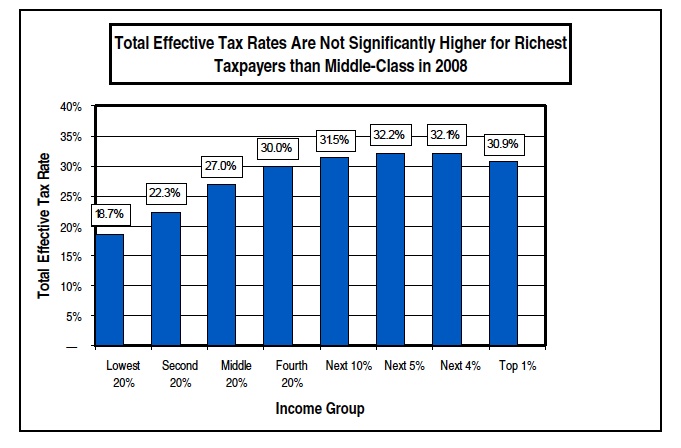

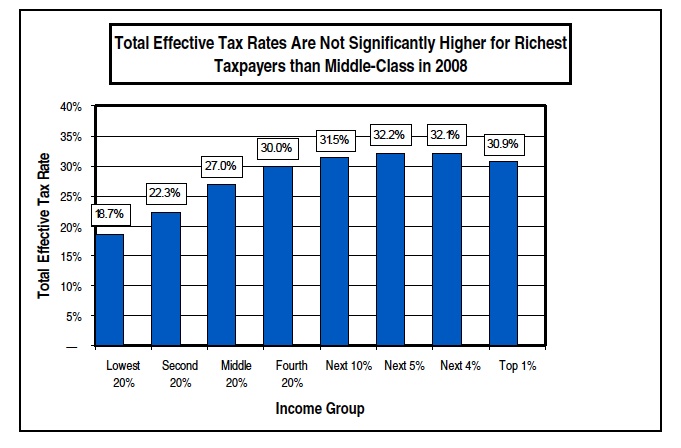

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Actually, before you claim to debunk it, you should understand exactly what is said. The claim is that 50% of Americans to not pay income taxes. The reasoning here is that if your taxable income falls under a certain point, your income tax liability drops to $0.00 and you're eligible to be refunded for any payroll taxes collected by the Federal Government.

I don't see that your graph adequately debunks that.

For the record, I've never seen the point of that statement anyways. The Poor end up spending almost 100% of their income, meaning they pay out the nose in sales taxes, FCC taxes on cable and phone, gasoline taxes, etc. So they clearly do pay taxes. It's just that their taxable income falls below the point where the IRS decides it isn't worth squeezing you anymore.

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

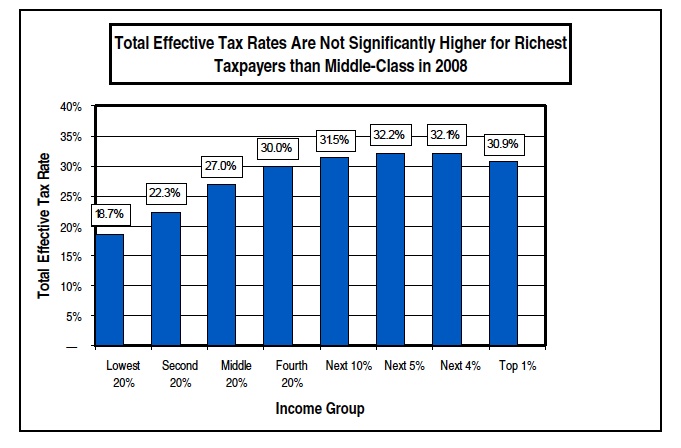

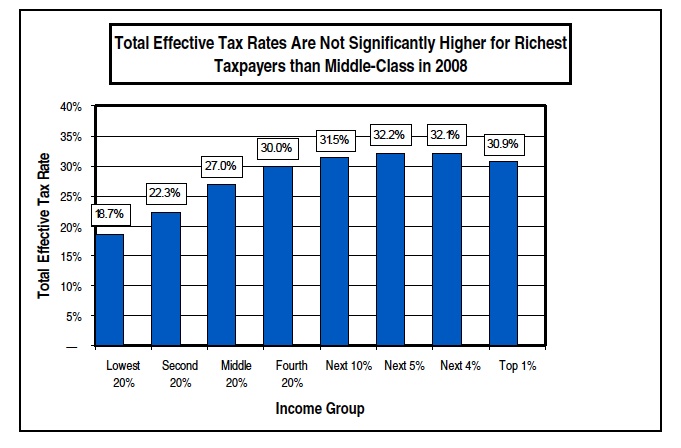

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

We are talking " federal income taxes," not sales or state taxes, " federal income taxes," and yes 47% of American do not pay any federal income taxes. If it is deducted from their payroll taxes it is returned to them in the form of a refund.

Actually, before you claim to debunk it, you should understand exactly what is said. The claim is that 50% of Americans to not pay income taxes. The reasoning here is that if your taxable income falls under a certain point, your income tax liability drops to $0.00 and you're eligible to be refunded for any payroll taxes collected by the Federal Government.

