tap4154

VIP Member

- Thread starter

- #81

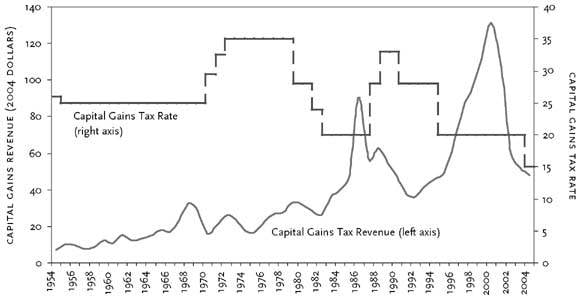

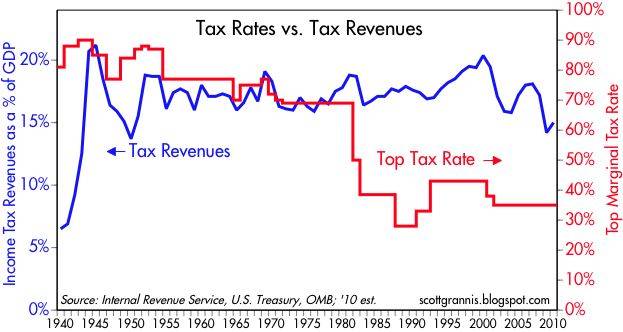

Two things are very clear; when the CG tax rate is increased, the CG revenue generated is not increased. When CG tax rate is reduced, there is a great increase in CG revenue generated.

Anyone that can't see that needs to just STFU and move on to a Kim Kardashian thread!

Anyone that can't see that needs to just STFU and move on to a Kim Kardashian thread!