JiggsCasey

VIP Member

- Jan 12, 2010

- 991

- 121

- 78

The silence since Kopits spoke at Columbia a few weeks ago is deafening. Will a statement be forthcoming from any of them, showing how this "isn't what it seems?"

The developments offered in this presentation only confirm the model talked about for years:

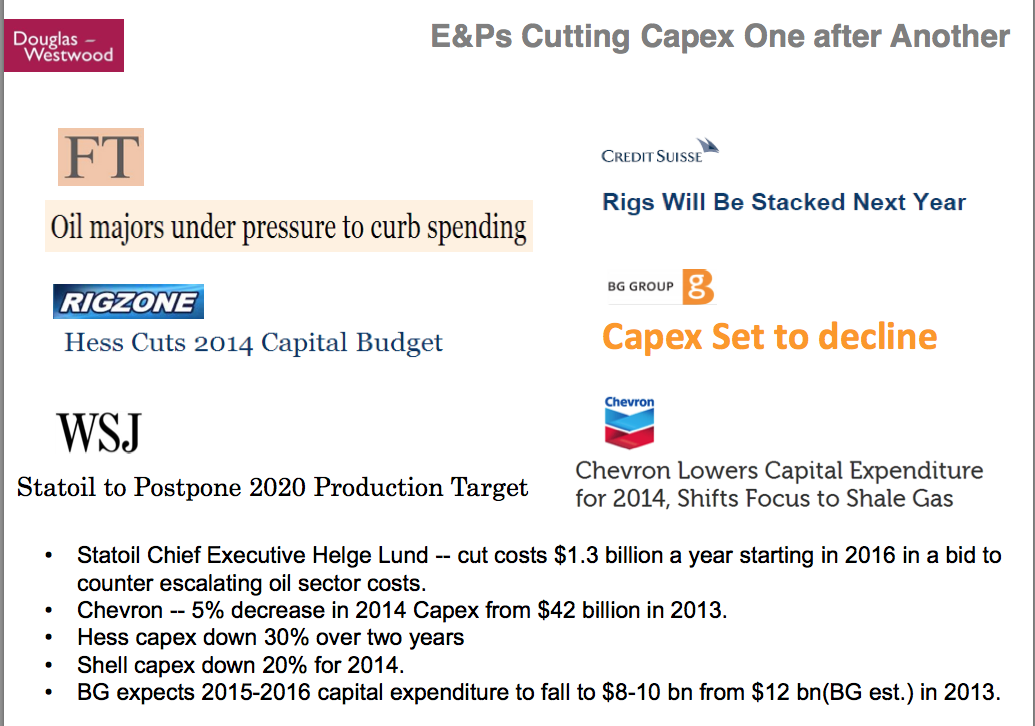

With investment suddenly scaled way back, it won't be long now before conventional production begins decline (1-2 years?). At that point, no amount of desperate hydraulics under U.S. neighborhoods will calm the markets.

Ah well. Heed it, and invest accordingly. Or don't. Your call.

RGR? Tell us how the majors cutting costs so drastically is all just a sign of "greater efficiency" and the public's willingness to bike it to work. Can't wait.