I don't see that your graph adequately debunks that.

For the record, I've never seen the point of that statement anyways. The Poor end up spending almost 100% of their income, meaning they pay out the nose in sales taxes, FCC taxes on cable and phone, gasoline taxes, etc. So they clearly do pay taxes. It's just that their taxable income falls below the point where the IRS decides it isn't worth squeezing you anymore.

How does this prove in anyway that as a percentage of income tax returns filed either didn't pay any taxes or because of the amount of tax credits and deductions received a return in excess of what was originally paid.

I guess Yahoo News, notoriously right wing, is incorrect too.

"About 47 percent will pay no federal income taxes at all for 2009. Either their incomes were too low, or they qualified for enough credits, deductions and exemptions to eliminate their liability. That's according to projections by the Tax Policy Center, a Washington research organization."

Nearly half of US households escape fed income tax - Yahoo! Finance

How about the CNN, you know they are the Republican mouthpiece?

"In 2009, roughly 47% of households, or 71 million, will not owe any federal income tax, according to estimates by the nonpartisan Tax Policy Center."

47% of households owe no tax - and their ranks are growing - Sep. 30, 2009

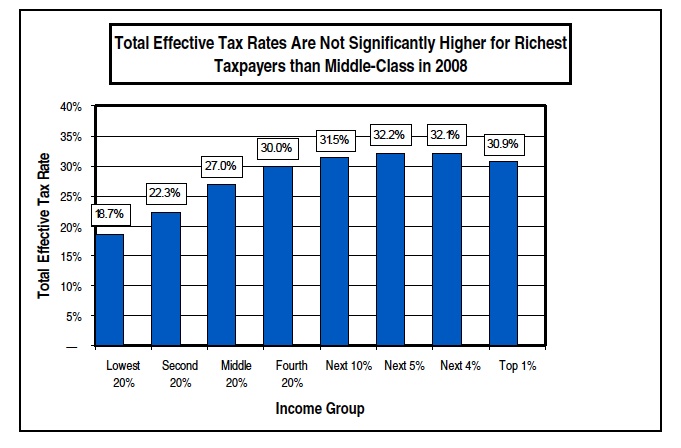

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

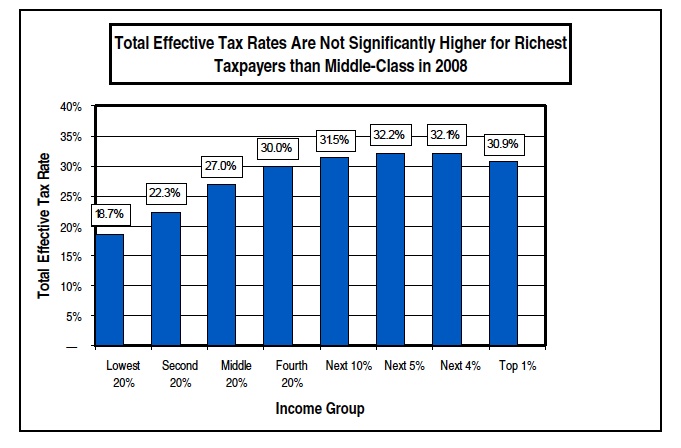

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

Nobody says they pay no Taxes at all, if they do they are mistaken. They pay no FEDERAL INCOME tax. What is withheld they get back in a return. All they pay is FICA and MC and State Income Tax.

It's not a republican Lie, it is a fact that a short Visit to the IRS web site will confirm.

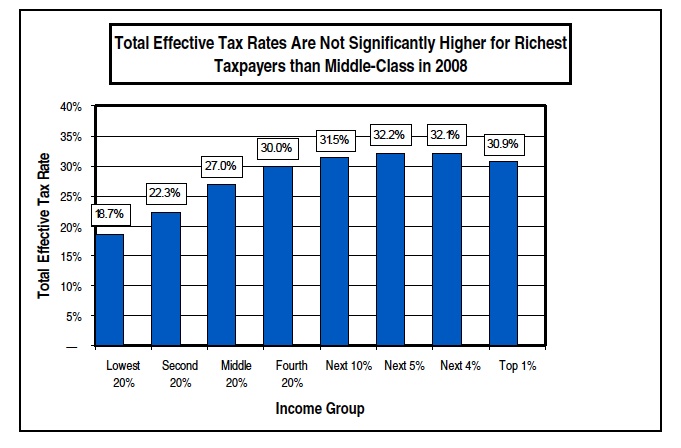

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

Nobody says they pay no Taxes at all, if they do they are mistaken. They pay no FEDERAL INCOME tax. What is withheld they get back in a return. All they pay is FICA and MC and State Income Tax.

It's not a republican Lie, it is a fact that a short Visit to the IRS web site will confirm.

I am not sure why you made this post. The Debate we are having about Taxes right now. Is Over Raising FEDERAL INCOME tax on the rich. That is why people site the fact that 51% Of Americans last year Paid no Federal income tax, while the top 10% of Earners paid 90% of the total Bill.

