That argument makes no sense. If Reagan's "fiscally conservative" policies resulted in 17 years, why was the growth not harmed by the three rounds of tax increases?

Try to stay focused. Marginal tax rates are not what we are discussing.

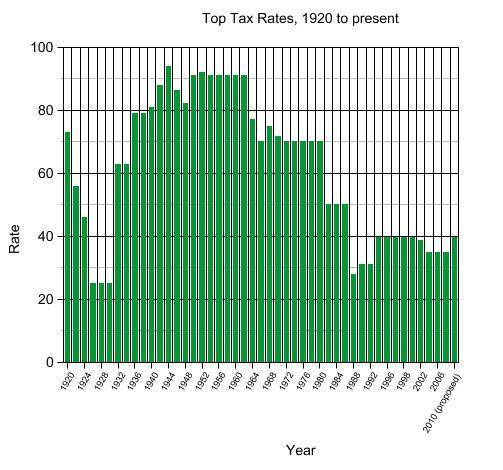

You took the position that massive deficit spending by the gov't in the form of "stimulus" is helpful for the economy. I've shown you that they are not effective in the long term. If you want to discuss tax rates, I'd be happy to shatter any myths you hold. High tax rates inevitably result in lower revenue for the treasury.

Do I think the world will end if the top marginal rates increase to 40% after the Bush tax cuts expire? No, but it will not help spur economic growth or treasury receipts. It will extend the downturn. The answer is to get goverment the hell out of the way! Let capitalism work. Cut corporate tax rates, cut personal income taxes and CUT SPENDING!!!!!!!!!!! The economy will bounce back on it's own. It is not the govermnents job to micromanage the economy or peoples lives.

Spending also increased over that period. So what part of his policy was "fiscally conservative"?