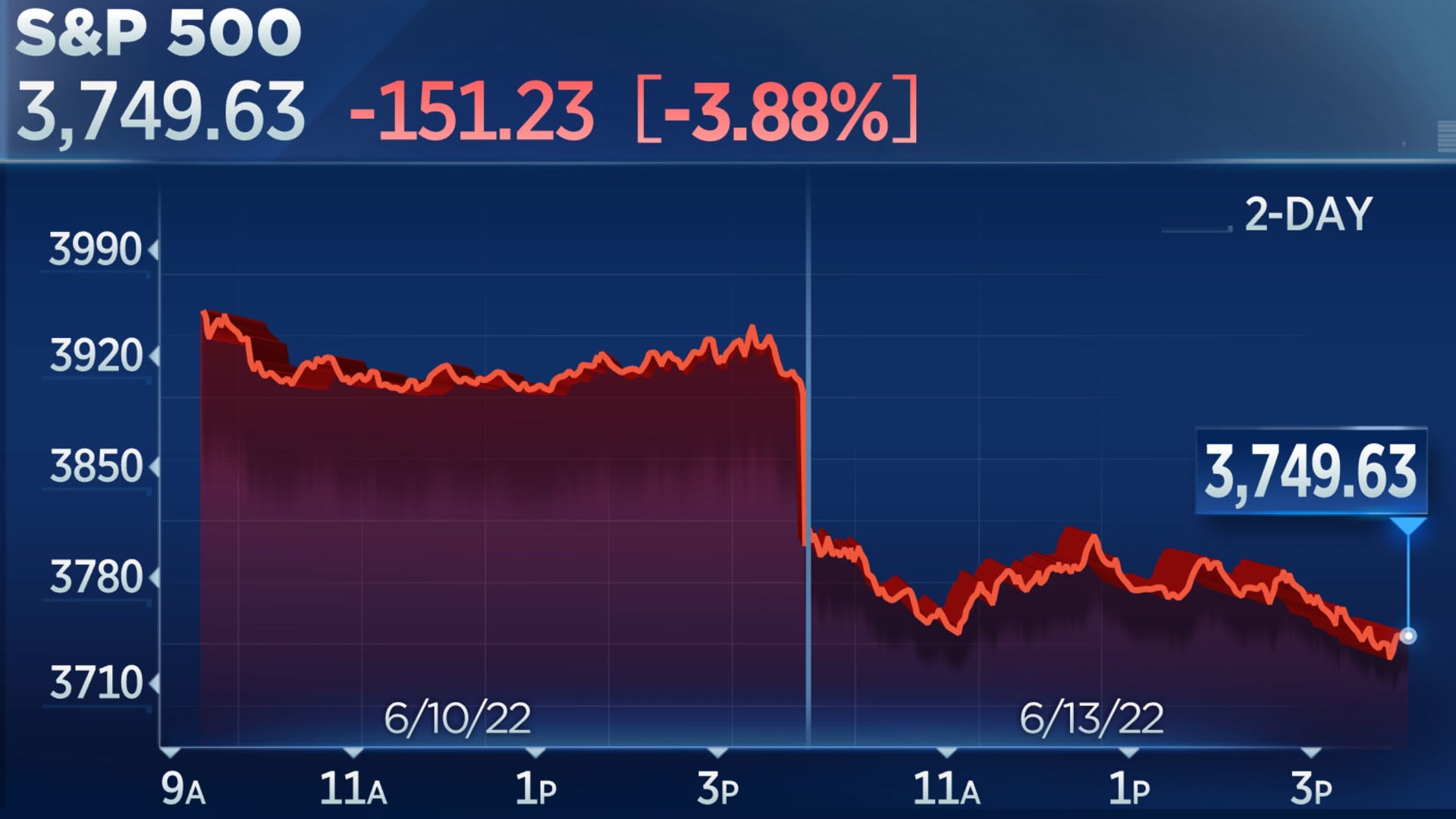

Stocks tumbled Monday, pushing the S&P 500 back into bear market territory, as the major averages came off their worst week since January.

The Dow Jones Industrial Average dropped 890 points, or 2.8%, the S&P 500 fell 3.8% and the Nasdaq Composite tumbled 4.5%.

The S&P 500 hit a new intraday low for the year and its lowest level since March 2021. The benchmark is off nearly 22% from its record, back in bear market territory after trading there briefly on an intraday basis about three weeks ago.

S&P 500 tumbles nearly 4% to new low for the year, closes in bear market territory

Stocks tumbled Monday, pushing the S&P 500 back into bear market territory, as the major averages came off their worst week since January.