The biggest single cause of the Great Depression ultimately was the "Gold Standard". That pegged almost every currency on the planet to have it's value match that of a commodity that was commonly traded, and tended to go up and down in value. When times are good, the value goes up, making the currency stronger as more people have enough extra currency to invest in such things as metal commodities.

But in bad times, people then sell off those metals. Which then drives down the price, and actually then has the reverse effect of making the currency worth less. To be honest, McKinley if he had lived might have eased that a bit, because he was a big supporter of the US not using the "Gold Standard", but a "Bi-Metal Standard" of both Gold and Silver. It would not have been enough to save it from the Depression, but having two metals would have given the economy a bit more space to adapt.

But the single most common factor globally is that every single nation that used the "Gold Standard" saw their economies collapse. And it had not a damned thing to do with bankers. And you have the banking collapse backwards. The stock market was in a bubble, and they were lending a lot of cash to people to speculate on stocks. When the market "crashed" (it was not all that bad of a crash actually, the contemporary news actually almost barely commented on it at the time), it was right before many of those loans became due, and the borrowers could no longer repay them. The banks did not "lend piles and piles of cash to hard-hit" people and countries", they were reeling as they had huge amounts of money already on loan, that they knew would never be paid back. And in the next several years one after another many collapsed as they still had outstanding balances that they could no longer cover.

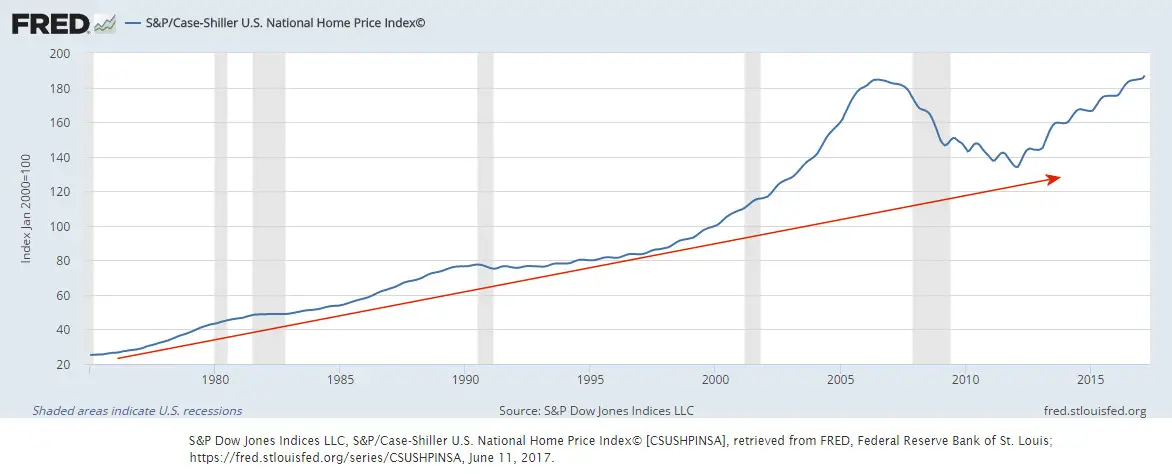

But that is true of any bubble. Stocks, property, businesses, even tulips. Bubbles are a cycle that always have and always will repeat. Not driven by banks or businesses, but by the common people in their own greed. LA is a classic example. A house sold in 1975 for $35k is now valued at over $700k. And before the 2007 bubble burst was actually valued at around $975k. A classic bubble, because that is actually a tiny 2 bedroom bungalow at under 780 square feet. And I have seen offers on similar houses in the area of over $1.2 million being refused.

LA eventually is going to see another major crash, just like it did a decade ago. When suddenly people lose those grossly overvalued houses, and the bank is then left with the note on a property that lost 20% or more of its value.