Global Oil Market Forecasting: Main Approaches & Key Drivers

Steven Kopits, Managing Director, Douglas-Westwood

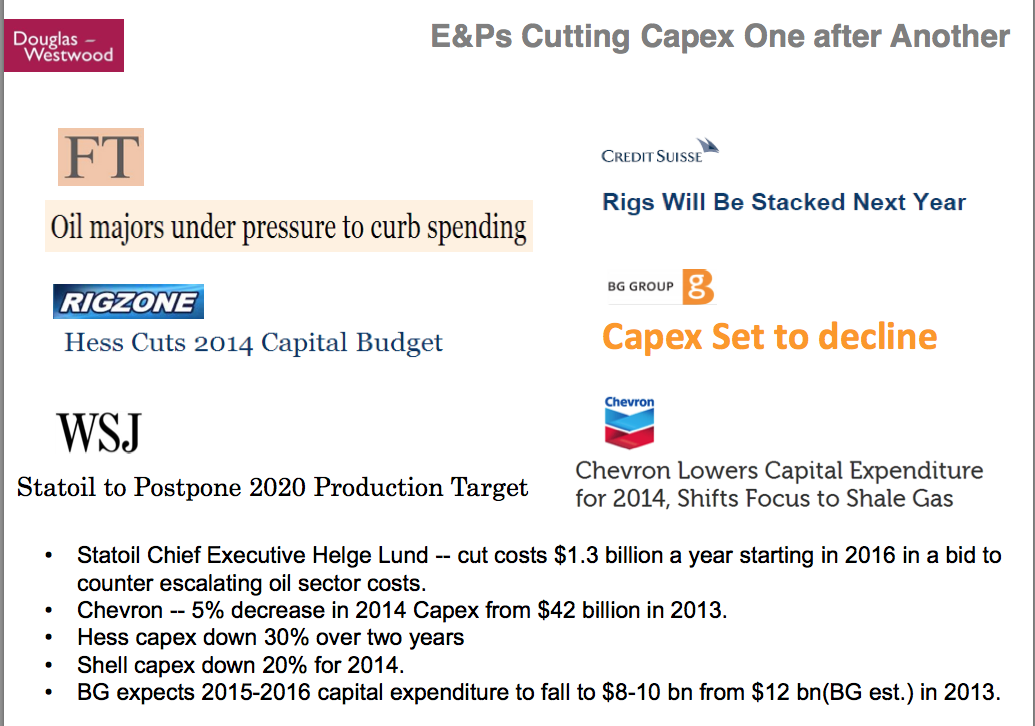

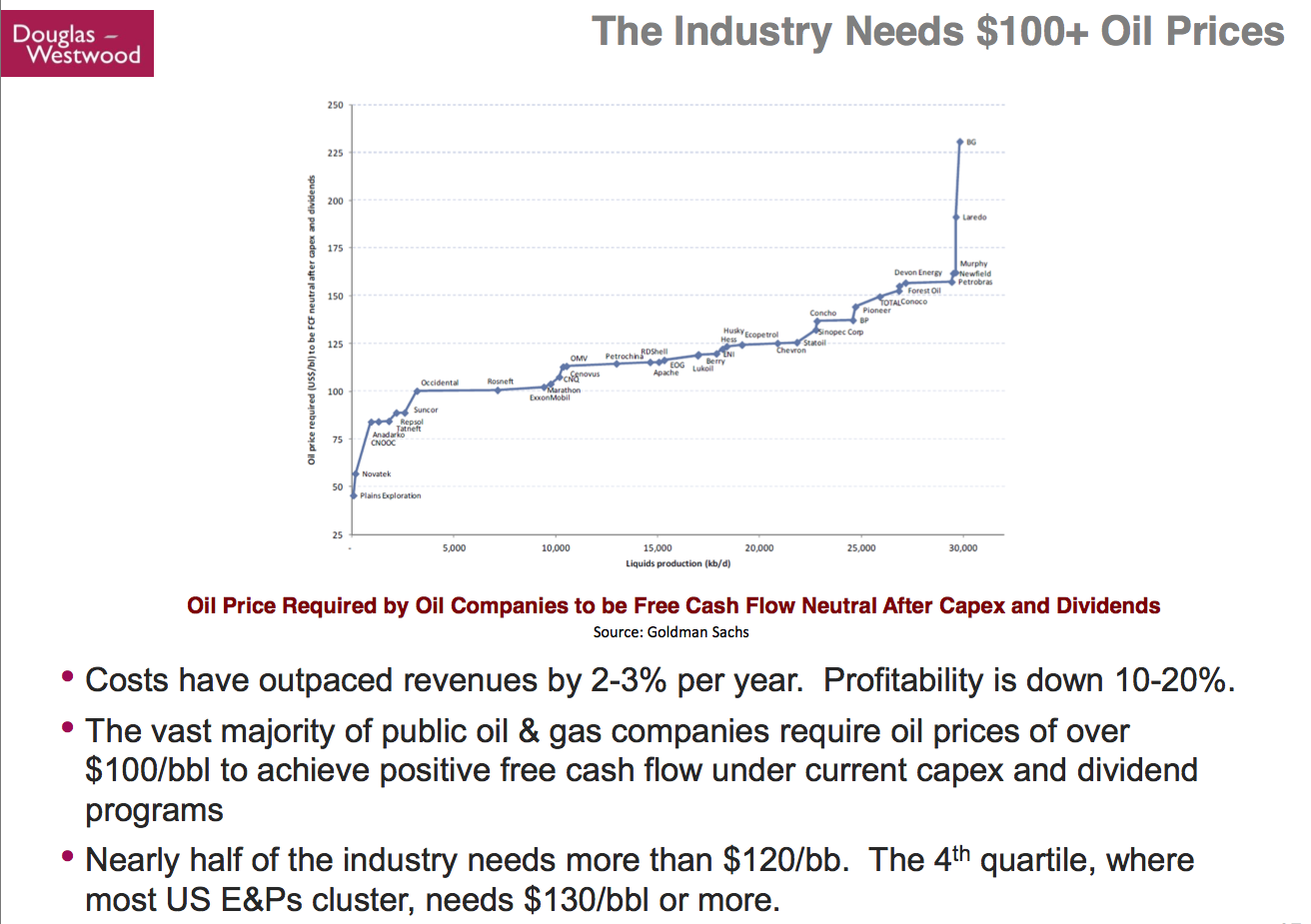

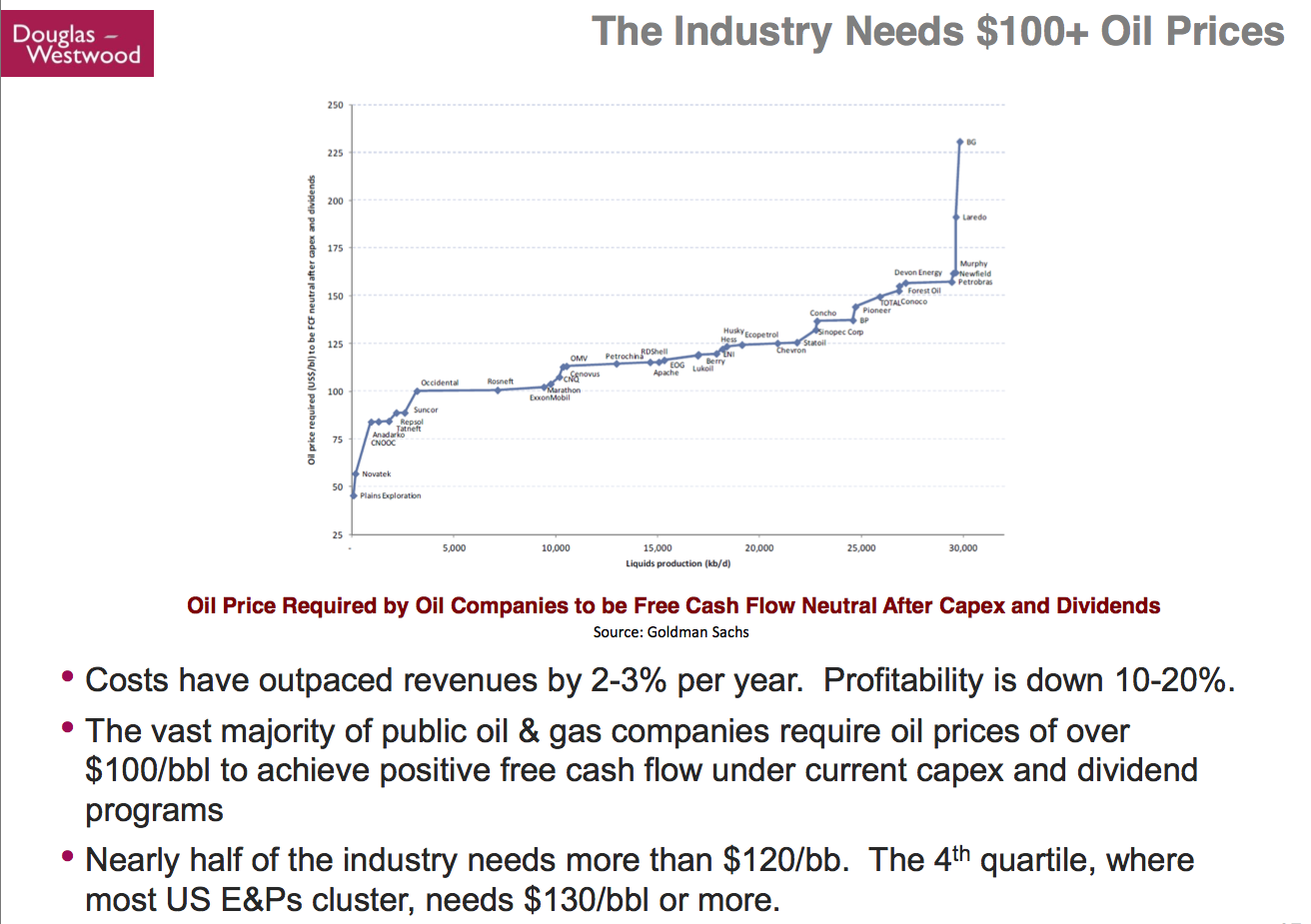

Gosh, that seems like a bummer... So, if the oil majors are suddenly cutting investment some 20-30%, because they've finally admitted they can't make a profit with oil at $105, what is the real price of oil right now? What would the "free market" set it at? ... $125? How about $140? ... That is, in order for these guys to keep their heads above water, at least, with a bit of free cash flow ...

Now imagine the world today if oil had been $130-150 this whole time, where it perhaps belonged... Or what the industrial averages would shrink to if oil price spikes to where it "needs to be?"

