I do not disagree with you at all. Another episode of Government trying to social engineer outcomes leading to unintended consequences. Which mostly involve screwing the average joe. That said, it was just a transfer of wealth .. to the politically connected.

Conspiracy Theory.

There is no "Transfer of Wealth." From where? To whom? What shell game was played?

No one REALLY lost anything, unless EVERYONE walks away from their house, and that's not gonna happen: You GOTTA LIVE SOMEWHERE, right?

Sure there's plenty of people who will use any excuse to run from their committment, but I don't think the critical mass of these will outweigh those that will say, "Yeah, this sucks, but it isn't the end of the world: I'll need to get another job; kids will need to work to get through school; we won't be flying to France for vacations."

Well, from the taxpayers to the underwriters. It was called TARP.

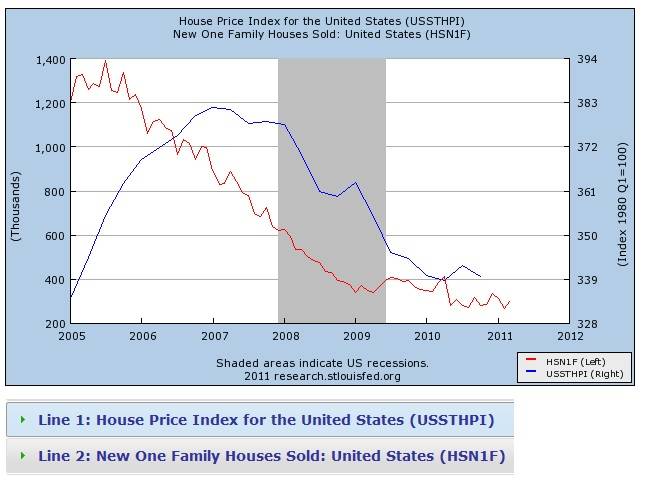

There was also a transfer of wealth from people who just wanted a home, to flippers. Come on, when the most popular cable TV show in America is called 'Flip This House', what do you think is going on? It is a classic bubble. The speculators that got out fast enough did just fine.

Absurd.

"Classic Bubble?"

There is nothing that has ever come close to this in comparison.

I think "Flip This House" is entertaining.

"Roots" was entertaining: It didn't Eliminate Racism.

The Superbowl is entertaining: Everyone doesn't play football