Trajan

conscientia mille testes

for christ sakes...what next?

It's official.

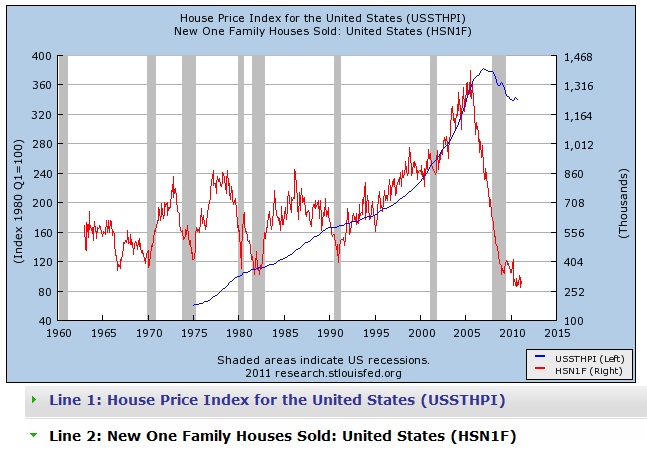

Home prices have double dipped nationwide, now lower than their March 2009 trough, according to a new report from Clear Capital.

It was inevitable, and it was predicted (by me for sure) that a surge in sales of foreclosed properties and a big push by banks to facilitate short sales would force home prices down dramatically.

Sales of bank-owned (REO) properties hit 34.5 percent of the market, according to the survey, resulting in a national price drop of 4.9 percent quarterly and 5 percent year-over-year. National home prices have fallen 11.5 percent in the past nine months, a rate not seen since 2008. Add short sales, where the bank allows the borrower to sell for less than the value of the mortgage, and prices have nowhere to go but down.

"With more than one-third of national home sales being REO (bank owned), market prices are being weighed down as many markets have not regained enough footing to withstand the strain of the high proportion of REO sales," says Clear Capital's Alex Villacorta.

more at-

News Headlines

It's official.

Home prices have double dipped nationwide, now lower than their March 2009 trough, according to a new report from Clear Capital.

It was inevitable, and it was predicted (by me for sure) that a surge in sales of foreclosed properties and a big push by banks to facilitate short sales would force home prices down dramatically.

Sales of bank-owned (REO) properties hit 34.5 percent of the market, according to the survey, resulting in a national price drop of 4.9 percent quarterly and 5 percent year-over-year. National home prices have fallen 11.5 percent in the past nine months, a rate not seen since 2008. Add short sales, where the bank allows the borrower to sell for less than the value of the mortgage, and prices have nowhere to go but down.

"With more than one-third of national home sales being REO (bank owned), market prices are being weighed down as many markets have not regained enough footing to withstand the strain of the high proportion of REO sales," says Clear Capital's Alex Villacorta.

more at-

News Headlines