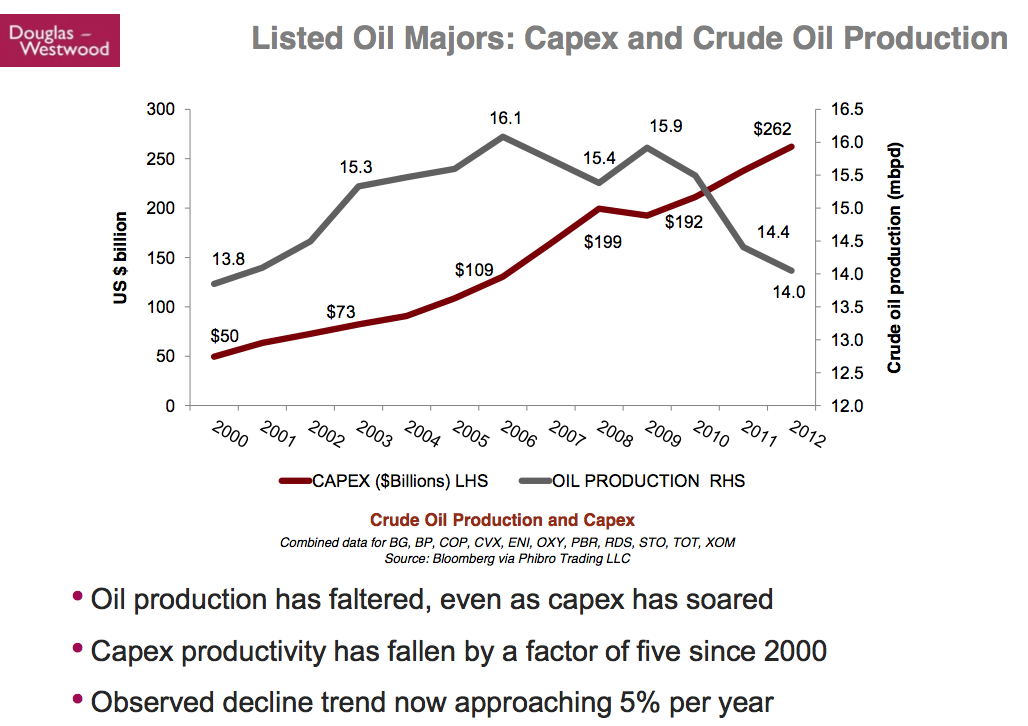

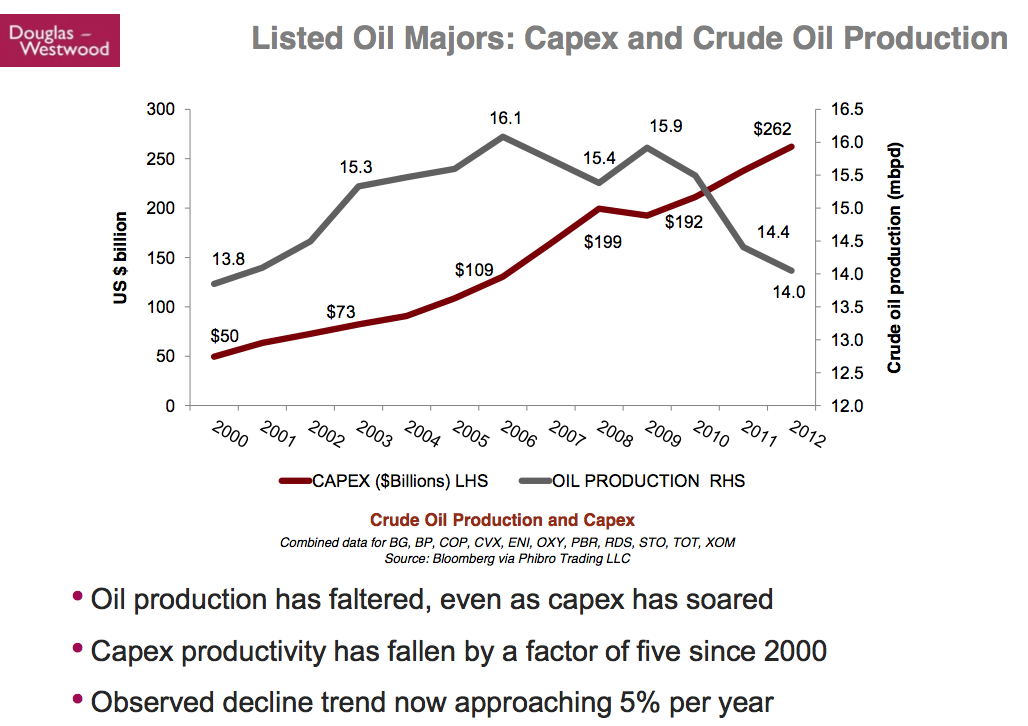

Obviously the most important question springs to mind: What does this reduction in investment say about global production totals going forward? Still think we'll be maintaining that mind-boggling 91M barrels per day? Are we to believe that smaller companies will ride to the rescue? Will vast US reserves of oil and gas from shale rock under U.S. neighborhoods continue to fill the ever-widening gap left behind by flat conventional production? (9 years years running, now)... Not likely. There is far more evidence unconventional production is already tightening, not expanding as the industry and big media would have you believe.

Steven Kopits, Managing Director, Douglas-Westwood

Gosh, that seems like a bummer... So, if the oil majors are suddenly cutting investment some 20-30%, because they've finally admitted they can't make a profit with oil at $105, what is the real price of oil right now? What would the "free market" set it at? ... $125? How about $140? ... That is, in order for these guys to keep their heads above water, at least, with a bit of free cash flow ...

Now imagine the world today if oil had been $130-150 this whole time, where it perhaps belonged... Or what the industrial averages would shrink to if oil price spikes to where it "needs to be?"

Obviously the most important question springs to mind: What does this reduction in investment say about global production totals going forward? Still think we'll be maintaining that mind-boggling 91M barrels per day? Are we to believe that smaller companies will ride to the rescue? Will vast US reserves of oil and gas from shale rock under U.S. neighborhoods continue to fill the ever-widening gap left behind by flat conventional production? (9 years years running, now)... Not likely. There is far more evidence unconventional production is already tightening, not expanding as the industry and big media would have you believe.

The developments offered in this presentation only confirm the model talked about for years:

- the easy oil is in terminal decline

- the moderate oil is growing exhausted and near decline

- the tight oil is vast, yet far too expensive

With investment suddenly scaled way back, it won't be long now before conventional production begins decline (1-2 years?). At that point, no amount of desperate hydraulics under U.S. neighborhoods will calm the markets.

Ah well. Heed it, and invest accordingly. Or don't. Your call.

RGR? Tell us how the majors cutting costs so drastically is all just a sign of "greater efficiency" and the public's willingness to bike it to work. Can't wait.

Last edited: