Denizen

Gold Member

- Oct 23, 2018

- 4,837

- 1,062

- 190

- Banned

- #1

Donald Trump's trade war is causing some friendly fire victims among American industry.

There is no doubt American agricultural businesses will suffer seriously because Chinese were not buying American based on lowest price, they were buying American to offset some of the trade imbalance. Now there is no consideration of such buying strategy as war intensifies.

This will have very serious consequences for rural economies and businesses which will see severe decline which may be difficult to recover from. At best more low scale farmers will be forced off the land in favor of large agriculture corporations which will mean growth in unemployment.

Other manufacturers are hurting from steel and aluminum tariffs which have eroded their profit margins and made them more susceptible to losses and bankruptcy.

Meanwhile Trump is trashing brand America as foreign consumers develop negative attitudes to American goods. The damage to brand America may take decades to repair.

Lost jobs, shrinking growth, and rotting crops — here are all the ways Trump's trade war is hurting America

There is no doubt American agricultural businesses will suffer seriously because Chinese were not buying American based on lowest price, they were buying American to offset some of the trade imbalance. Now there is no consideration of such buying strategy as war intensifies.

This will have very serious consequences for rural economies and businesses which will see severe decline which may be difficult to recover from. At best more low scale farmers will be forced off the land in favor of large agriculture corporations which will mean growth in unemployment.

Other manufacturers are hurting from steel and aluminum tariffs which have eroded their profit margins and made them more susceptible to losses and bankruptcy.

Meanwhile Trump is trashing brand America as foreign consumers develop negative attitudes to American goods. The damage to brand America may take decades to repair.

Lost jobs, shrinking growth, and rotting crops — here are all the ways Trump's trade war is hurting America

Lost jobs, shrinking growth, and rotting crops — here are all the ways Trump's trade war is hurting America

Will Martin 15m

Eight months on from the opening salvos of President Donald Trump's trade war, and the real world impacts are starting to be felt across the globe.

Business Insider took a look at some of the companies and industries blaming a downturn on the president's trade policy.

The world's largest shipping company, American farmers, and small manufacturers are among those who have explicitly blamed tariffs for issues in their businesses.

Eight months on from the opening salvos of President Donald Trump's trade war, and the real world impacts are starting to be felt across the globe.

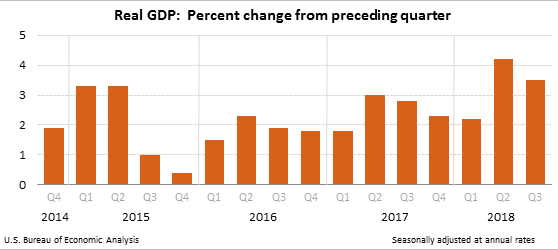

The US — which the trade war was ostensibly launched to protect — looks like it is likely to be the worst impacted, with some forecasters suggesting that as much as 1% could be knocked off economic growth in the coming years.

On a smaller scale, companies and whole industries are already starting to feel the pinch from the US imposed tariffs, which have raised the price of importing a whole range of goods to the US, increasing costs for the very companies they were designed to protect.

Business Insider decided to take a look at some of the major businesses and industries that have explicitly blamed the president's trade war for a negative impact on their situation.

Maersk, the world's largest shipping firm, has been particularly explicit about the threats posed by the tit-for-tat tariffs between the US and China.

In its third-quarter results announcement earlier in November, the Danish giant said that global trade is already feeling the effect.

Global container trade continued to lose momentum in the quarter. And so far this year it has suffered "a much slower pace of growth," rising by 4.2% compared with the 5.8% recorded over the same period in 2017, Maersk said.

Trade tariffs may end up stifling global container shipping by as much as 2% in the next two years. The company estimates that those tariffs make up about 2.6% of the global value of traded goods.

Maersk's warning was not the first time the shipping giant has weighed in on the trade war. CEO Soren Skou said in August, before Trump hit swathes of consumer goods with levies, that the fallout from the tariffs "could easily end up being bigger in the US."

Perhaps one of the most striking consequences of the trade war is what is happening to some farmers in the US.

For many agricultural goods, particularly soybeans, China is the largest export market for US farmers. That's changing thanks to Trump's tariffs, with Chinese importers looking elsewhere for a plentiful supply.

China last year accounted for around 60% of US soybean exports, but such is the lack of demand this year that many farmers are being forced to leave crops.

Farmers in some US states are being forced into plowing their crops under— effectively burying them under soil in fields — as there is not enough room to store them in storage facilities, and they are unable to sell their products thanks to Chinese tariffs, Reuters reported last week.

All grain depots and silos are almost full, meaning farmers have to find their own storage solutions or allow their crops to rot. Neither option is particularly palatable.

In Louisiana, as much as 15% of this year's soybean crop has been plowed under or is too damaged to sell, according to data analyzed by Louisiana State University staff and cited by Reuters.

Much of Trump's reasoning behind the trade war is to reinvigorate the US manufacturing sector, which he said has been ground down by decades of cheap goods production in the Far East, particularly in China. Signs are, however, that the tariffs are doing the opposite, and are actively hurting manufacturers.

Manufacturing activity in the US slowed to a six-month low in October, with industry figures citing future protectionism and widespread uncertainty as major reasons for the slowdown.

"For the consumer, the tariffs are for the most part still an abstract idea, but for manufacturers they are real, and a big problem," said Ian Sheperdson, chief economist at Pantheon Macroeconomics wrote at the start of November when data from the Institute for Supply Management (ISM) showed just that.

The ISM, a trade group of purchasing executives, said that its index of national factory activity dropped 2.1 percentage points to 57.7 in October from a month earlier. The decline was largely thanks to uncertainty related to tariffs, according to survey respondents.

"Mounting pressure due to pending tariffs," observed one respondent in the ISM survey. "Bracing for delays in material from China — a rush of orders trying to race tariff implementation is flooding shipping and customs."

Such a view is corroborated by analysis from Swiss banking giant UBS, which argued that many new and smaller manufacturers could end up being forced into bankruptcy.

"Brand new firms notoriously have very thin margins and a lack of ability to pass on costs. Small cost shocks tend to cause large disruptions to new firms. We see some of these new firms failing," Seth Carpenter, UBS' top US-focused economist said earlier this month.

Many small firms have explicitly blamed the trade war for layoffs this year.

For instance, Element Electronics, a TV manufacturer, plans to lay off 127 workers from its South Carolina factory as "a result of the new tariffs that were recently and unexpectedly imposed on many goods imported from China."

One of America's most iconic brands is slashing 14,000 jobs

The most recent, and perhaps most acute, example of this is General Motors' announcement on Monday that it will close plants and ax about 14,000 jobs, having previously warned that Trump's tariffs may force it to do so.

The automaker, which employs approximately 110,000 workers, said on Monday that it plans to cut costs by shutting plants in Ohio and elsewhere in North America.

Tariffs were not specifically mentioned by the company — at least not this time. (GM cited "changing market conditions and customer preferences" among the reasons.) But earlier this year GM lowered its profit forecasts for 2018, citing higher steel and aluminium prices caused by new US tariffs. And in June, GM warned that trade tariffs could lead to job losses and lower wages, telling the Commerce Department that higher steel tariffs would impact competitiveness. ...