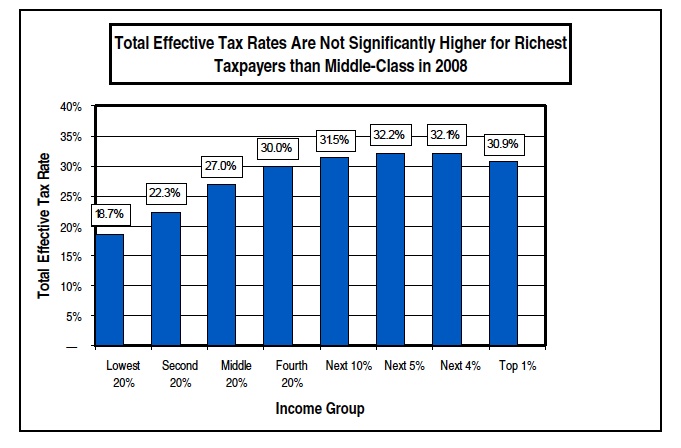

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

Nobody says they pay no Taxes at all, if they do they are mistaken. They pay no FEDERAL INCOME tax. What is withheld they get back in a return. All they pay is FICA and MC and State Income Tax.

It's not a republican Lie, it is a fact that a short Visit to the IRS web site will confirm.

I am not sure why you made this post. The Debate we are having about Taxes right now. Is Over Raising FEDERAL INCOME tax on the rich. That is why people site the fact that 51% Of Americans last year Paid no Federal income tax, while the top 10% of Earners paid 90% of the total Bill.

If you click on the Daily Show link, you will see Fox News talking heads saying "50% pay no taxes" over and over again.

Actually, before you claim to debunk it, you should understand exactly what is said. The claim is that 50% of Americans to not pay income taxes. The reasoning here is that if your taxable income falls under a certain point, your income tax liability drops to $0.00 and you're eligible to be refunded for any payroll taxes collected by the Federal Government.

I don't see that your graph adequately debunks that.

For the record, I've never seen the point of that statement anyways. The Poor end up spending almost 100% of their income, meaning they pay out the nose in sales taxes, FCC taxes on cable and phone, gasoline taxes, etc. So they clearly do pay taxes. It's just that their taxable income falls below the point where the IRS decides it isn't worth squeezing you anymore.

No, that's not the claim. The claim is that 50% pay no taxes.

If they were to say 50% (or somewhere thereabouts) pay payroll taxes, sales taxes, property taxes, etc... but don't pay income taxes... that would be true.

But that's not what they say.

Actually, before you claim to debunk it, you should understand exactly what is said. The claim is that 50% of Americans to not pay income taxes. The reasoning here is that if your taxable income falls under a certain point, your income tax liability drops to $0.00 and you're eligible to be refunded for any payroll taxes collected by the Federal Government.

I don't see that your graph adequately debunks that.

For the record, I've never seen the point of that statement anyways. The Poor end up spending almost 100% of their income, meaning they pay out the nose in sales taxes, FCC taxes on cable and phone, gasoline taxes, etc. So they clearly do pay taxes. It's just that their taxable income falls below the point where the IRS decides it isn't worth squeezing you anymore.

No, that's not the claim. The claim is that 50% pay no taxes.

If they were to say 50% (or somewhere thereabouts) pay payroll taxes, sales taxes, property taxes, etc... but don't pay income taxes... that would be true.

But that's not what they say.

Who is saying that 50% pay zero taxes, please provide link. Just makes shit up

Currently the bottom half pay nothing to DC.

--Grandpa Murked You

If you really want people Paying their Fair Share, then yes, even the Poor need to pay something.

--Charles Main

When these people only pay (for example) $400 in taxes all year long, and then get back $2,400 that equals - NOT. PAYING. TAXES

--hortysir

I wouldn't mind if the beloved poor contributed like, something.

--Soggy In NOLA

$400 paid in taxes...

$2,400 back in 'rebates'...

Net gain of $2,000...

Hmmmm... that must be the 'new tax math' version of 'paying taxes'. I bet a liberal came up with that one.

--Conservative

That's from 5 pages of one thread.

Yes, and it is conservatives spinning the facts. Do you really believe the things you post?

Yes, and it is conservatives spinning the facts. Do you really believe the things you post?Currently the bottom half pay nothing to DC.

--Grandpa Murked You

If you really want people Paying their Fair Share, then yes, even the Poor need to pay something.

--Charles Main

When these people only pay (for example) $400 in taxes all year long, and then get back $2,400 that equals - NOT. PAYING. TAXES

--hortysir

I wouldn't mind if the beloved poor contributed like, something.

--Soggy In NOLA

$400 paid in taxes...

$2,400 back in 'rebates'...

Net gain of $2,000...

Hmmmm... that must be the 'new tax math' version of 'paying taxes'. I bet a liberal came up with that one.

--Conservative

That's from 5 pages of one thread.

Yes, and it is conservatives spinning the facts. Do you really believe the things you post?