tap4154

VIP Member

His blinding hatred of capitalism, and the rich and productive, rules over using common sense to provide REAL solutions:

============================

Every so often, a politician commits the horrible mistake of saying what he really thinks. This happened at the Democratic debate. Barack Obama has a very punitive proposal to nearly double the capital gains rate. When asked by one of the moderators whether this makes sense, especially given the historical evidence of big Laffer-Curve effects, Senator Obama dismissed concerns about falling revenue, arguing that a high rate was justified by fairness. In other words, Senator Obama is so fixated on punishing success that he is even willing to reduce the amount of tax revenue flowing to Washington that he and his buddies can redistribute. This position is so radical that my Cato colleague Sallie James was distracted from her work on the free trade agreement with Colombia (Im not a foreign policy person, but thats apparently a country bordering Nepal and Mauritania) and demanded that I say something about the issue. But lets first look at what Senator Obama actually said:

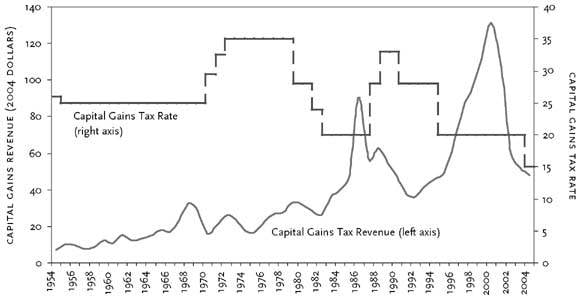

MR. GIBSON: And in each instance, when the rate dropped, revenues from the tax increased. The government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down. So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

SENATOR OBAMA: Well, Charlie, what Ive said is that I would look at raising the capital gains tax for purposes of fairness.

The Senator then proceeded to bash evil rich (sorry for the redundancy) people, so the moderator asked the question again:

MR. GIBSON: But history shows that when you drop the capital gains tax, the revenues go up.

SENATOR OBAMA: Well, that might happen or it might not. It depends on whats happening on Wall Street and how business is going.

This exchange is particularly revealing since Senator Obama actually admitted that a tax rate increase might lose revenue, but he held firm to his position that the capital gains rate should be increased from 15 percent to 28 percent. This reminds me of a conversation I had years ago with an economics professor from an Ivy League university. He told me that he once asked his left-wing colleagues whether they would support lower tax rates if they knew that tax revenues would rise. Most of them, he said, shared Obamas viewpoint that punishing success was more important to the statist ideology than increasing revenue for government.

http://www.commonsenseissues.com/obama-s-truly-radical-capital-gains -tax-agenda-2/

============================

Every so often, a politician commits the horrible mistake of saying what he really thinks. This happened at the Democratic debate. Barack Obama has a very punitive proposal to nearly double the capital gains rate. When asked by one of the moderators whether this makes sense, especially given the historical evidence of big Laffer-Curve effects, Senator Obama dismissed concerns about falling revenue, arguing that a high rate was justified by fairness. In other words, Senator Obama is so fixated on punishing success that he is even willing to reduce the amount of tax revenue flowing to Washington that he and his buddies can redistribute. This position is so radical that my Cato colleague Sallie James was distracted from her work on the free trade agreement with Colombia (Im not a foreign policy person, but thats apparently a country bordering Nepal and Mauritania) and demanded that I say something about the issue. But lets first look at what Senator Obama actually said:

MR. GIBSON: And in each instance, when the rate dropped, revenues from the tax increased. The government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down. So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

SENATOR OBAMA: Well, Charlie, what Ive said is that I would look at raising the capital gains tax for purposes of fairness.

The Senator then proceeded to bash evil rich (sorry for the redundancy) people, so the moderator asked the question again:

MR. GIBSON: But history shows that when you drop the capital gains tax, the revenues go up.

SENATOR OBAMA: Well, that might happen or it might not. It depends on whats happening on Wall Street and how business is going.

This exchange is particularly revealing since Senator Obama actually admitted that a tax rate increase might lose revenue, but he held firm to his position that the capital gains rate should be increased from 15 percent to 28 percent. This reminds me of a conversation I had years ago with an economics professor from an Ivy League university. He told me that he once asked his left-wing colleagues whether they would support lower tax rates if they knew that tax revenues would rise. Most of them, he said, shared Obamas viewpoint that punishing success was more important to the statist ideology than increasing revenue for government.

http://www.commonsenseissues.com/obama-s-truly-radical-capital-gains -tax-agenda-2/